Why Should You Buy Delta Air Lines, Inc. (NYSE:DAL)

Ann Coulter’s rants on Twitter aren’t damaging Delta stock even one bit. The stock soared after the company gave a strong third quarter guidance. Delta also posted strong traffic numbers in June. However, the company missed second quarter estimates, which was a surprise for analysts. Earlier this month, Evercore’s analyst Duane Pfennigwerth and Raymond Wong gave a strong rating to Delta Air Lines, Inc. (NYSE:DAL), and said that the stock had transitioned to “leading” from “lagging” after a strong improvement in margins.

Delta Air Lines, Inc. (NYSE:DAL) is one of the very few airliners which managed to grow in intense pressure of fuel and labor costs. Analysts think that the stock will gain value in the near future as there is an oil price hike expected in the later months of 2017.

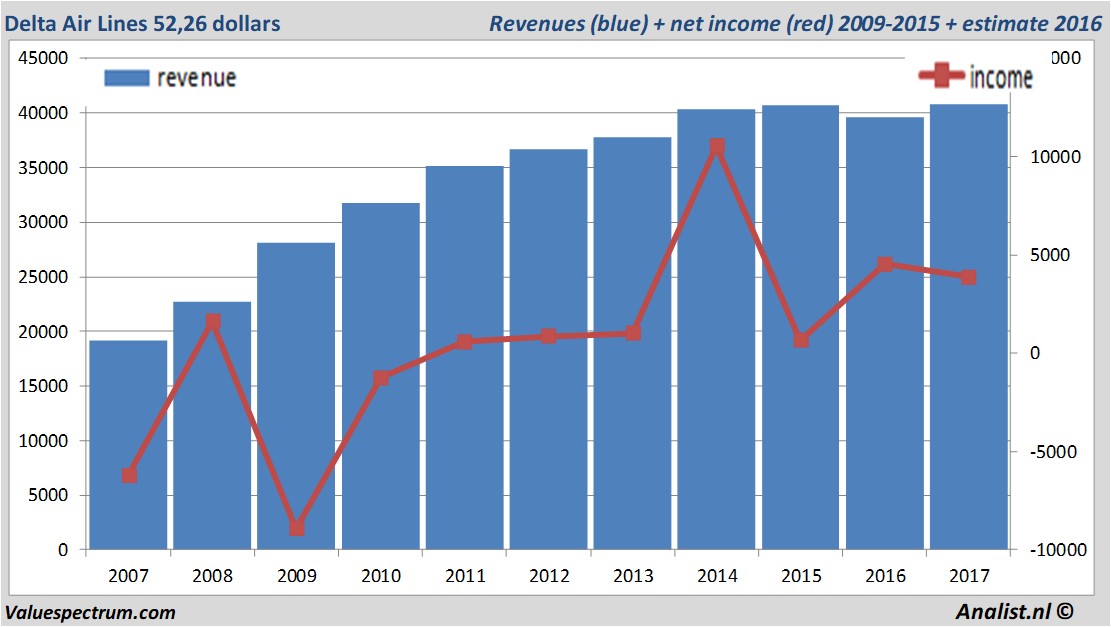

For this year Delta Air Lines's revenue will be around 40,83 billion Dollar. This is according to the average of the analysts' estimates. The expected revenue would be a record for the company. This is slightly more than 2016's revenue of 39,64 billion Dollar.

Historical revenues and results Delta Air Lines plus estimates 2017

The analysts expect for 2017 a net profit of 3,88 billion Dollar. For this year most of the analysts expect a profit per share of 5,46 Dollar. The price/earnings-ratio therefore is 9,57.

For this year the analysts expect a dividend of 0,98 cent per share. The dividend yield is then 1,88 percent. The average dividend yield of the airline companies equals a poor 0,78 percent.

Delta Air Lines's market capitalization is around 40,7 billion Dollar. Friday the stock closed at 52,26 Dollar.Historical stock prices Delta Air Lines period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.