Here’s Why Goldman Sachs Likes Caterpillar Inc. (NYSE:CAT)

Caterpillar Inc. (NYSE:CAT) is set to announce third quarter results later this month. The company posted better-than-expected second quarter results in July. The stock is up more than 41% since the start of this year. Investment firm Goldman Sachs recently increased its price target for Caterpillar to $158 from $143. Goldman’s analyst Jerry Revich said in his report that he expected about $9 billion stock buybacks over the next three years. He is also bullish on the stock amid an increasing construction activity in the US and around the world.

Caterpillar is also expected to gain value amid the declining value of dollar. Caterpillar has a lot of business traction outside of the US. As a result, the company’s revenue will increase.

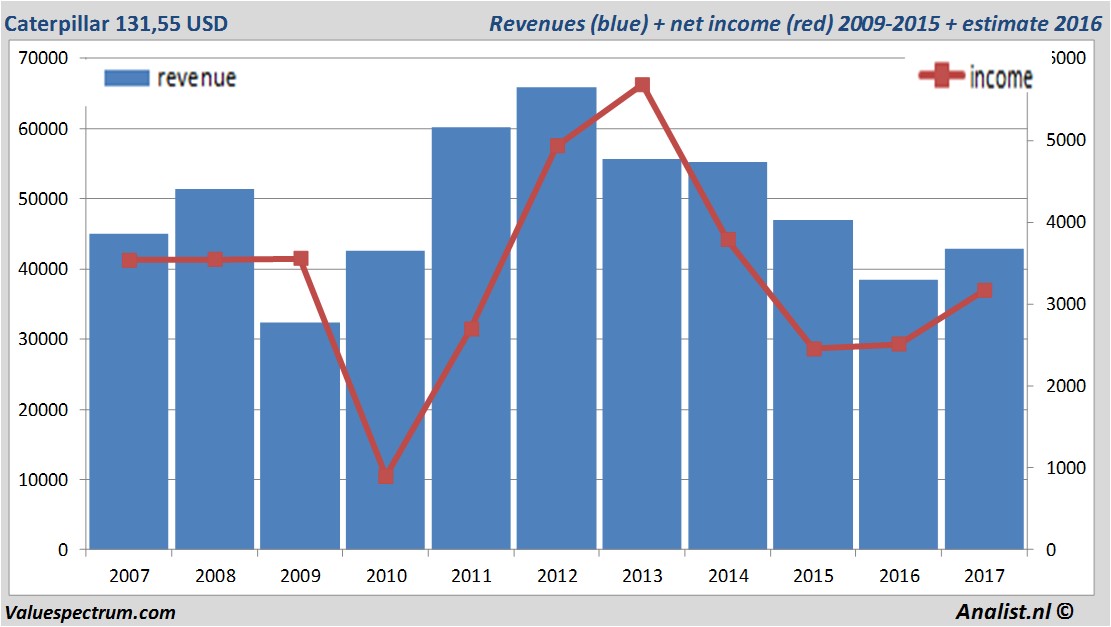

Over the current book year the total revenue will be 42,94 billion USD (consensus estimates). This is hugely more than 2016's revenue of 38,54 billion USD.

Historical revenues and results Caterpillar plus estimates 2017

The analysts expect for 2017 a net profit of 3,17 billion USD. Most of the analyst anticipate on a profit per share of 5,29 USD. The price-earnings-ratio equals 24,87.

For this year the analysts expect a dividend of 3,11 USD per share. Thus the dividend yield equals 2,36 percent. The average dividend yield of the industrial companies equals a moderate 0,60 percent.

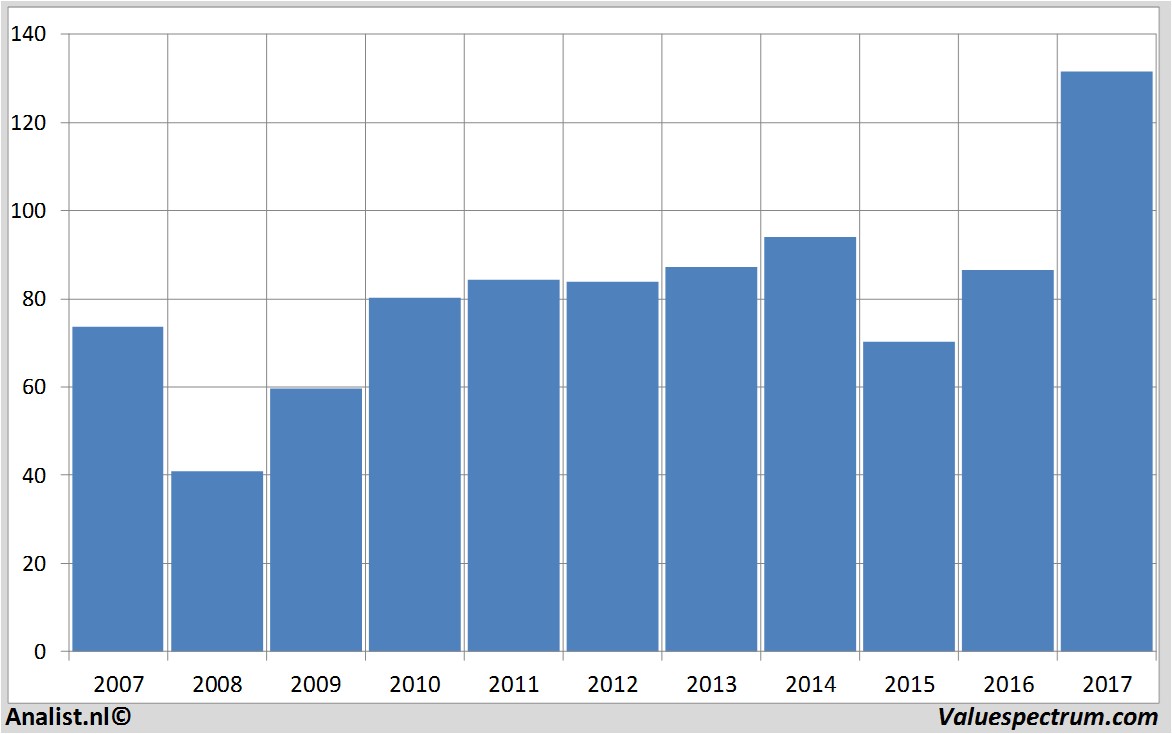

Newest target prices around 107 USD

The most recent recommendations for the industrial company are from JP Morgan, KBC Securities and BMO Capital Markets. Based on the current number of outstanding shares Caterpillar 's market capitalization 76,6 billion USD. At 18.46 the stock trades 0,26 percent higher at 131,55 USD.Price data Caterpillar 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.