Why Boeing Co (NYSE:BA) Is Up 62% This Year

Boeing Co (NYSE:BA) has been on a tear lately. The stock is up over 62% since the start of this year. Boeing is benefitting from the troubled geopolitical situation around the world and increasing demand of military and civil aircrafts. Malaysia recently reached a deal with the company after which Malaysia will use Boeing aircrafts for its state operations. Earlier this month, Canaccord Genuity increased its price target for Boeing to $235. Boeing recently sold six 777s to Russia. The company is also getting orders from Iran. Growth prospects remain strong and analysts believe the stock is a good buying opportunity.

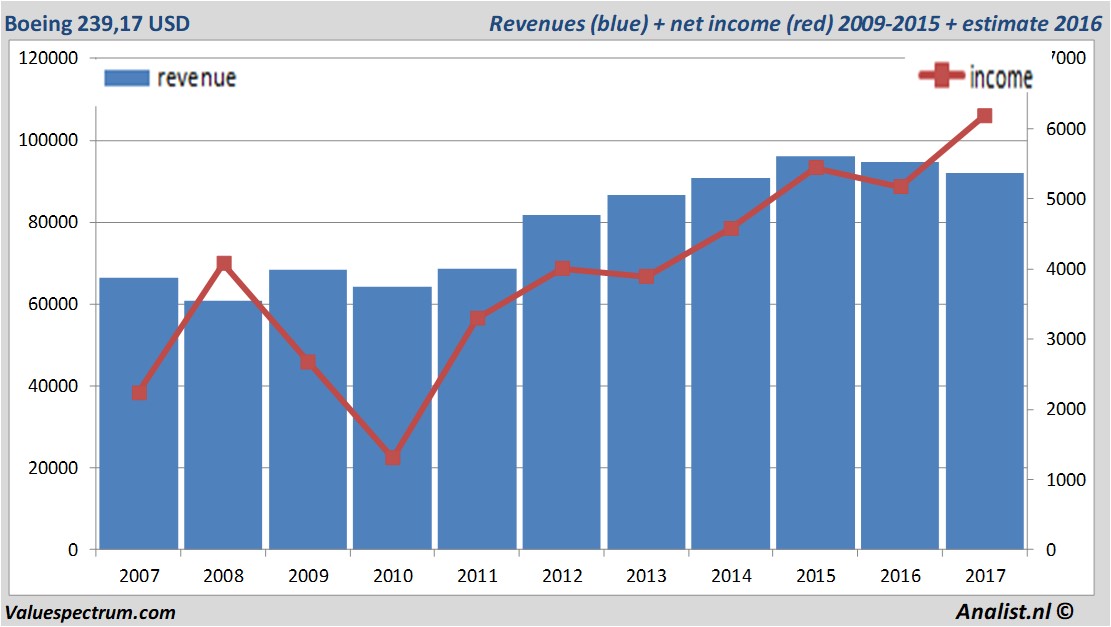

For this year Boeing 's revenue will be around 91,91 billion USD. This is according to the average of the analysts' estimates. This is slightly lower than 2016's revenue of 94,57 billion USD.

Historical revenues and results Boeing plus estimates 2017

The analysts anticipate for 2017 a record net profit a 6,28 billion USD. The majority of the analysts expects for this year a profit per share of 10,02 USD. So the price/earnings-ratio equals 25,38.

Per share the analysts expect a dividend of 5,64 USD per share. The dividend yield is then 2,22 percent. The average dividend yield of the aerospace & defense companies equals a limited 0,43 percent.

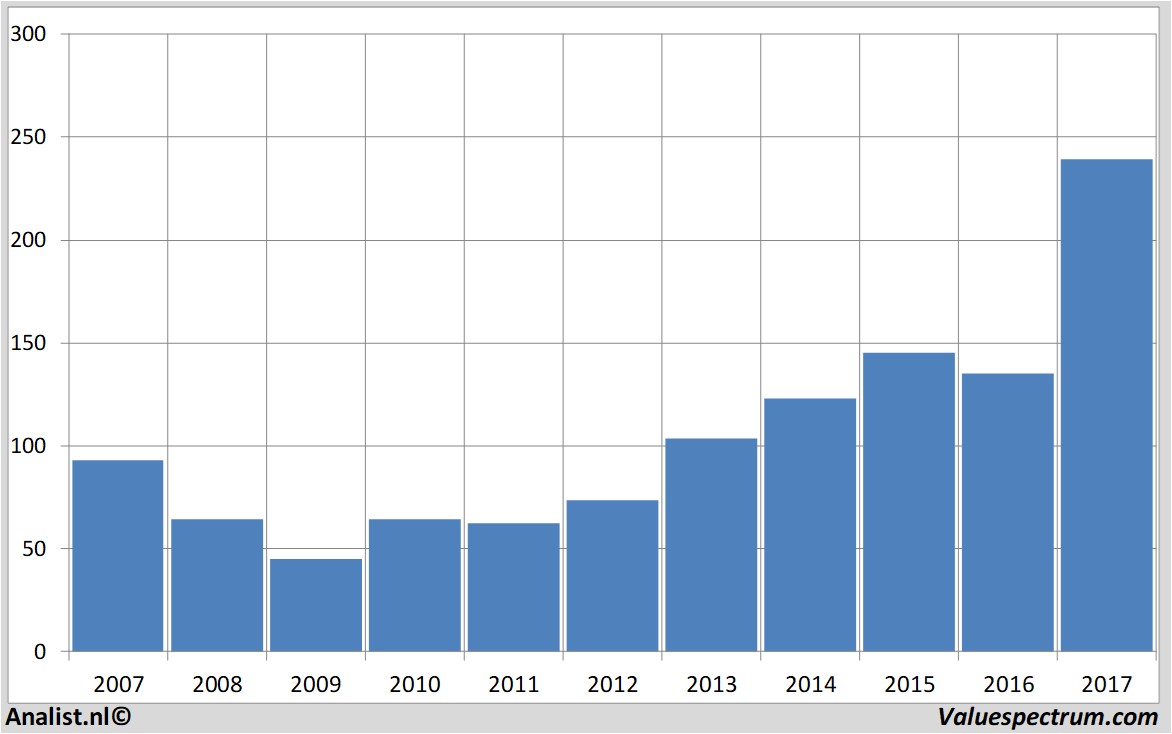

Recent target prices around 269 USD

The most recent recommendations for the aerospace & defense company are from ER Capital, Argus Research Company and RBC Capital Markets. Based on the current number of outstanding shares Boeing 's market capitalization is 169,5 billion USD. On Thursday the stock closed at 254,27 USD.Price data Boeing 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.