Banca Monte Paschi Siena huge underperformer in European banking sector

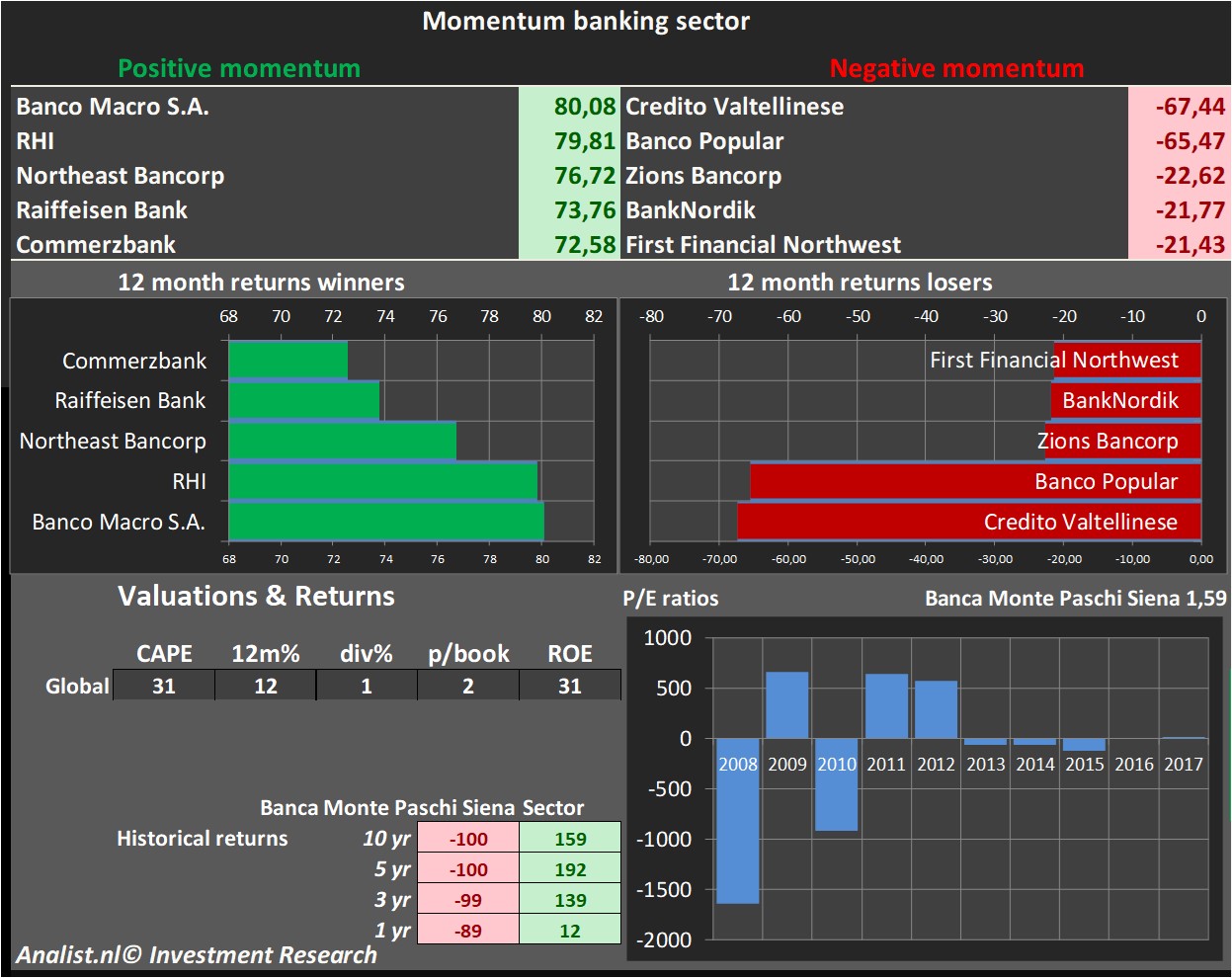

Because of the huge loss of 59 percent since early this year, the share is one of the worst shares of the banking sector. The average stock of the banking sector yielded the this year a profit of 143 percent. Other bad performing shares in the peer group are Credito Valtellinese , Banco Popular and Zions Bancorp . Among the losers in the sector are Banco Macro S.A., RHI and Northeast Bancorp.

Momentum banking sector

On average the sector trades costs now 12 times the earnings per share. Currently the sector trades at 2,32 times the book value per share. Since 2012 the sector has plus of 192 percent and since 2007 a plus of 159 percent.

