Nike Inc (NKE): Should You Buy The Dip

Nike (NYSE:NKE) took a hit after the company annoucned lower-than-expected quarterly results. Nike sales in North America are declining. Nike ’s partner Foot Locker’s CEO recently said in a statement that Nike shoes are selling at a slower rate. However, investors shouldn’t lose all hope. Nike is still expecting mid to single digit revenue growth for the full fiscal year.

The company is ready to remove third-party retailers and sell its products to the customers directly, both online and through physical stores. Nike sales in China are increasing. In the fiscal first quarter, revenue in China increased by 9% to $1.1 billion on year over year basis. But analysts think that overall recovery of Nike ’s business will take time, and the stock is a decent opportunity only for the investors who are ready to wait with patience.

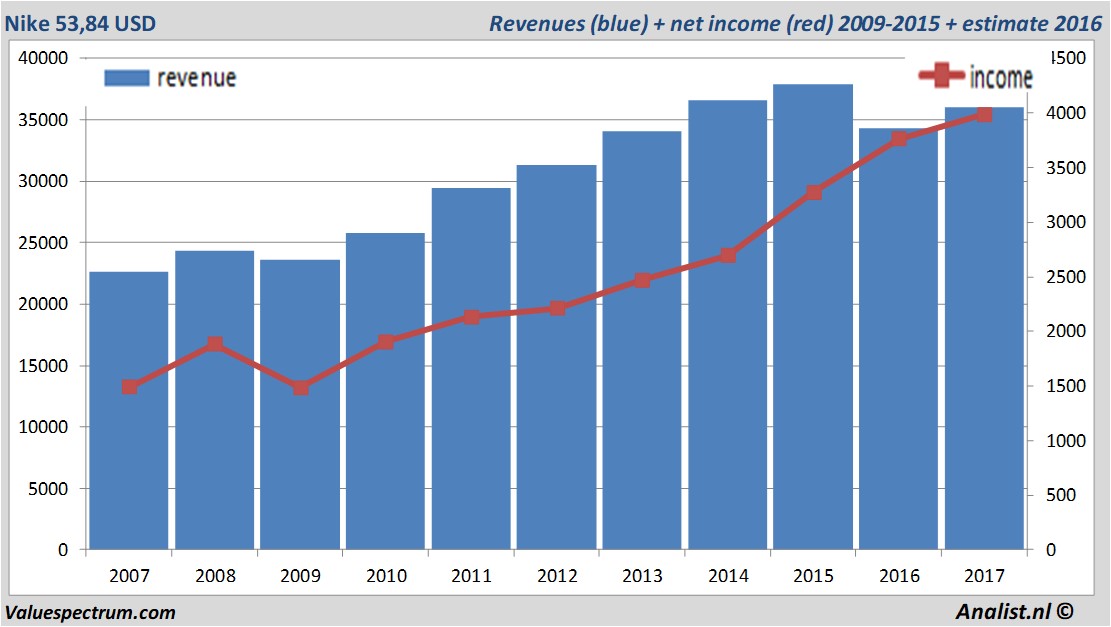

Based on the analysts' consensus: both the revenue and the net result would be on record levels. Over the current book year the total revenue will be 35,79 billion USD (consensus estimates). The expected revenue would be the highest in her history. This is slightly more than 2016's revenue of 34,35 billion USD.

Historical revenues and results Nike plus estimates 2017

The analysts anticipate for 2017 a record net profit a 3,85 billion USD. For this year most of the analysts expect a profit per share of 2,33 USD. Based on this the price/earnings-ratio is 22,09.

For this year the analysts expect a dividend of 0,77 cent per share. Nike 's dividend yield thus equals 1,5 percent. The average dividend yield of the personal goods companies equals a limited 0,90 percent.

Most recent target prices around 49 USD

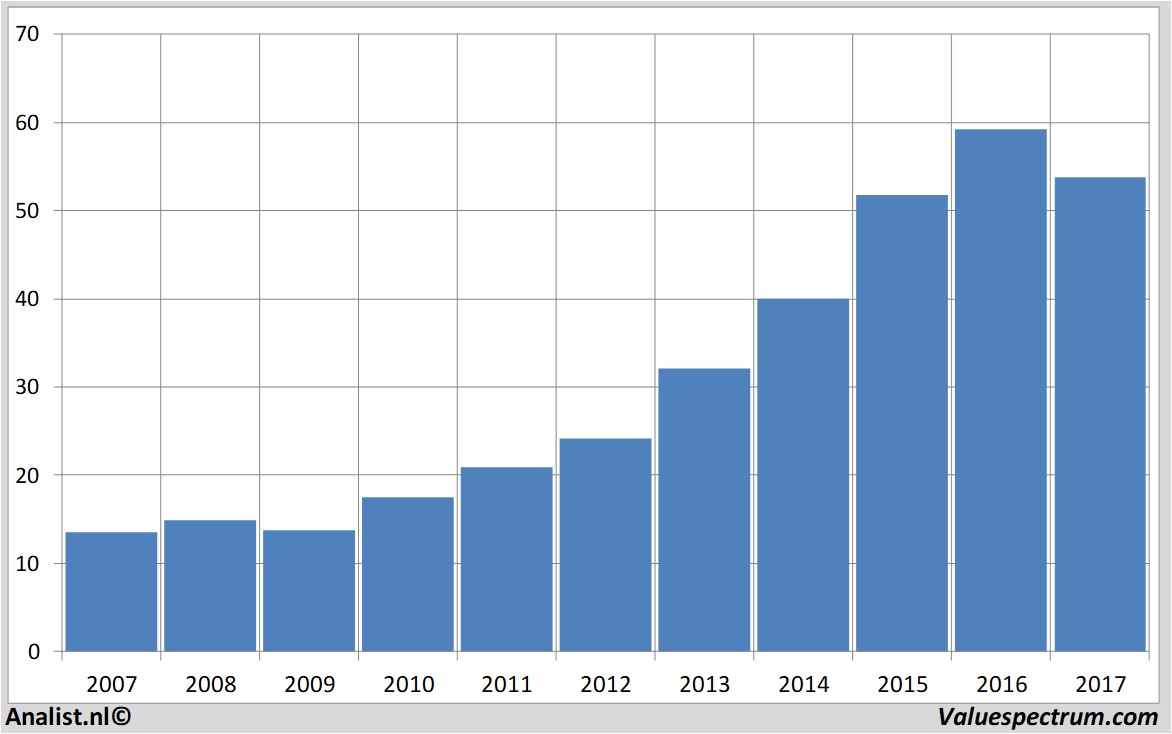

The most recent recommendations for the personal goods company are from Cowen and Company, Canacord Adams and Susquehanna. Nike 's market capitalization is based on the number of outstanding shares around 68,4 billion USD. On Tuesday the stock closed at 51,47 USD.Historical stock prices Nike

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.