Amazon will unlikely take over everything, economists say

Amazon is the world’s biggest retailer today. Data from One Click Retail last month showed that the e-commerce giant controlled 44 percent of all U.S online retail sales in 2017.

But, economists stated that people would not need to expect a”global takeover” story from Amazon . There are also limits, said Daniel Lacalle, chief economist at Tressis Gestion as quoted by on Thursday. The expert added that Amazon ’s great acquisition would be stopped by reality.

Amazon has been expanding its business to other sectors such as health and finance. The tech giant announced last month it would partner with JP Morgan and Warren Buffet’s Berkshire Hathaway to create a firm that cut health expenses and improve healthcare for American employees. The aim of the company is not to make profits. .

Don’t expect a ‘global takeover’ story from Amazon, economist says from CNBC.

Amazon also quietly introduced over-the-counter products, in partnership with drug maker Perrigo .

Amazon ’s stock reached its all-time high of $1,500 for the first time Wednesday. Its shares have soared to more than 70 percent in the last 12 months.

Stiff competition from Amazon sends Tops Markets to bankruptcy

Amazon ’s dominance has affected similar players in the retail business. The U.S supermarket chains Tops Markets declared bankruptcy on Wednesday. The New York-based firm stated that declining food prices, unsustainable debt load and fierce competition with Amazon .com forced it to restructure its business.

Amazon acquired Whole Foods Market last year, affecting some of Tops stores in New York.

The supermarket has more than 14,200 employees. As of December 2017, the company’s asset was $977 million with $1.18 billion of liabilities.

Some supermarket chains are trying to survive amid stiff competition from such an online retailer like Amazon .Online shopping has hurt profits of supermarket chains.

Tops expects its 169 stores operating in Vermont, Pennsylvania, and upstate New York to remain open.

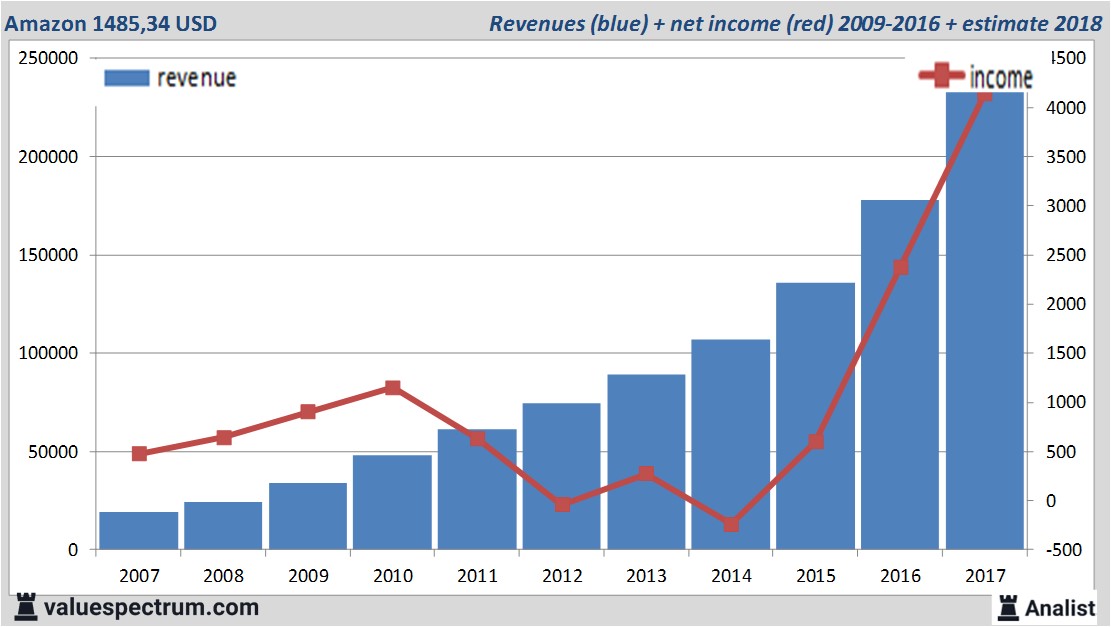

For this year Amazon 's revenue will be around 233,29 billion USD. This is according to the average of the analysts' estimates. This is quite more than 2016's revenue of 177,87 billion USD.

Historical revenues and results Amazon plus estimates 2018

The analysts expect for 2018 a net profit of 4,14 billion USD. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 8,31 USD. With this the price/earnings-ratio is an extreme 178,74.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the general retailers equals a low 1 percent.

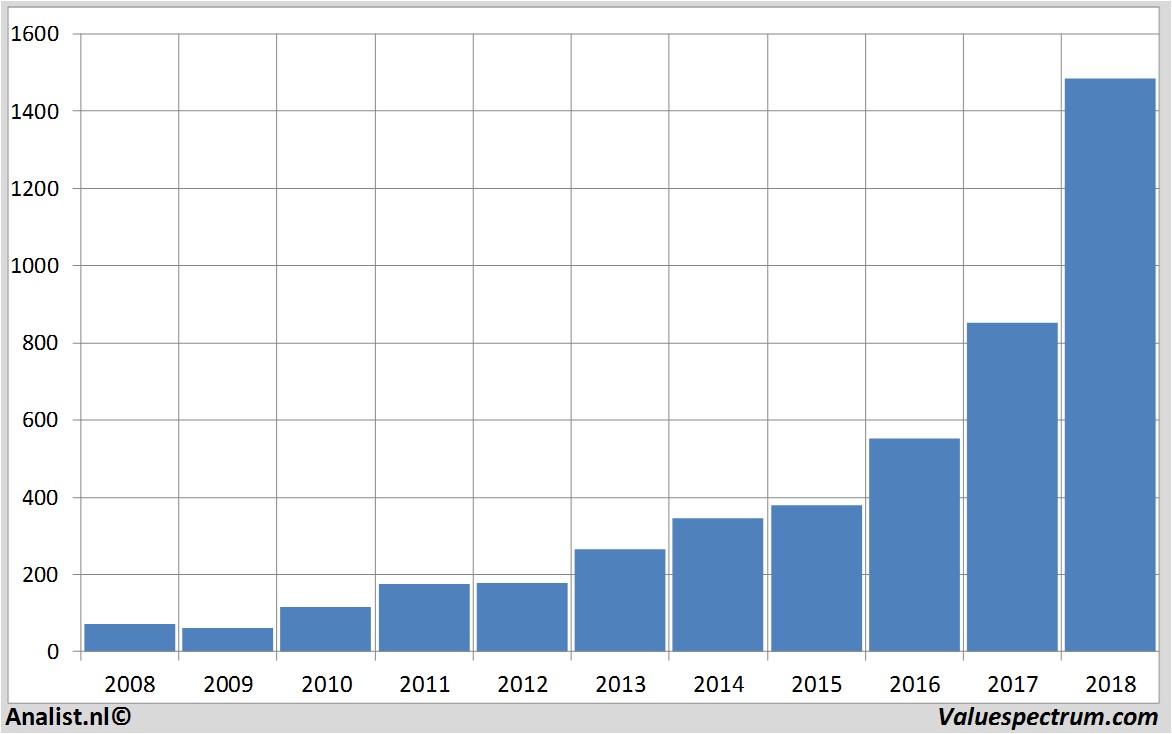

Most recent target prices around 1617 USD

The most recent recommendations for the general retailer are from Nomura Securities, Canacord Adams and Morgan Stanley . Based on the current number of outstanding shares Amazon 's market capitalization is 708,51 billion USD. On Wednesday the stock closed at 1485,34 USD.Historical stock prices Amazon from 2007 till 2018

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.