Should You Buy 3M Co (NYSE:MMM)

3M Co (NYSE:MMM) has been a big gainer this year, rising about 30% so far this year. In October, the manufacturing company posted better than expected quarterly results. 3M Company’s revenue in the quarter increased to $8.17 billion from $7.71 billion, beating the FactSet consensus of $7.92 billion. The company also raised its earnings guidance. However, analysts think that the margin growth at 3M is stalling, which means that the stock might not grow enormously in 2018.

Therefore, investors should practice caution while investing in this stock. 3M remains a long term hold amid a rise in manufacturing demand and revenue growth. 3M revenue for different segments is improving. Electronics and Energy segment revenue increased by 13% organically. Industrial and Safety and Graphics revenue increased by 6% while healthcare revenue jumped 7% in the quarter.

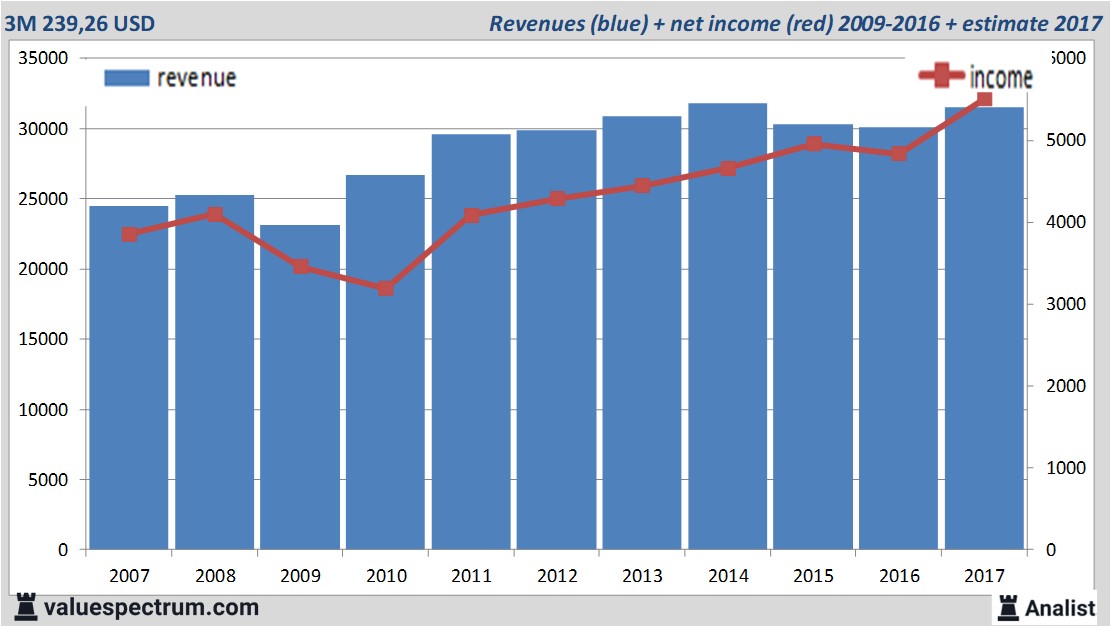

Over the current book year the total revenue will be 31,46 billion USD (consensus estimates). This is slightly more than 2016's revenue of 30,11 billion USD.

Historical revenues and results 3M plus estimates 2017

The analysts anticipate for 2017 a record net profit a 5,5 billion USD. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 9,07 USD. The price/earnings-ratio therefore equals 25,53.

Per share the analysts expect a dividend of 4,7 USD per share. Thus the dividend yield equals 2,03 percent. The average dividend yield of the diversified companies equals a low 0,72 percent.

Most recent target prices around 205 USD

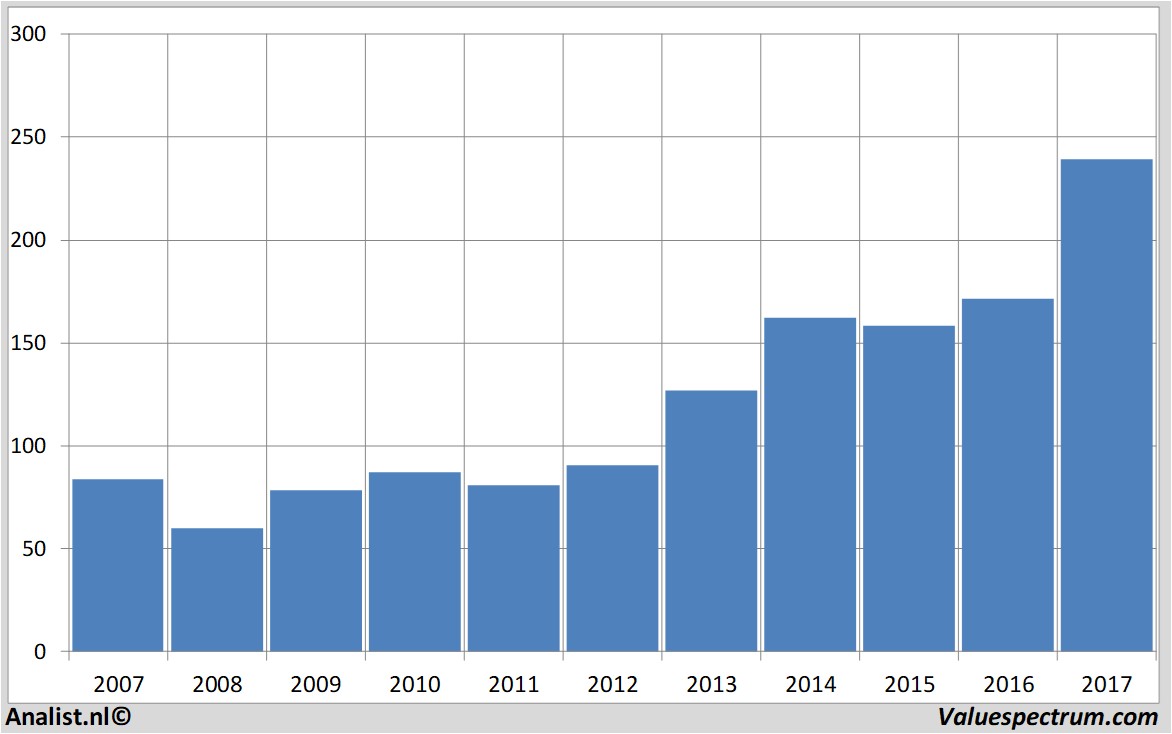

Morgan Stanley , Barclays and Jefferies & Co. recently provided recommendations for the stock. Based on the current number of outstanding shares 3M 's market capitalization 141,11 billion USD. On Wednesday, the stock closed at 231,58 USD.Historical stock prices 3M period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.