Intel Corporation (NASDAQ:INTC) Will Benefit from a Timely Transition

Intel (NASDAQ:INTC) is under pressure amid a changing industry environment. Almost 59% of Intel ’s revenue comes from PC business and related services, a segment which is rapidly losing steam worldwide. But analysts think that Intel (NASDAQ:INTC) started transitioning its business model timely, and the stock will gain value in the future. Intel still has over 90% market share in the server chips business.

The company is betting big on the self-driving cars industry, which is going to have a total worth of $7 trillion. Intel acquired Israel-based MobilEye to delve deeper into the driverless car industry. Intel reported better-than-expected first quarter earnings. Analysts think that Intel is a good investment if you are looking for long term gains.

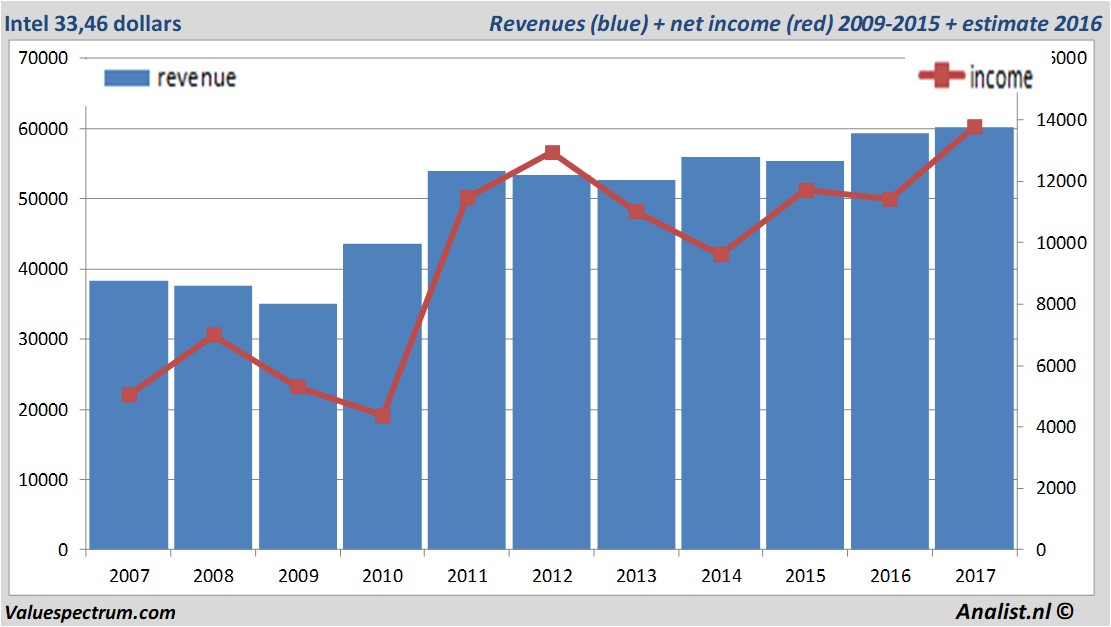

Based on the analysts' estimates both the revenue and the net result would be the highest in years. Over the current book year the total revenue will be 60,17 billion Dollar (consensus estimates). The expected revenue would be the highest in her history. This is slightly more than 2016's revenue of 59,39 billion Dollar.

Historical revenues and results Intel plus estimates 2017

The analysts anticipate for 2017 a record net profit a 13,77 billion Dollar. Most of the analyst anticipate on a profit per share of 2,86 Dollar. Based on this the price/earnings-ratio is 11,7.

Huge dividend Intel

For this year the analysts expect a dividend of 1,07 Dollar per share. Thus the dividend yield equals 3,2 percent. The average dividend yield of the semiconductor companies equals a low 0,19 percent.Most recent target prices around 42 Dollar

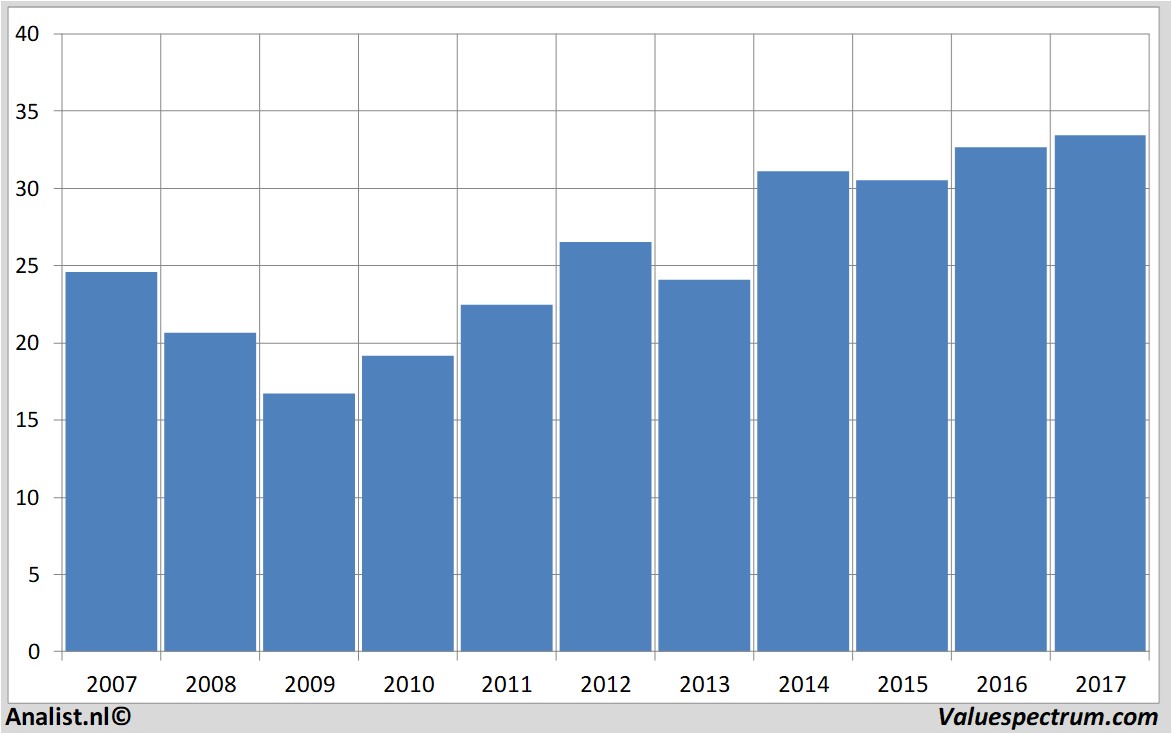

The most recent recommendations for the semiconductor company are from ER Capital, Deutsche Bank and Jefferies & Co.. Intel 's market capitalization is based on the number of outstanding shares around 158,1 billion Dollar. Monday the stock closed at 33,46 Dollar.Historical stock prices Intel

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.