General Electric Company (NYSE:GE): Buy on Weakness

General Electric (NYSE:GE) recently reported second quarter results after which the stock dipped. The company didn’t meet expectations amid a weakness and oil and gas business. However, analysts think that the stock is a good buy because the company will recover after the arrival of the new CEO in August, as he will announce new, drastic measures to reform the company.

General Electric is also good dividend stock. The company’s cash flow remain strong and expected to rise in 2018. General Electric is well on track to cut $1 billion in costs by the end of 2017. Since the start of 2017, the company was able to slash over $650 million in costs. Therefore, General Electric currently presents a good buying opportunity.

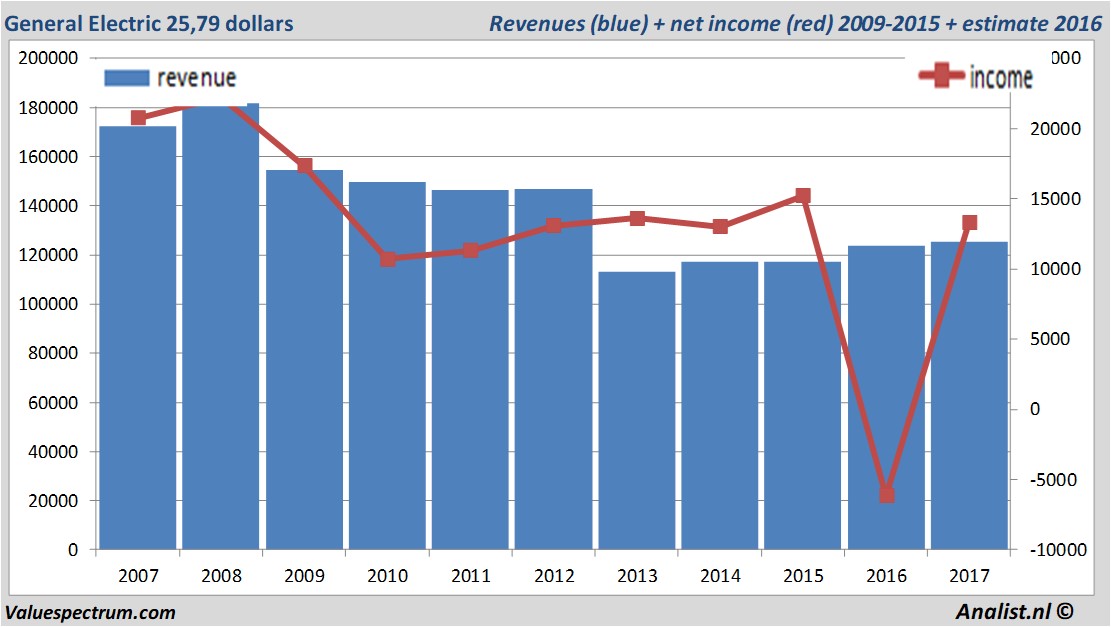

Over the current book year the total revenue will be 125,46 billion Dollar (consensus estimates). This is slightly more than 2016's revenue of 123,69 billion Dollar.

Historical revenues and results General Electric plus estimates 2017

The analysts expect for 2017 a net profit of 13,28 billion Dollar. For this year the consensus of General Electric 's result per share is a profit of 1,57 Dollar. Based on this the price/earnings-ratio is 16,43.

Huge dividend General Electric

For this year the analysts expect a dividend of 0,96 cent per share. The dividend yield is then 3,72 percent. The average dividend yield of the diversified companies equals a low 1,22 percent.Most recent target prices around 29 Dollar

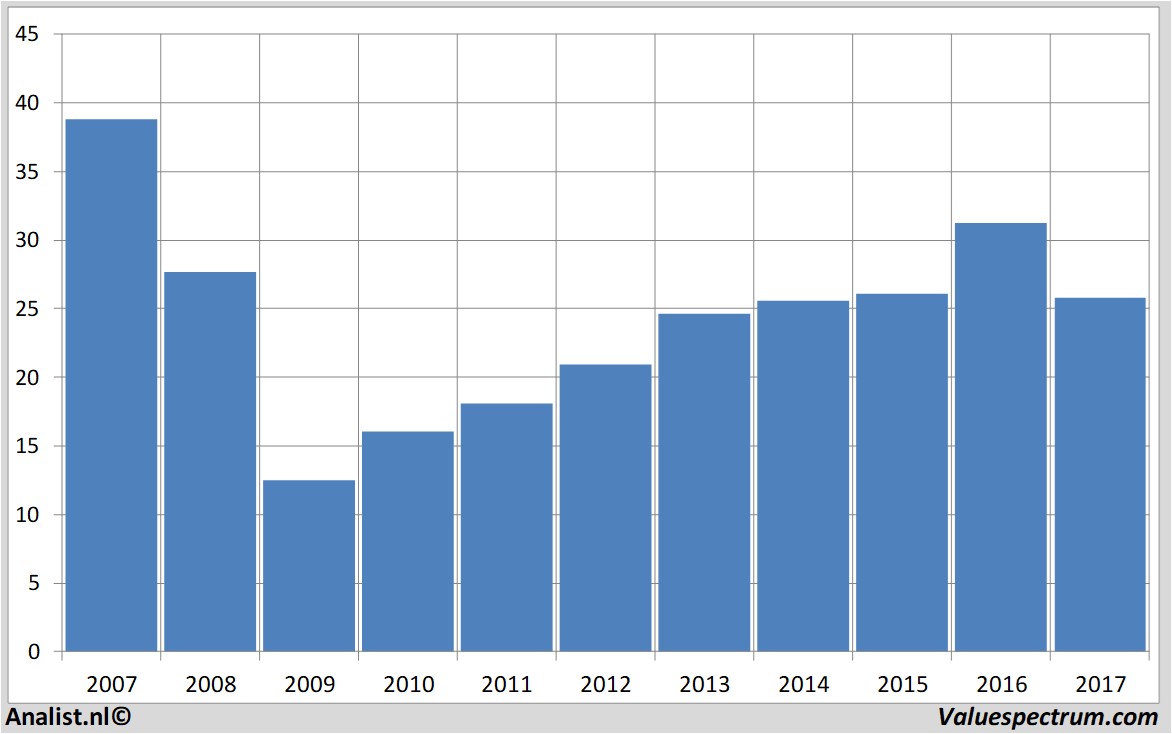

The latest 3 recommendations for the diversified company were provided by Independent Research, Morgan Stanley and Goldman Sachs . Based on the current number of shares General Electric 's market capitalization equals 241,89 billion Dollar.Historical stock prices General Electric past 10 years

Thursday the stock closed at 25,79 Dollar.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.