Buy BlackBerry Ltd (BB) Because of These Strong Growth Catalysts

BlackBerry Ltd (NYSE: BB) stock is a strong investment opportunity because it is currently cheap and has good growth potentials. Blackberry has almost completed its transition towards software and services business. The company now earns over 80% of its revenue from the software business. Blackberry now has $277 million in deferred revenue. Blackberry’s software is currently being used in over 120 million cars. According to an estimate, self-driving cars market worth is expected to touch over $7 trillion in the future.

Blackberry also has partnerships with Chinese giants like Baidu and TLC. The company recently signed a partnership with British Bullitt Group, which will allow the company to install its software in thousands of devices. These catalysts will become growth drivers for Blackberry in the future.

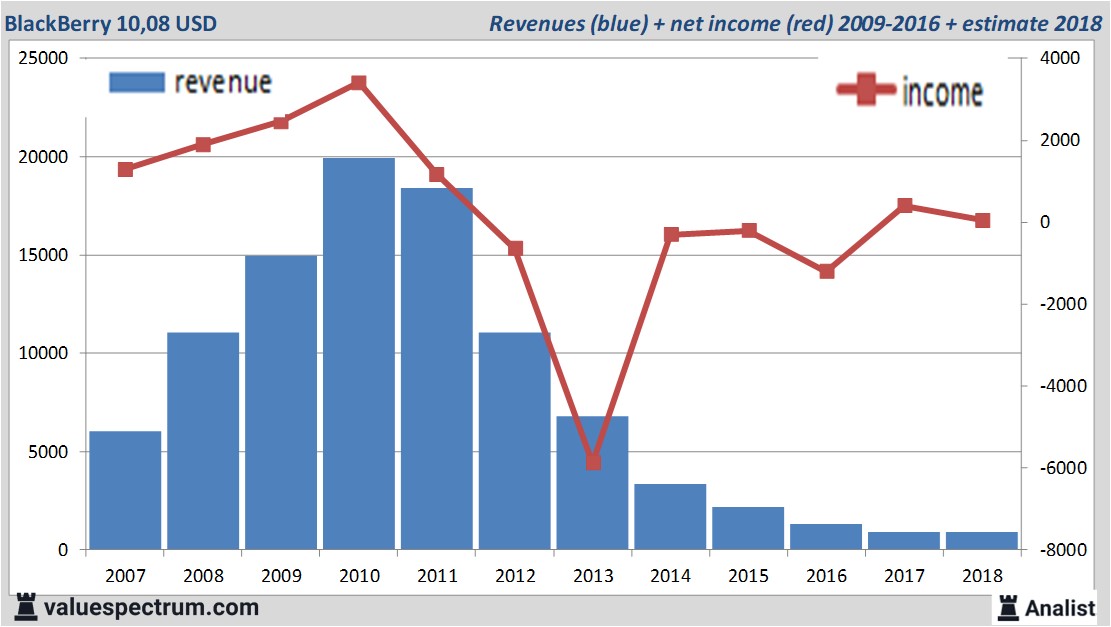

For this year BlackBerry 's revenue will be around 892,75 million USD. This is according to the average of the analysts' estimates. This is slightly lower than 2017's revenue of 932 million USD.

Historical revenues and results BlackBerry plus estimates 2018

The analysts expect for 2018 a net profit of 53 million USD. For this year the consensus of BlackBerry 's result per share is a profit of 9 cent. The price/earnings-ratio therefore equals a very high 112.

For this year analysts don't expect the company to pay a dividend. The average dividend yield of the telecommunications companies is an attractive 2 percent.

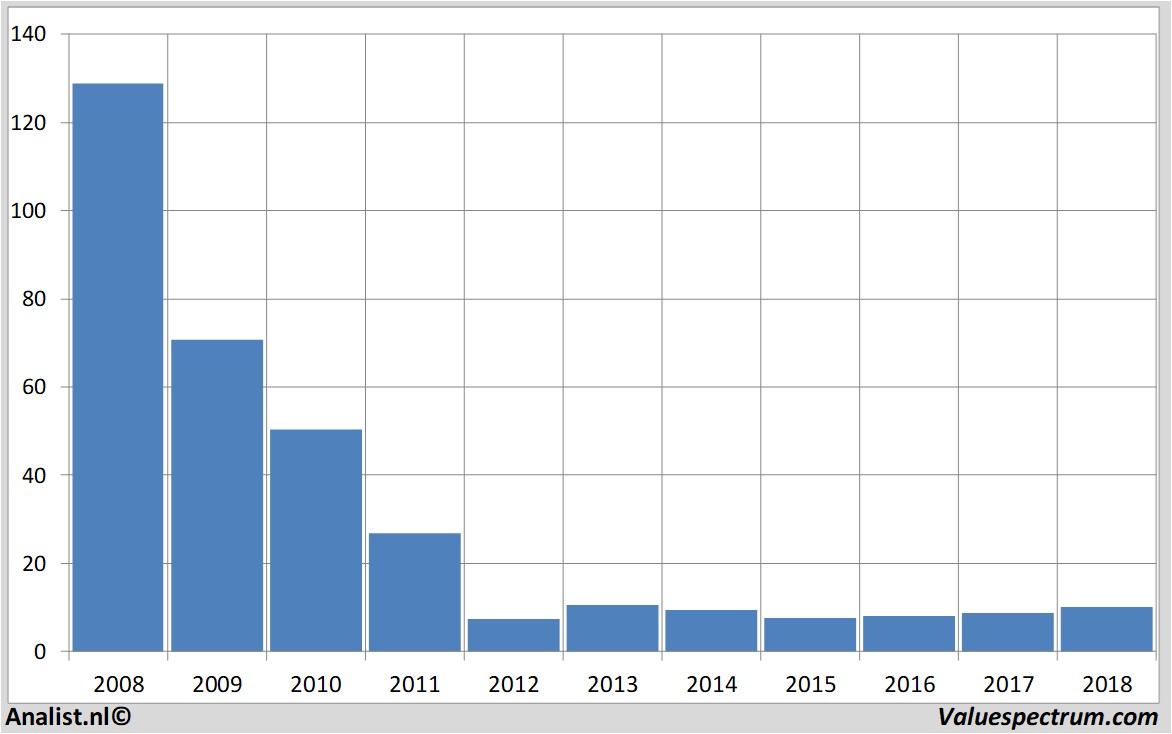

BlackBerry 's market capitalization is based on the number of outstanding shares around 5,35 billion USD. At 16.59 the stock trades 1,59 percent lower at 10,08 USD.Price data BlackBerry 2007-2018

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.