Exxon Mobil Corporation (XOM) VS Chevron Corporation (CVX): Which Stock to Buy

Exxon Mobil Corporation (NYSE:XOM) missed EPS estimates for the second quarter last week, but the oil giant managed to double its profits in the period. Exxon Mobil downstream business unexpectedly saw a growth of about 68% in the quarter. The company’s production 1% weaker than expectations. Exxon Mobil Corporation (NYSE:XOM) is also cutting costs and analysts think that this step will positively affect the company’s finance in the third and fourth quarter.

As compared to Exxon, Chevron Corporation (NYSE:CVX) took a clear lead last week by posting better-than-expected quarterly results and a double-digit percentage increase in production. Exxon is also struggling to increase its oil output. Therefore, on a short term basis, Chevron Corporation (NYSE:CVX) seems to be a good Buy according to most of the analysts.

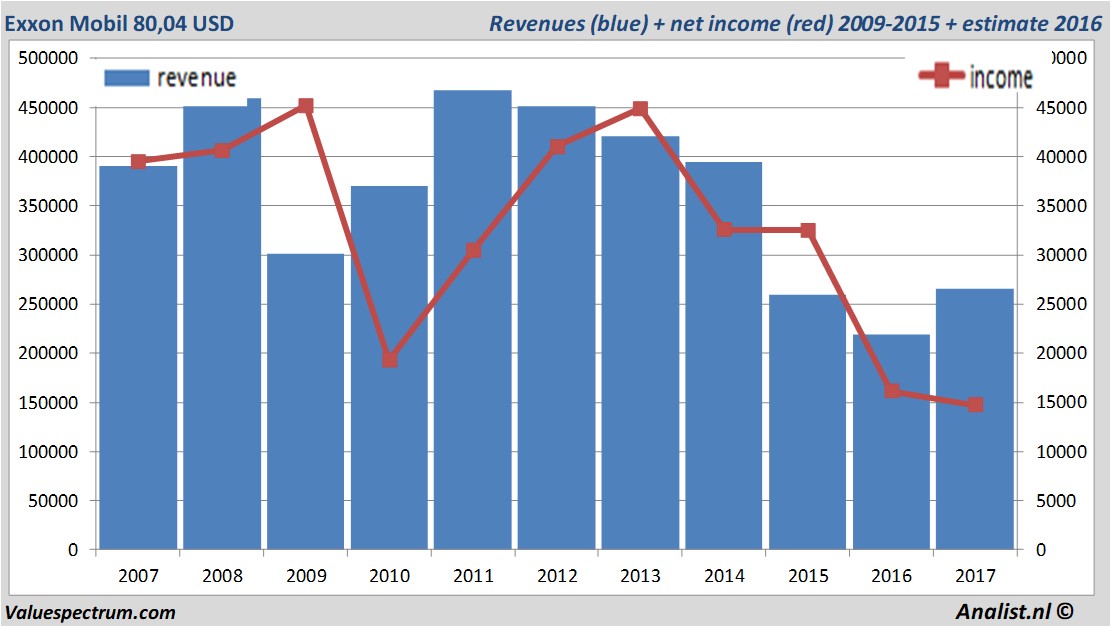

For this year Exxon Mobil 's revenue will be around 265,87 billion USD. This is according to the average of the analysts' estimates. This is quite more than 2016's revenue of 218,61 billion USD.

Historical revenues and results Exxon Mobil plus estimates 2017

The analysts expect for 2017 a net profit of 14,79 billion USD. For this year the consensus of Exxon Mobil 's result per share is a profit of 3,48 USD. The price/earnings-ratio therefore equals 22,87.

Huge dividend Exxon Mobil

Per share the analysts expect a dividend of 3,06 USD per share. The dividend yield is then 3,84 percent. The average dividend yield of the oil & gas producers equals a poor 0,73 percent.Latest estimates around 83 USD

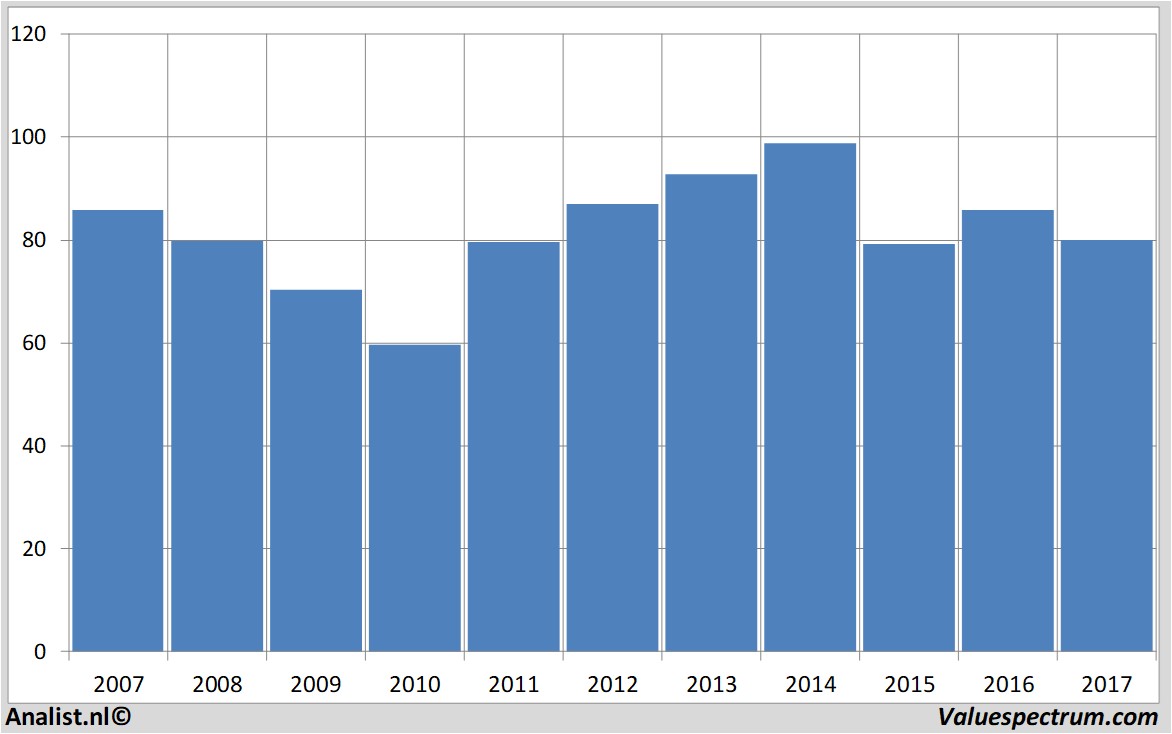

The most recent recommendations for the oil & gas producer are from RBC Capital Markets, Exane BNP Paribas and HSBC . Based on the current number of shares Exxon Mobil 's market capitalization equals 330,82 billion USD. At 17.18 the stock trades 0,38 percent higher at 79,6 USD.Historical stock prices Exxon Mobil

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.