Nike Inc (NKE)’s Plans to Fix Its Falling Revenues in North America

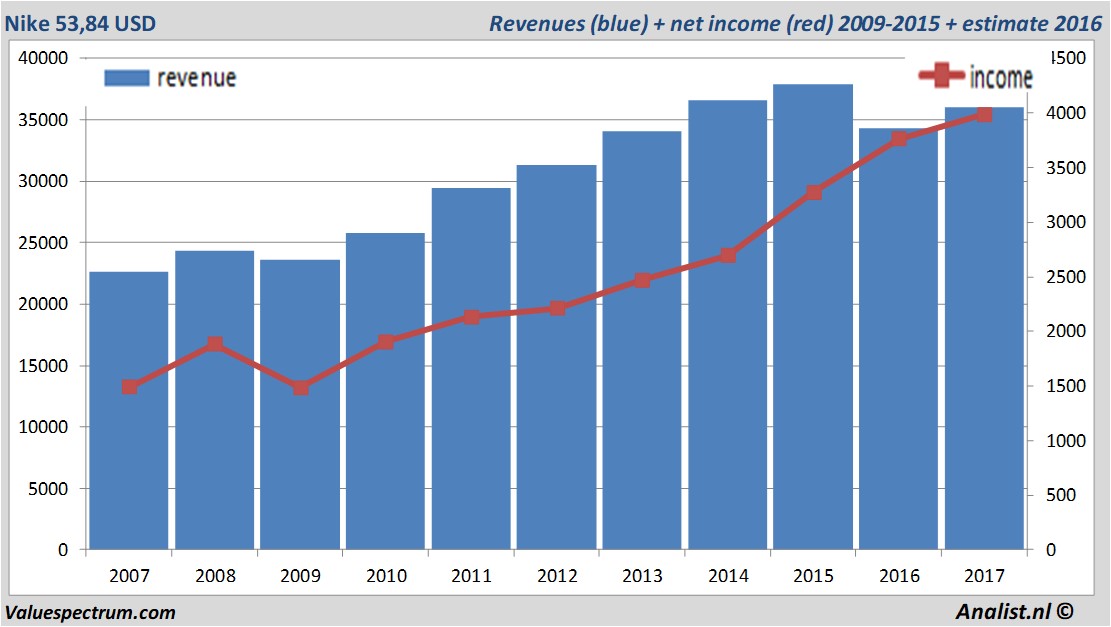

Nike (NYSE:NKE) sales are falling in North America. The company failed to seize the first position in the top-selling sneakers in 2016 for the first time. But Nike is a highly profitable company. In fiscal 2017, Nike ’s revenue came in at $34.350, which was more than the revenue of Under Armor and Adidas combined. Revenue of Nike has increased by a CAGR of 8% in the last 5 years.

In the September quarter, Nike expects to earn $0.49 per share, lower than the forecasts of $0.73 per share. Nike recently signed a deal with Amazon.com after which the company will sell its products on Amazon.com ’s website directly. Analysts think that this step will boost Nike sales as most of the young shoppers now prefer to buy online.

Based on the analysts' consensus: both the revenue and the net result would be on record levels. For this year Nike 's revenue will be around 36,02 billion USD. This is according to the average of the analysts' estimates. The expected revenue would be the highest in her history. This is slightly more than 2016's revenue of 34,35 billion USD.

Historical revenues and results Nike plus estimates 2017

The analysts anticipate for 2017 a record net profit a 3,99 billion USD. The majority of the analysts expects for this year a profit per share of 2,42 USD. The price-earnings-ratio equals 22,37.

For this year the analysts expect a dividend of 0,78 cent per share. The dividend yield is then 1,44 percent. The average dividend yield of the personal goods companies equals a low 0,88 percent.

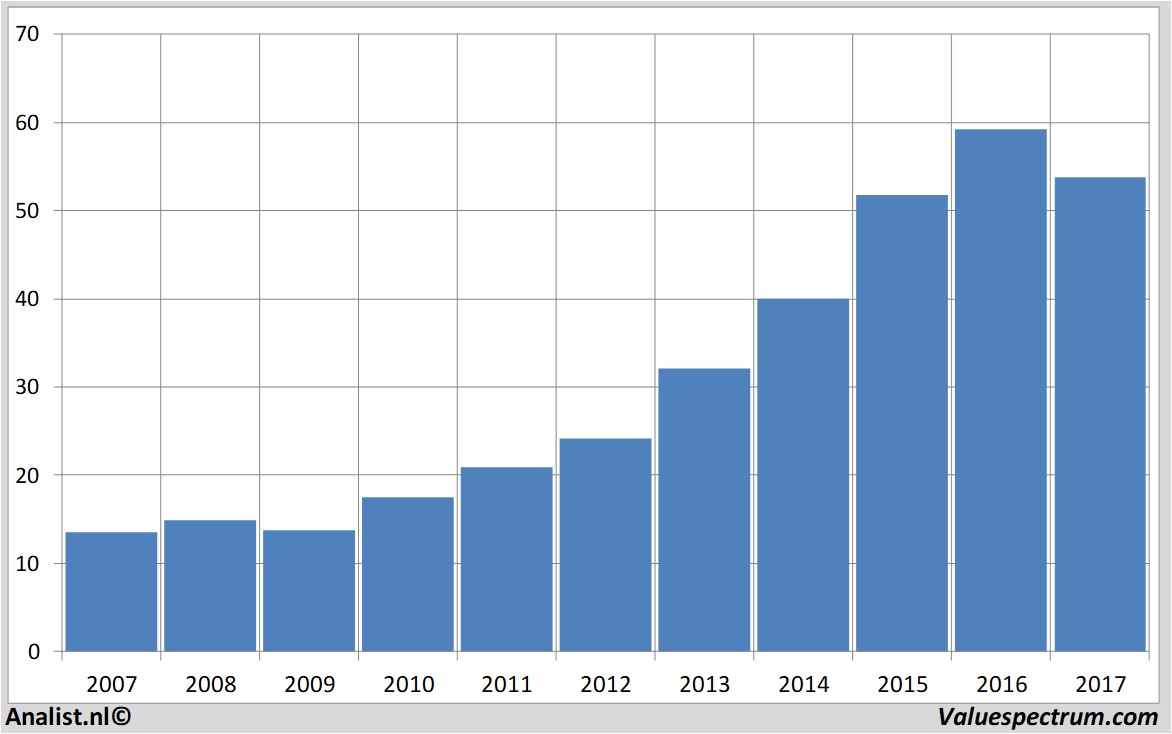

Newest target prices around 66 USD

The latest 3 recommendations for the personal goods company were provided by Jefferies & Co., Morgan Stanley and Raymond James. Nike 's market capitalization is based on the number of outstanding shares around 71,94 billion USD. At 17.17 the stock trades 0,86 percent lower at 54,13 USD.Historical stock prices Nike

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.