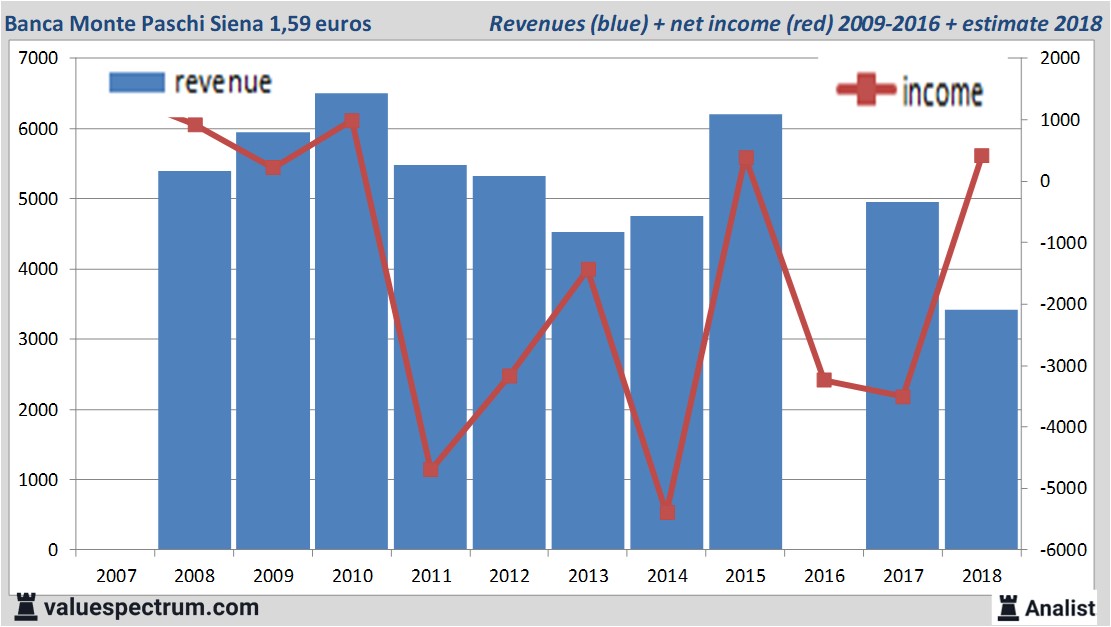

On average the sector trades costs now 12 times the earnings per share. Currently the sector trades at 2,32 times the book value per share. Since 2012 the sector has plus of 192 percent and since 2007 a plus of 159 percent. For this year Banca Monte Paschi Siena 's revenue will be around 3,43 billion euros. This is according to the average of the analysts' estimates. This is rather significant lower than 2017's revenue of 4,95 billion euros.

Historical revenues and results Banca Monte Paschi Siena plus estimates 2018

The analysts expect for 2018 a net profit of 414 million euros. Most of the analysts anticipate on a profit per share of 31 cent. So the price/earnings-ratio equals 5,13.

For this year analysts don't expect the company to pay a dividend. The average dividend yield of the banks is a low 1 percent.

Recent target prices around 32 euros

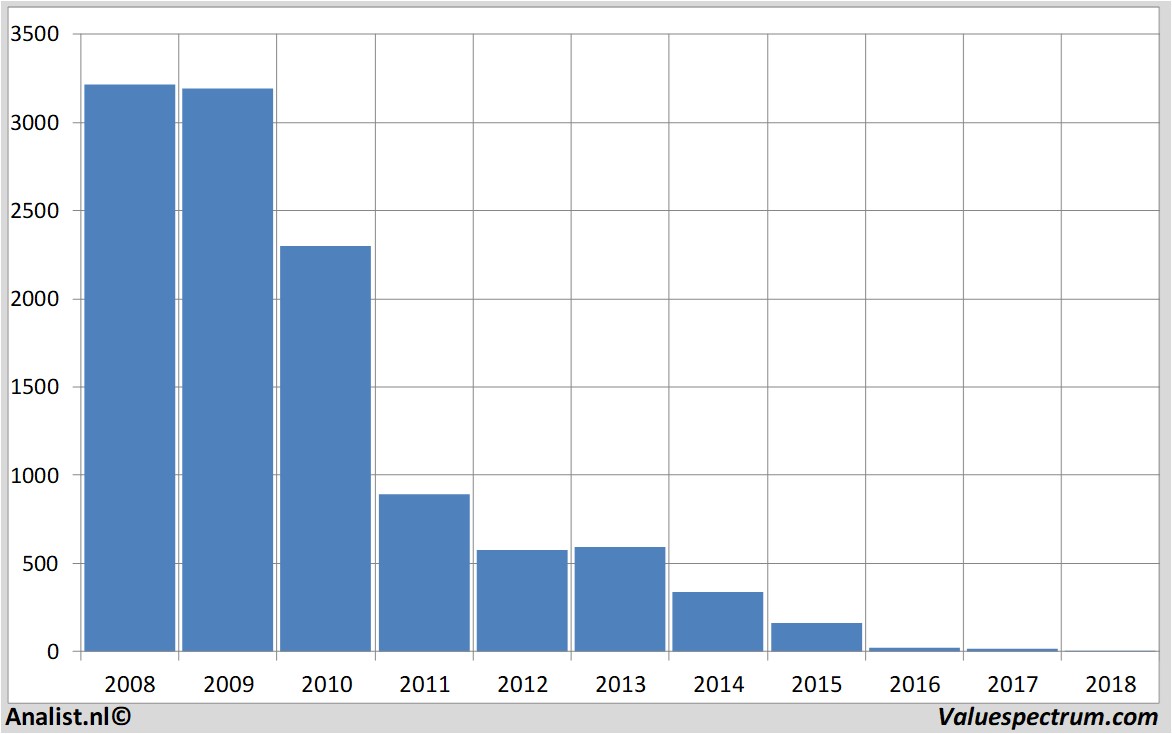

The most recent recommendations for the bank are from Berenberg, Standard & Poors and DZ Bank.Banca Monte Paschi Siena 's market capitalization is based on the number of outstanding shares around 46,63 million euros. The Banca Monte Paschi Siena stock was the past 12 months quite unstable. Since last October the stock is 89 percent lower. This year the stock price moved between 2 and 5 euro. Since 2008 the stock price is almost 100 percent lower.

Historical stock prices Banca Monte Paschi Siena

On Friday the stock closed at 1,59 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.