BlackBerry Ltd (NASDAQ:BBRY): Benefits of Software Transition are Visible

BlackBerry Ltd (NASDAQ:BBRY) got hammered last month after reported a 39% revenue decline on year over year basis in the last quarter. But analysts think that the company is currently going through a transition and it needs time. Blackberry is repositioning itself as a software and services company instead of a phone company. The stock is up over 44% since the start of this year. BlackBerry Ltd (NASDAQ:BBRY)’s margins are improving as a result of a huge element of software service in its revenue. Software AG and services already account for a whopping 69% of the total revenue.

Last month, BMO Capital upped its price target on Blackberry to $10 from $9 and gave a “Market Perform” rating. On Monday, the firm reiterated its rating.

Tomorrow BlackBerry will publish her past quarter's results. Over the current book year the total revenue will be 916,18 million Dollar (consensus estimates). This is quite more than 2016's revenue of 1,31 billion Dollar.

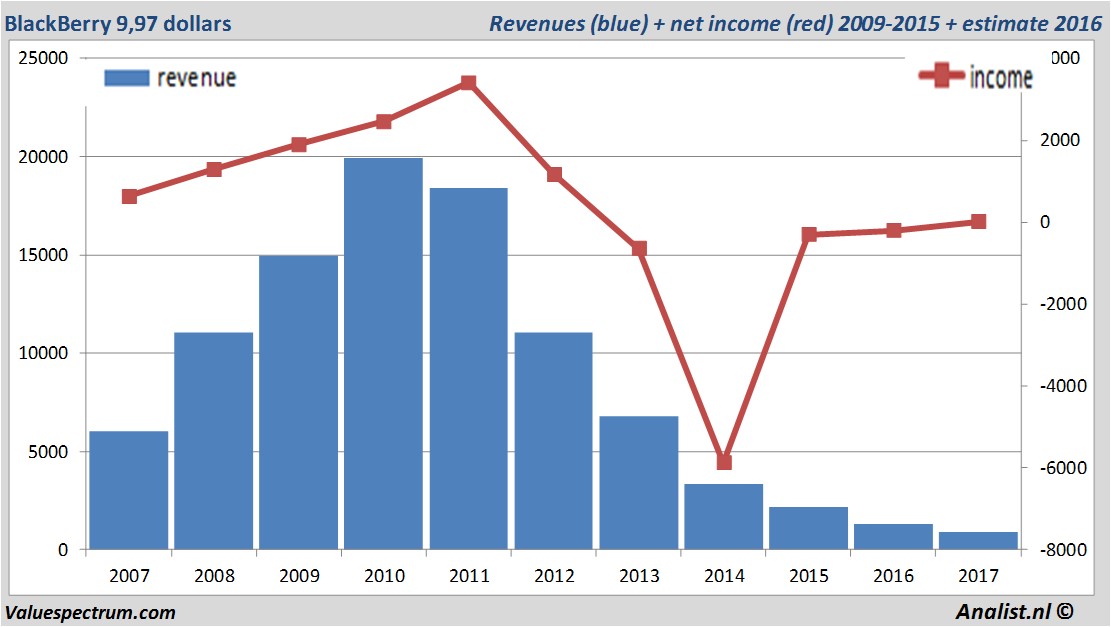

Historical revenues and results BlackBerry plus estimates 2017

The analysts expect for 2017 a net profit of 17 million Dollar. According to most of the analysts the company will have a profit per share for this book year of 3 cent. The price-earnings-ratio equals an extreme 332,33.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the telecommunications companies equals a low 0,93 percent.

Latest estimates around 10 Dollar

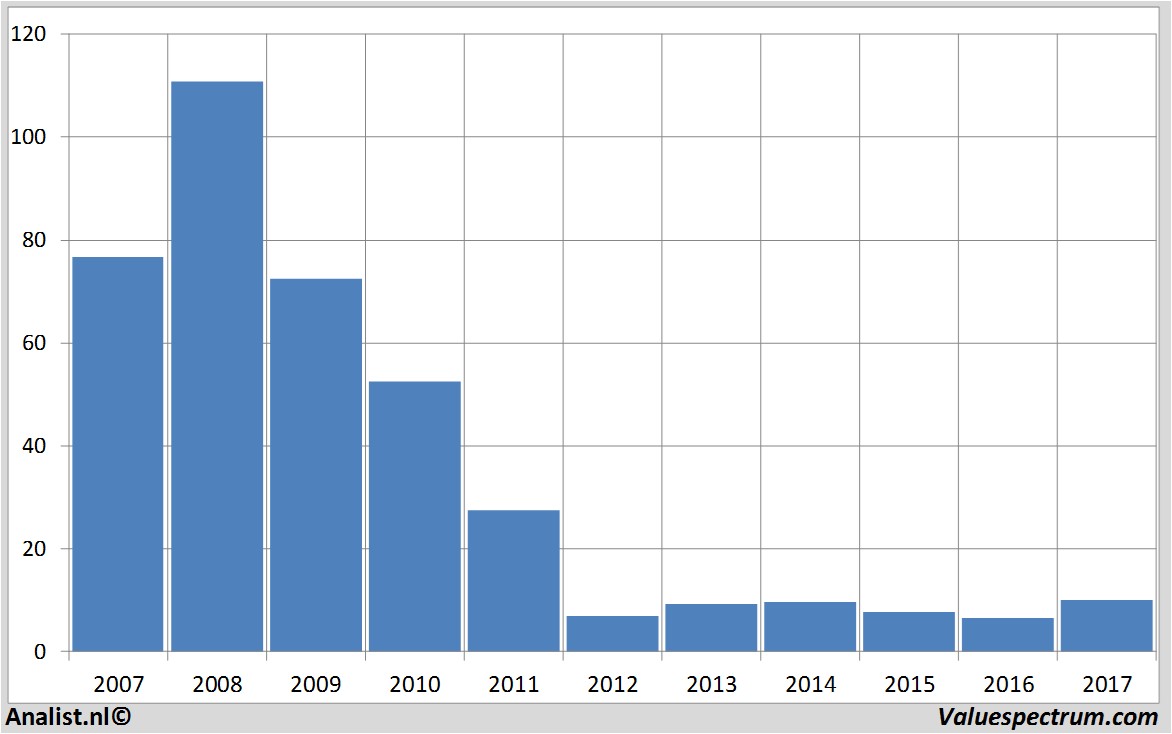

The most recent recommendations for the telecommunications company are from Morgan Stanley , ABN AMRO and Raymond James. Based on the current number of shares BlackBerry 's market capitalization equals 5,2 billion Dollar. Friday the stock closed at 9,97 Dollar.Historical stock prices BlackBerry period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.