Should You Sell Chipotle Mexican Grill, Inc. (CMG) After Latest Problems?

Even though Chipotle Mexican Grill , Inc. (CMG) recovery was reversed last month after reports of a virus outbreak at the food chain’s branches in Virginia, several analysts think that the stock will soon start recovering, and impact of the latest virus repot won’t hurt the growth. Chipotle reported excellent second quarter results. Revenue in the quarter increased by 17.1% year over year, and comparable sales jumped 8.1%. Margins also increased to over 9.1%. Chipotle has a strong balance sheet. The company has no debt. Its free cash flow in the first quarter came in at $94 million.

There is a chance Chipotle third quarter results will be lower-than-expected, because of the impact of the Virginia virus reports. But analysts think that the stock will become stable in the coming quarters.

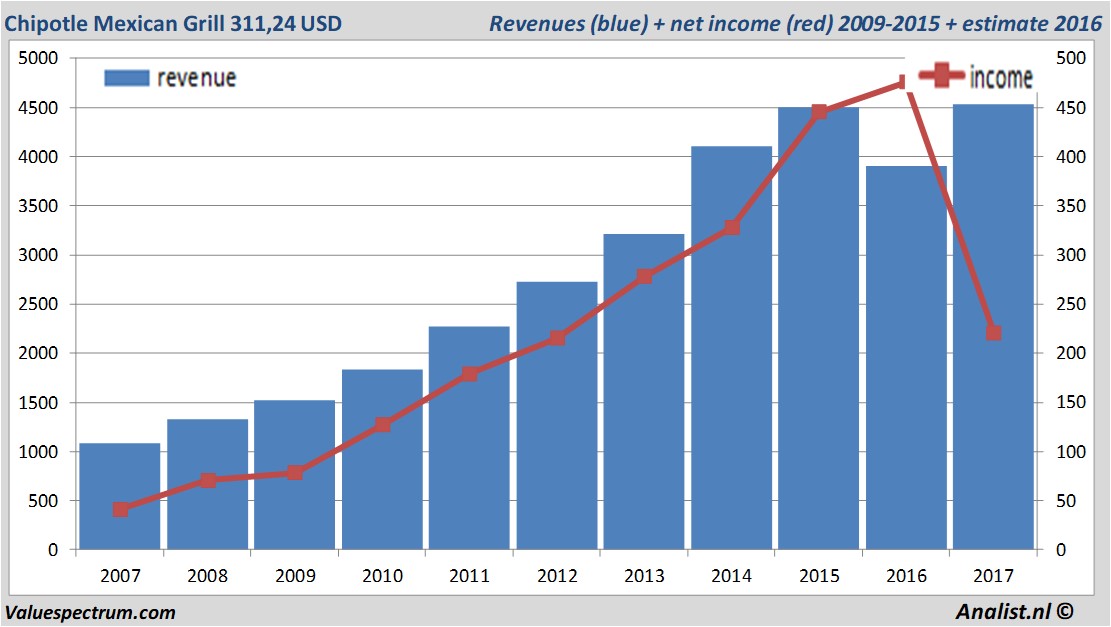

Over the current book year the total revenue will be 4,54 billion USD (consensus estimates). The expected revenue would be a record for the company. This is quite more than 2016's revenue of 3,9 billion USD.

Historical revenues and results Chipotle Mexican Grill plus estimates 2017

The analysts expect for 2017 a net profit of 221 million USD. The majority of the analysts expects for this year a profit per share of 7,73 USD. Based on this the price/earnings-ratio is 40,26.

Analysts don't expect the company to pay a dividend.The average dividend yield of the restaurants & bars companies equals a limited 0,27 percent.

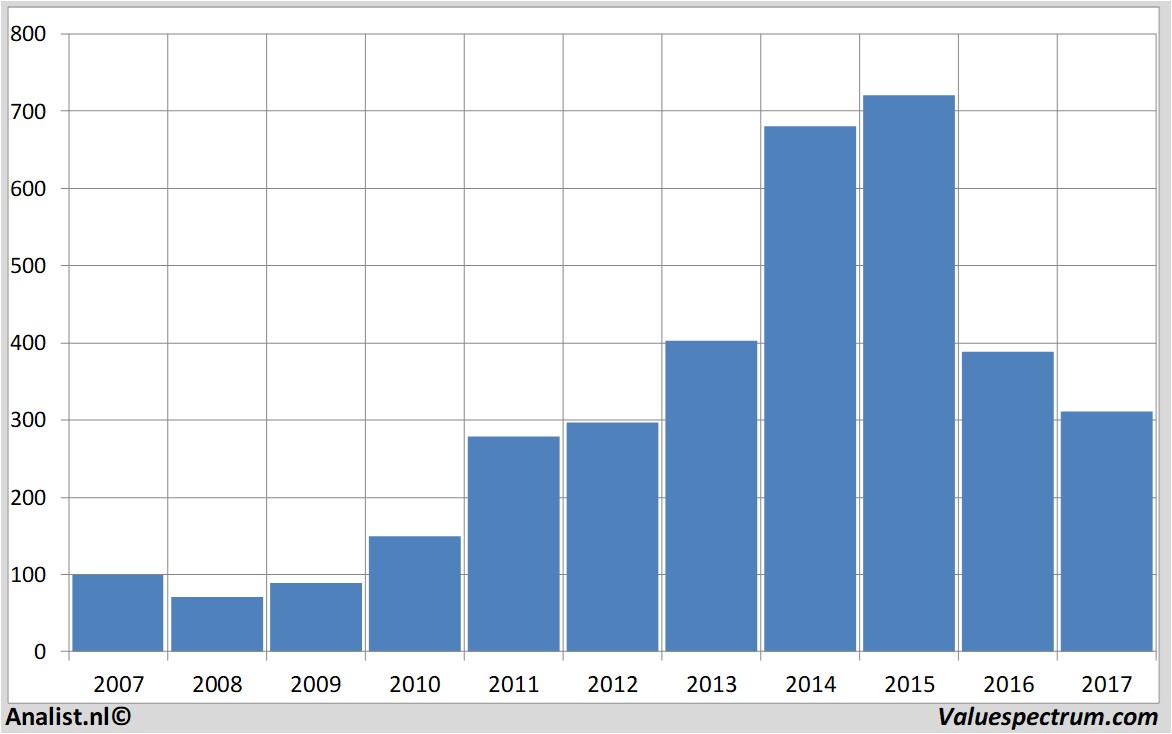

Based on the current number of shares Chipotle Mexican Grill 's market capitalization equals 9,52 billion USD. On Friday the stock closed at 311,24 USD.Historical stock prices Chipotle Mexican Grill

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.