Eaton Kicks Off 2025 with Record-Setting Q1 and Upgraded Yearly Outlook

Eaton Corporation plc (NYSE: ETN) launched 2025 on a strong note, delivering its most successful first-quarter performance to date. Solid gains in organic growth and expanding profit margins fueled the results, positioning the company for a robust year ahead.

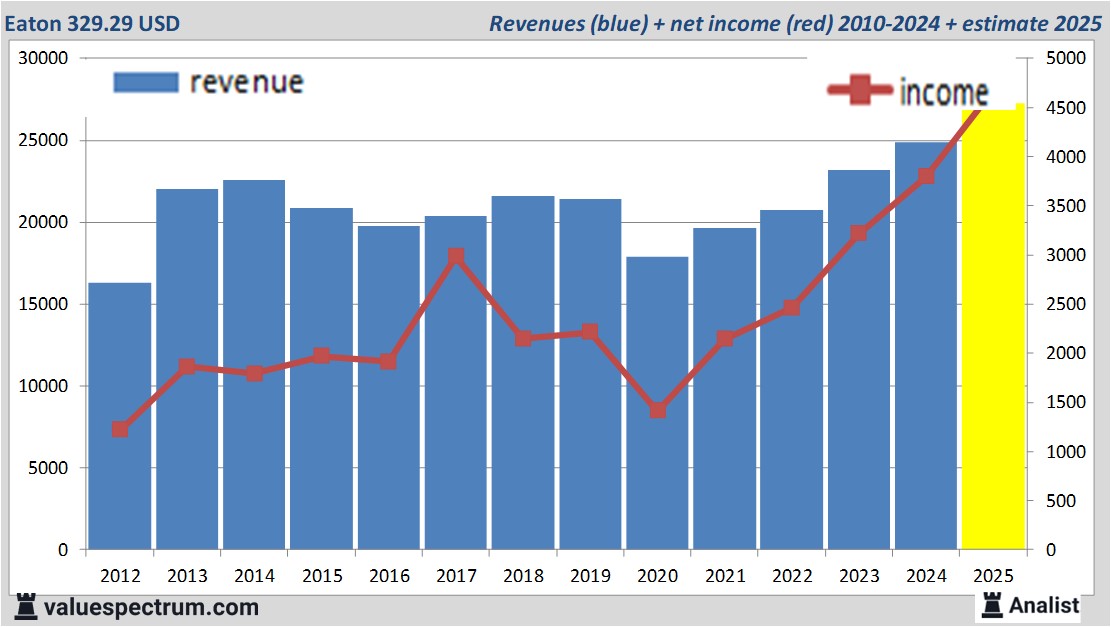

For this year the company from Dublin could earn a total revenue around 27.27 billion USD. This is according to the average of the analysts' estimates. The expected revenue would be a record for the company. This is slightly more than 2025's revenue of 24.88 billion USD.

Historical revenues and results Eaton plus estimates 2025

The analysts anticipate for 2025 a record net profit a 4.68 billion USD. The majority of the analysts expects for this year a profit per share of 11.96 USD. The price-earnings-ratio equals 27.53.

Per share the analysts anticipate on a dividend of 4.07 USD per share. The dividend yield is then 1.24 percent. The average dividend yield of the electronics companies is a good 3.17 percent.

Eaton 's market capitalization is based on the number of outstanding shares around 131.52 billion USD.

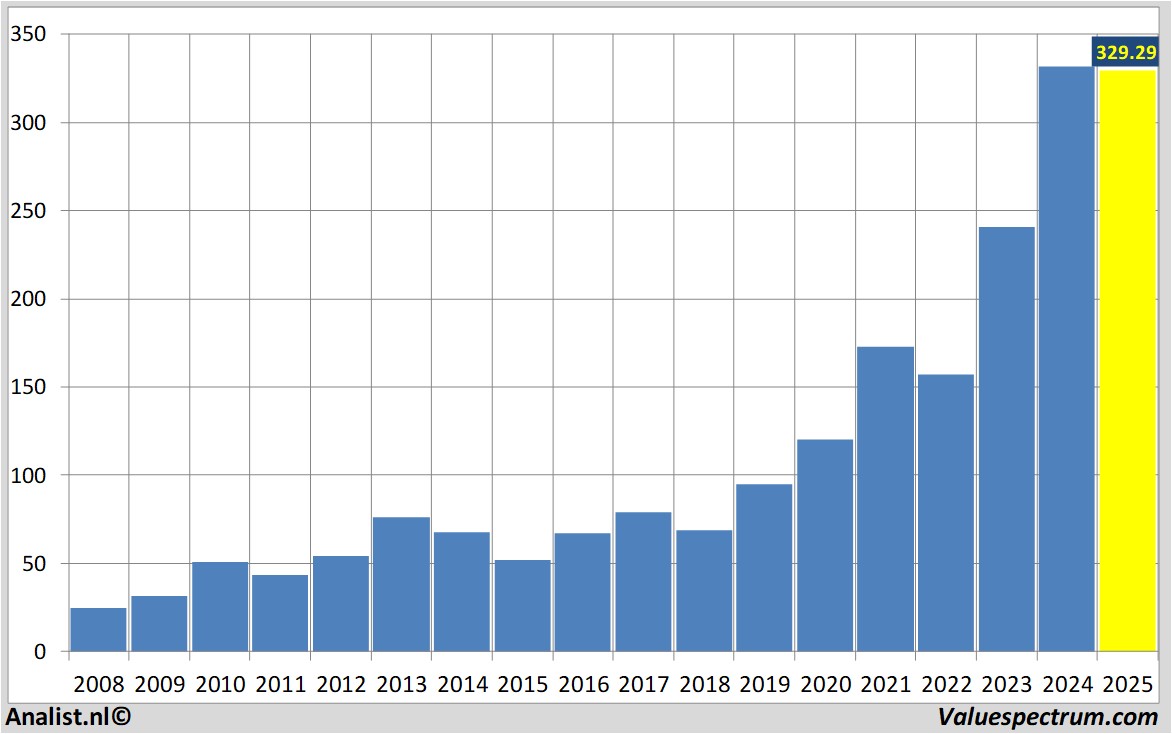

Historical stock prices Eaton

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.