Reasons to Buy Home Depot Inc (HD)

Home Depot Inc (NYSE:HD) is one of the favorite stocks of investors in 2017. The company is experiencing a lot of growth amid a rising home improvement trend in the US. Analysts are also expecting huge sales amid hurricanes in the country. The stock looks undervalued. Analysts expect about 11% earnings growth for Home Depot between 2017 and 2019. Based on this estimate, Home Depot has a price-to-earnings/growth (PEG) ratio of just 2. The stock is up over 23% since the start of the year. Analysts also think that Home Depot will gain valued amid the upcoming tax cuts in the US.

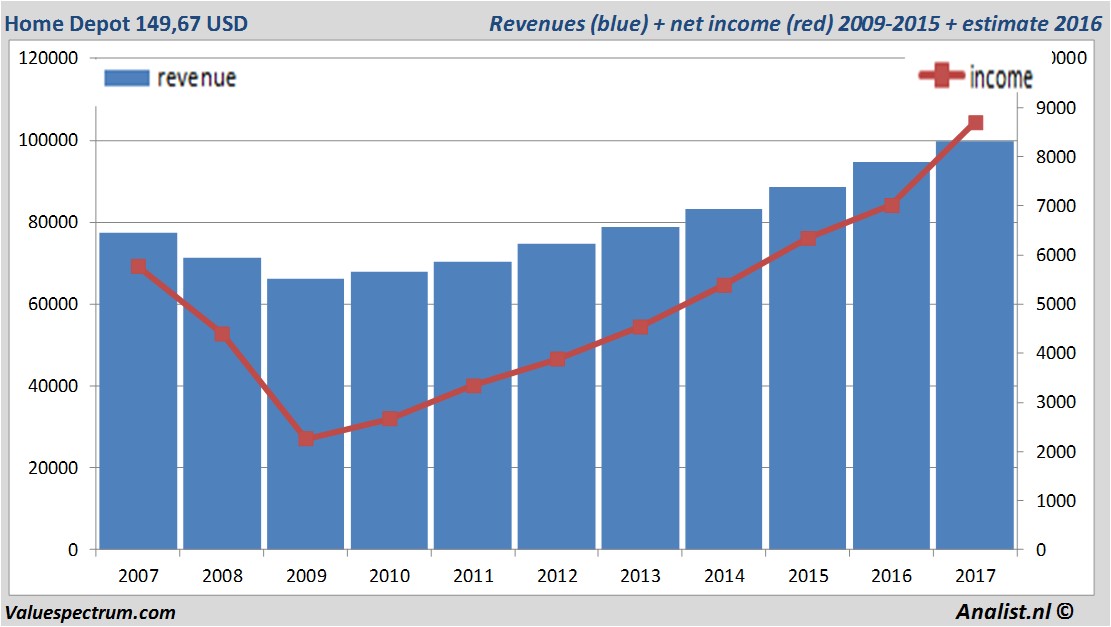

Based on the analysts' consensus: both the revenue and the net result would be the highest in years. Over the current book year the total revenue will be 99,83 billion USD (consensus estimates). The expected revenue would be the highest in her history. This is slightly more than 2016's revenue of 94,6 billion USD.

Historical revenues and results Home Depot plus estimates 2017

The analysts anticipate for 2017 a record net profit a 8,69 billion USD. According to most of the analysts the company will have a profit per share for this book year of 7,33 USD. Based on this the price/earnings-ratio is 22,44.

Per share the analysts expect a dividend of 3,59 USD per share. Home Depot 's dividend yield thus equals 2,18 percent. The average dividend yield of the general retailers equals a poor 0,54 percent.

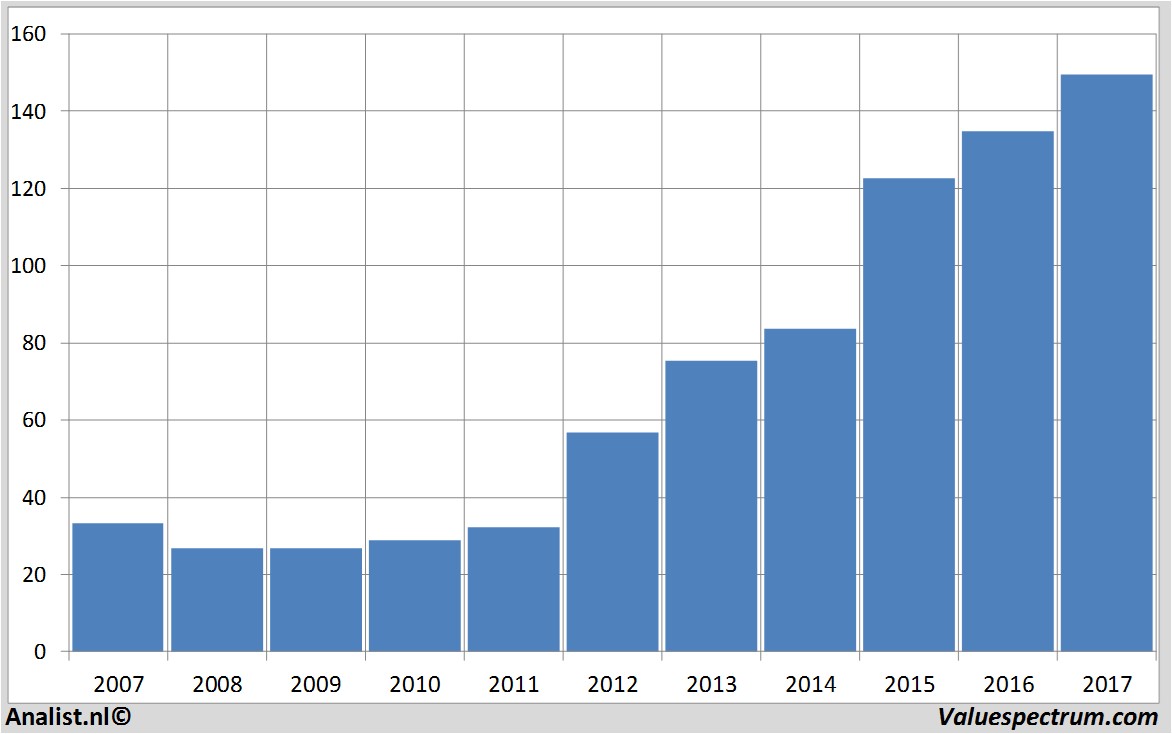

Latest estimates around 160 USD

Barclays , BMO Capital Markets and Beleggers Belangen recently provided recommendations for the stock. Home Depot 's market capitalization is based on the number of outstanding shares around 205,92 billion USD. On Friday the stock closed at 164,47 USD.Historical stock prices Home Depot

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.