Can Alibaba Group Holding Ltd (BABA) Double in the Next Two Years

Alibaba Group Holding Ltd (NYSE:BABA) shares are up over 72% since the start of the year. Analysts think that Alibaba will pose a major threat to Amazon.com in the US. Alibaba is a dominant player in the world’s biggest market, China. Amazon.com has a very little footprint in China. Alibaba recently started a “New Retail” strategy to ramp up its digital efforts. The company is using Big Data to track customer interests in order to improve ads and shopping experience.

This strategy has resulted in per-click growth because Alibaba ads are now becoming more relevant. Investment firm SumZero said in a report earlier this month that Alibaba’ stock could double in the next two years. The firm has a price target of $250-$300 for Alibaba.

Over the current book year the total revenue will be 233,37 billion USD (consensus estimates). This is rather significant more than 2016's revenue of 158,27 billion USD.

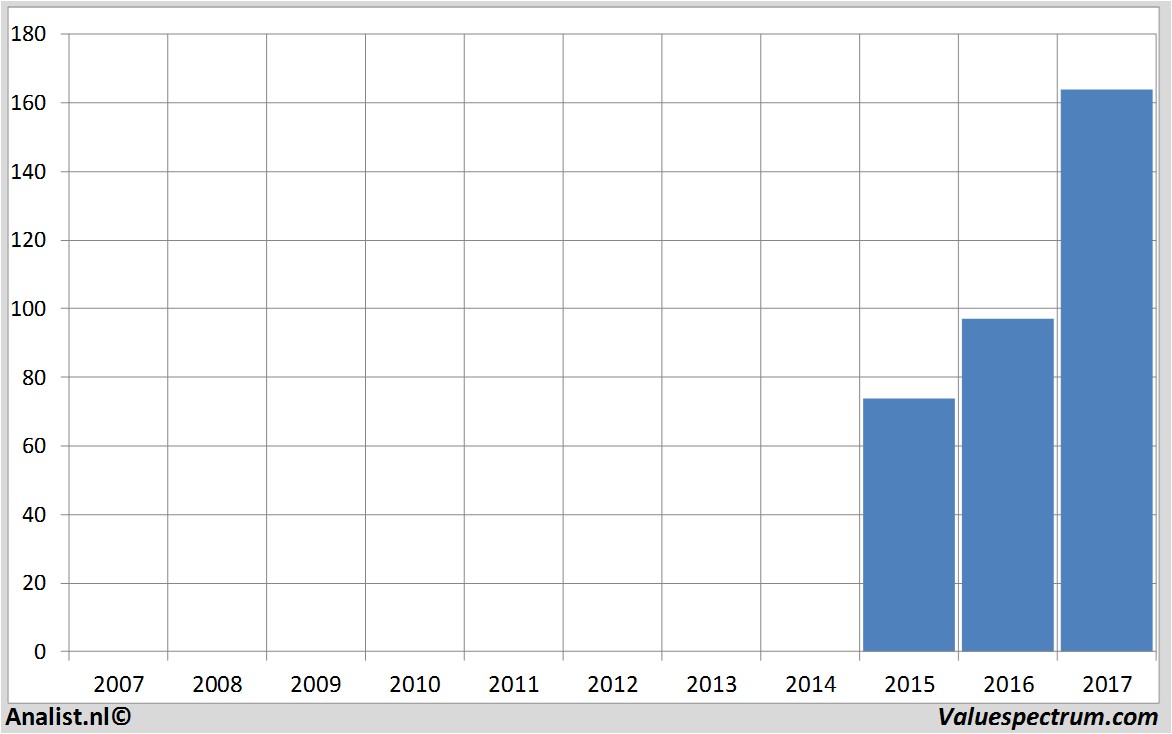

Historical revenues and results Alibaba plus estimates 2017

The analysts expect for 2017 a net profit of 83,46 billion USD. For this year the consensus of Alibaba's result per share is a profit of 32,08 USD. The price/earnings-ratio therefore is 5,11.

Analysts don't expect the company to pay a dividend.The average dividend yield of the internet companies equals a moderate 0,09 percent.

Most recent target prices around 195 USD

RBC Capital Markets, Raymond James and Stifel recently provided recommendations for the stock. Based on the current number of shares Alibaba's market capitalization equals 405,53 billion USD. At 16.11 the stock trades 1,15 percent higher at 163,92 USD.Historical stock prices Alibaba from 2007 till 2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.