Allstate Reports Revenue Growth and Strategic Changes while Dealing with Disaster Losses

Allstate increases income, streamlines its business portfolio, and brings customer service advancements despite major disaster-related losses

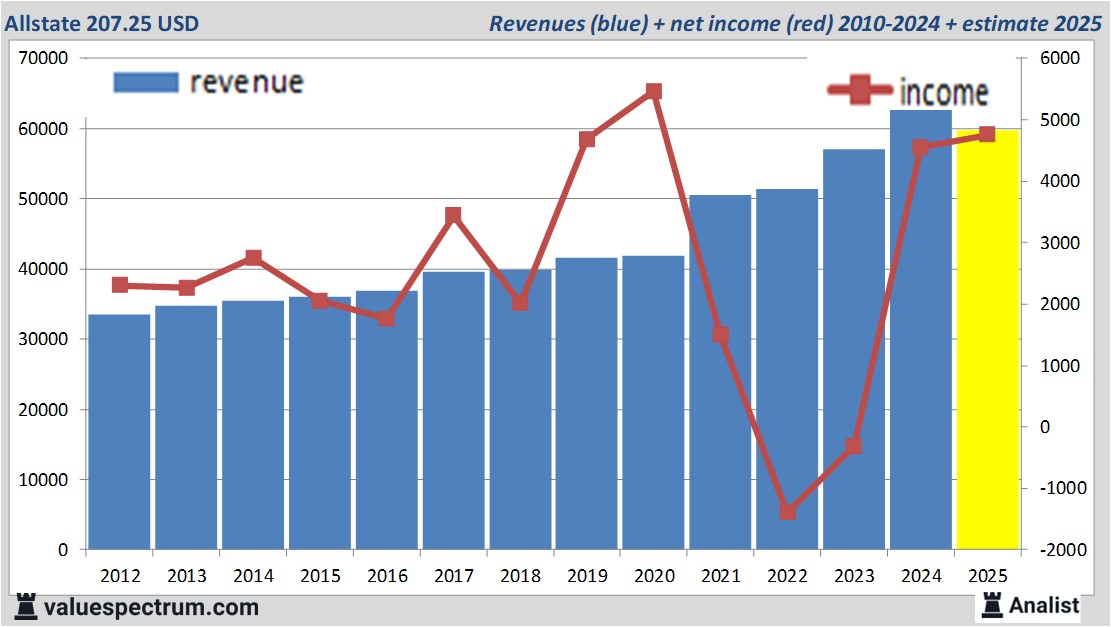

Over the current book year the total revenu from the company based in Northbrook will be 59.81 billion USD (consensus estimates). This is slightly lower than 2025's revenue of 64.11 billion USD.

Historical revenues and results Allstate plus estimates 2025

The analysts expect for 2025 a net profit of 4.75 billion USD. The majority of the analysts expects for this year a profit per share of 17.94 USD. So the price/earnings-ratio equals 11.55.

Per share the analysts expect a dividend of 3.98 USD per share. Thus the dividend yield equals 1.92 percent. The average dividend yield of the insurers equals an attractive 3.13 percent.

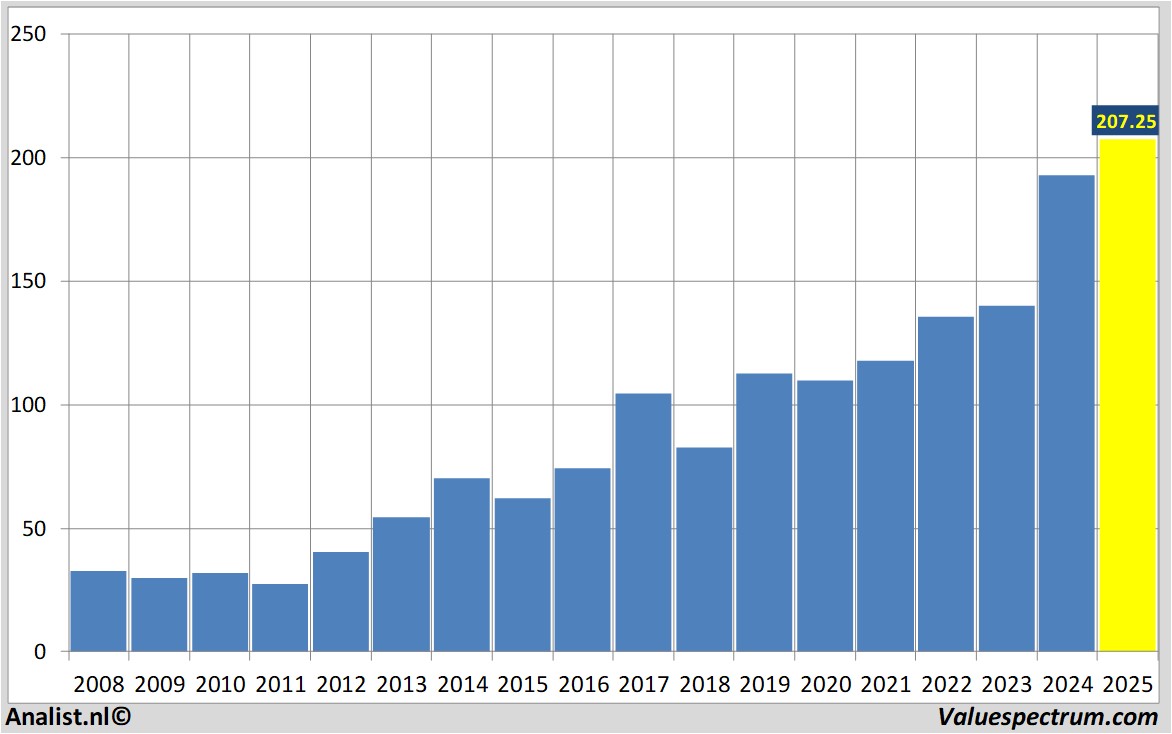

Based on the current number of shares Allstate 's market capitalization equals 54.3 billion USD.

Price data Allstate 2007-2025

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.