Advanced Micro Devices, Inc. (AMD) Catching Up Quickly With High Value for Money

Although Intel has a massive market share in the chips industry, analysts think that Advanced Micro Devices , Inc. (NASDAQ:AMD) has a strong chance of denting Intel ’s grip due to the pricing factor. Last month, AMD launched Threadripper chips, which are high performance CPUs with up to 16 cores. This product starts from $799. On the other hand, Intel ’s latest chips, multi-core Core i9 product line, costs over $1199. This major price difference brings Intel ’s dominance in question. Analysts think that most of the gaming community is now tilting towards AMD, as they cannot afford hefty price tags.

AMD is also expected to launch 7nm chips, which would boost its portfolio in the industry.

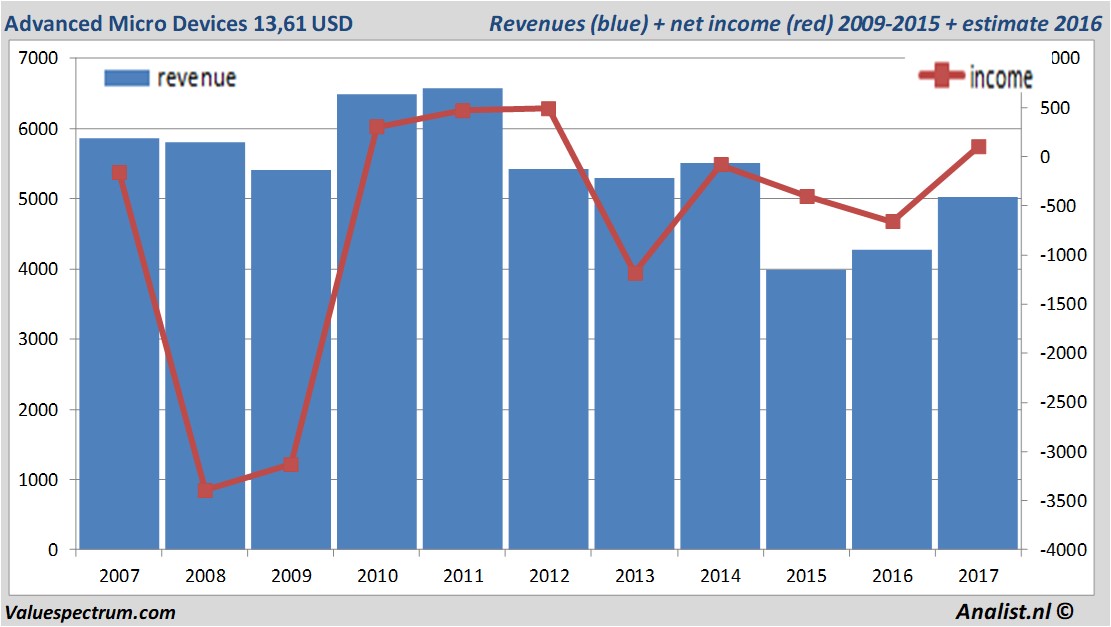

Over the current book year the total revenue will be 4,82 billion Dollar (consensus estimates). This is hugely more than 2016's revenue of 4,27 billion Dollar.

Historical revenues and results Advanced Micro Devices plus estimates 2017

The analysts expect for 2017 a net profit of 61 million Dollar. The majority of the analysts expects for this year a profit per share of 7 cent. Based on this the price/earnings-ratio is a significant 192,57.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the semiconductor companies equals a poor 0,25 percent.

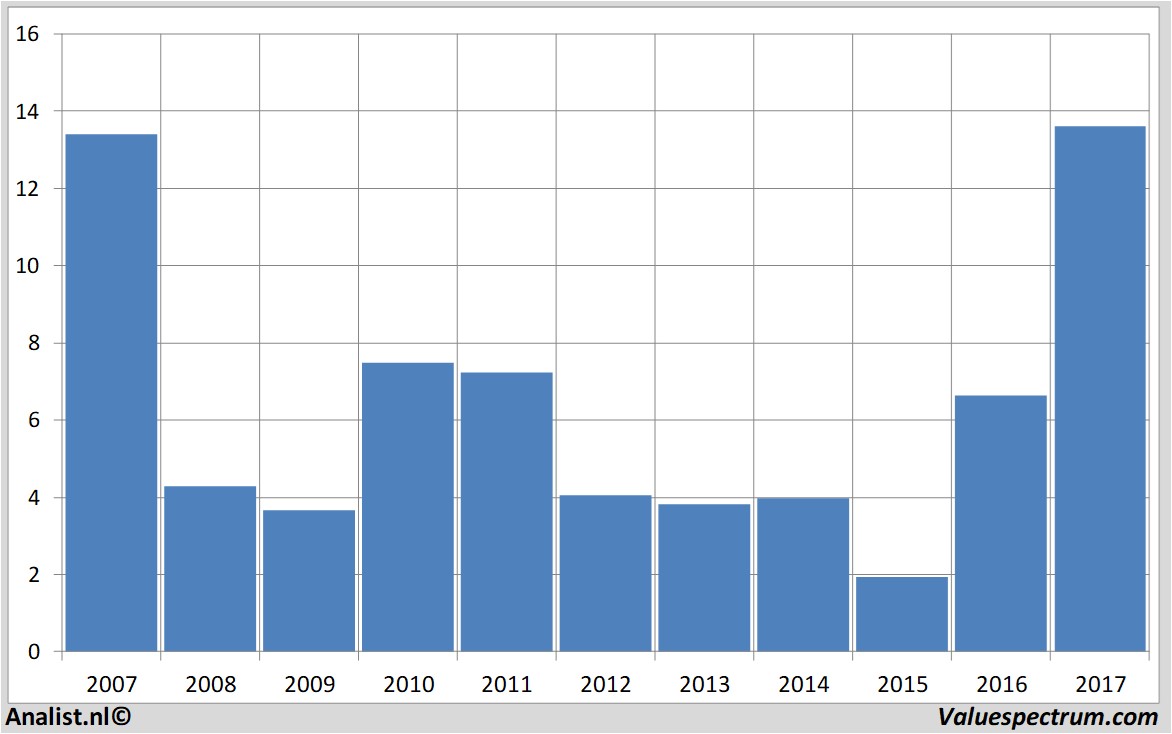

Based on the current number of outstanding shares Advanced Micro Devices 's market capitalization is 10,68 billion Dollar. At 16.29 the stock trades 0,54 percent higher at 13,48 Dollar.Historical stock prices Advanced Micro Devices period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.