Why is Chipotle Mexican Grill, Inc. (NYSE: CMG) Losing Value

Chipotle Mexican Grill , Inc. (NYSE: CMG) is trading in the red after stock analysis firm Mizuho downgraded the burrito company’s shares to underperform from neutral. The firm said in its report that Chipotle should be avoided until CEO Brian Niccol outlines a clear strategy for growth.

Mizuho acknowledged that Niccol is the best choice to lead Chipotle. But the firm believes that the lack of catalysts and an over 80% growth in stock value since Niccol’s arrival earlier this year are making Chipotle shares a risky option to buy.

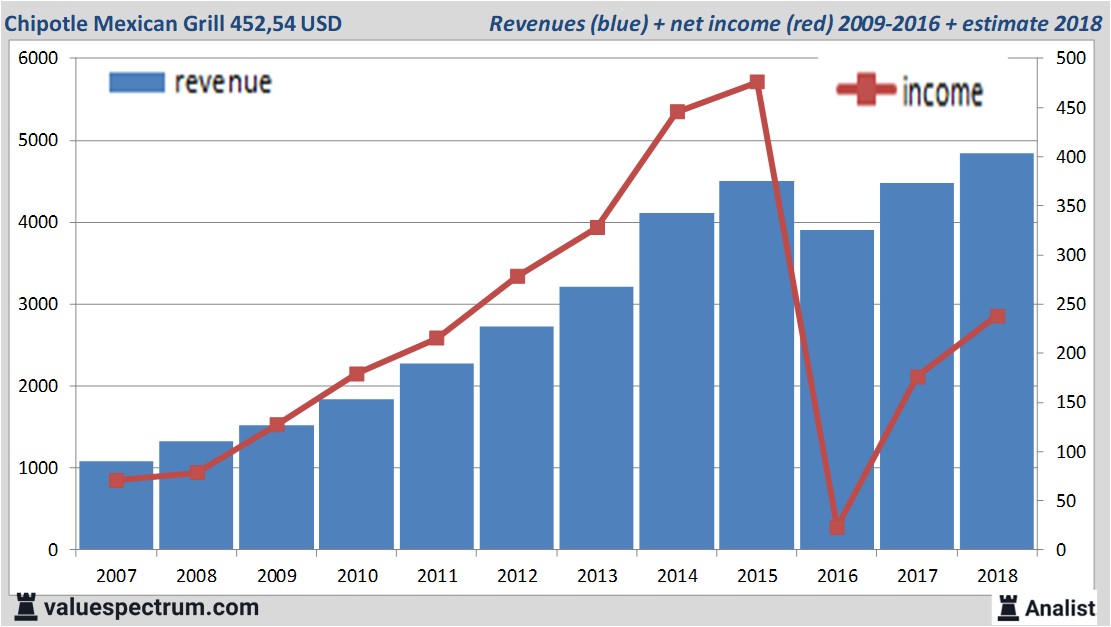

For this year Chipotle Mexican Grill 's revenue will be around 4,84 billion USD. This is according to the average of the analysts' estimates. This is slightly more than 2017's revenue of 4,48 billion USD.

Historical revenues and results Chipotle Mexican Grill plus estimates 2018

The analysts expect for 2018 a net profit of 238 million USD. The majority of the analysts expects for this year a profit per share of 8,67 USD. With this the price/earnings-ratio is an extreme 52,2.

Analysts don't expect the company to pay a dividend. The average dividend yield of the restaurants & bars companies is a relatively high 5 percent.

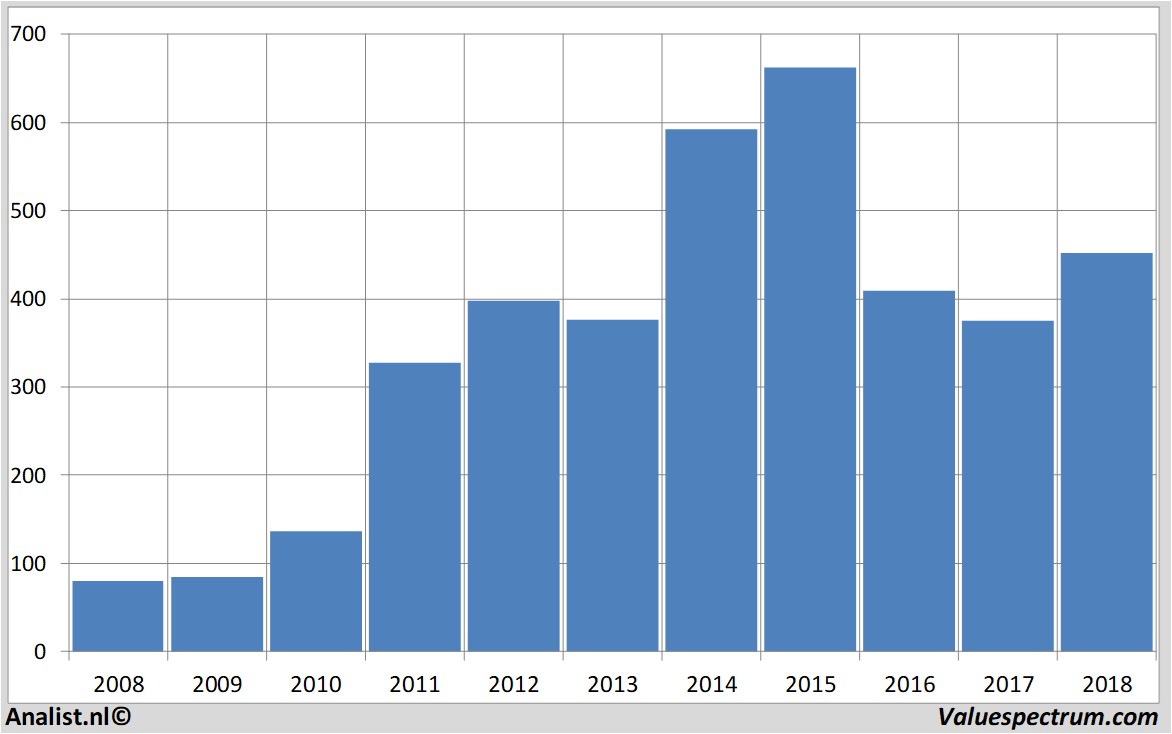

Based on the current number of outstanding shares Chipotle Mexican Grill 's market capitalization is 13,04 billion USD.Historical stock prices Chipotle Mexican Grill

At 16.38 the stock trades 0,1 percent higher at 452,54 USD.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.