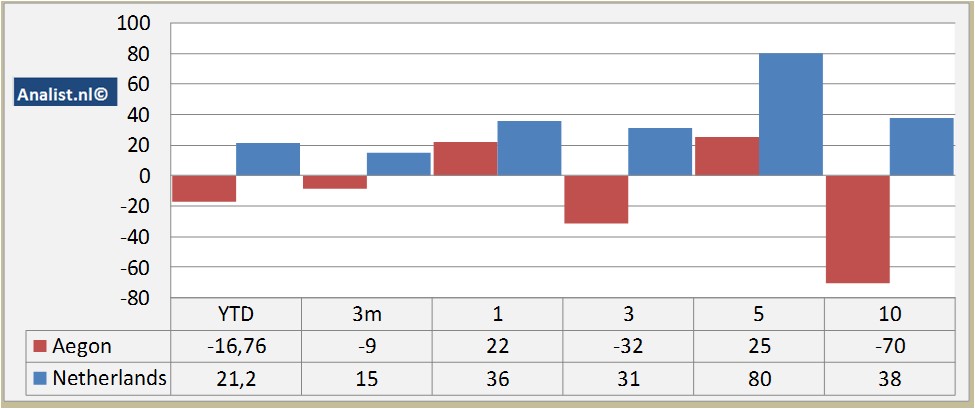

Aegon this year huge underperformer in the Netherlands

Because of this years' huge loss of 17 percent the stock is one of the worst shares of the Netherlands. Other shares with big underperformances in the sector are Hannover Rue , April Group and Munchener Rue . Among the sector winners are Delta Lloyd , Unipol and Mapfre . Over the past 3 months the stock was sold a lot (-9 percent(. The average Dutch stock is since the start of this year approximately 21,2 percent higher.

Returns Aegon versus Dutch stocks

Buy & hold Returns stock Aegon several periods, excluding dividend returns

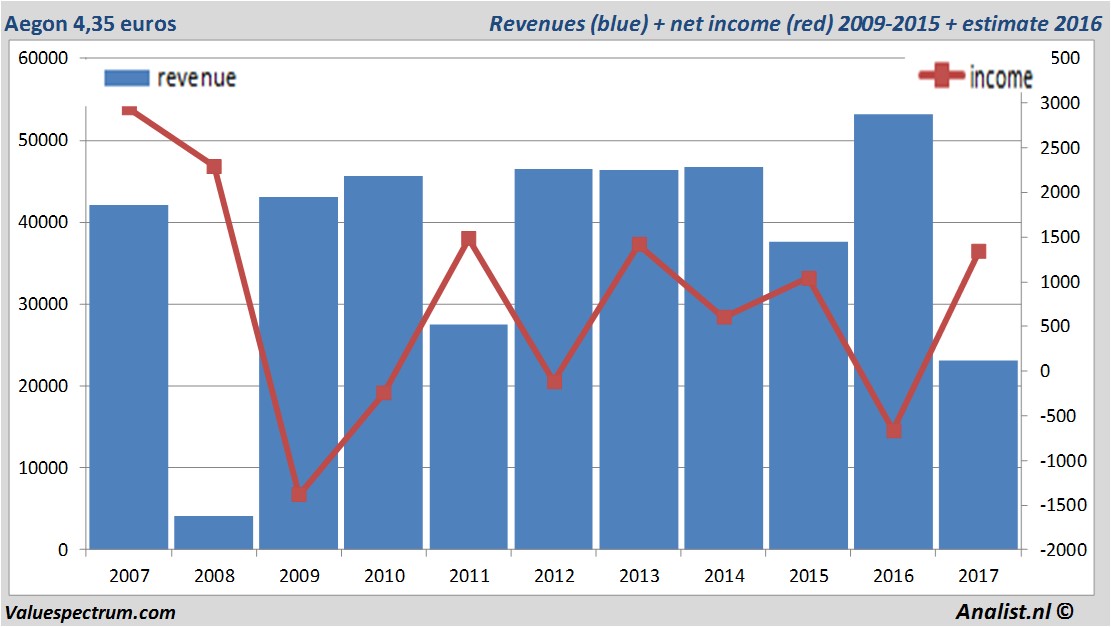

Investors who invested in 2007 in the company's share now have a limited loss of -70 percent. Since 2012 the stock has a price gain of 25 percent. Over the past 3 years the share gained.Over the current book year the total revenue will be 23,12 billion Euro (consensus estimates). This is quite lower than 2016's revenue of 53,19 billion Euro.

Historical revenues and results Aegon plus estimates 2017

The analysts expect for 2017 a net profit of 1,34 billion Euro. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 64 cent. Based on this the price/earnings-ratio is 6,8.

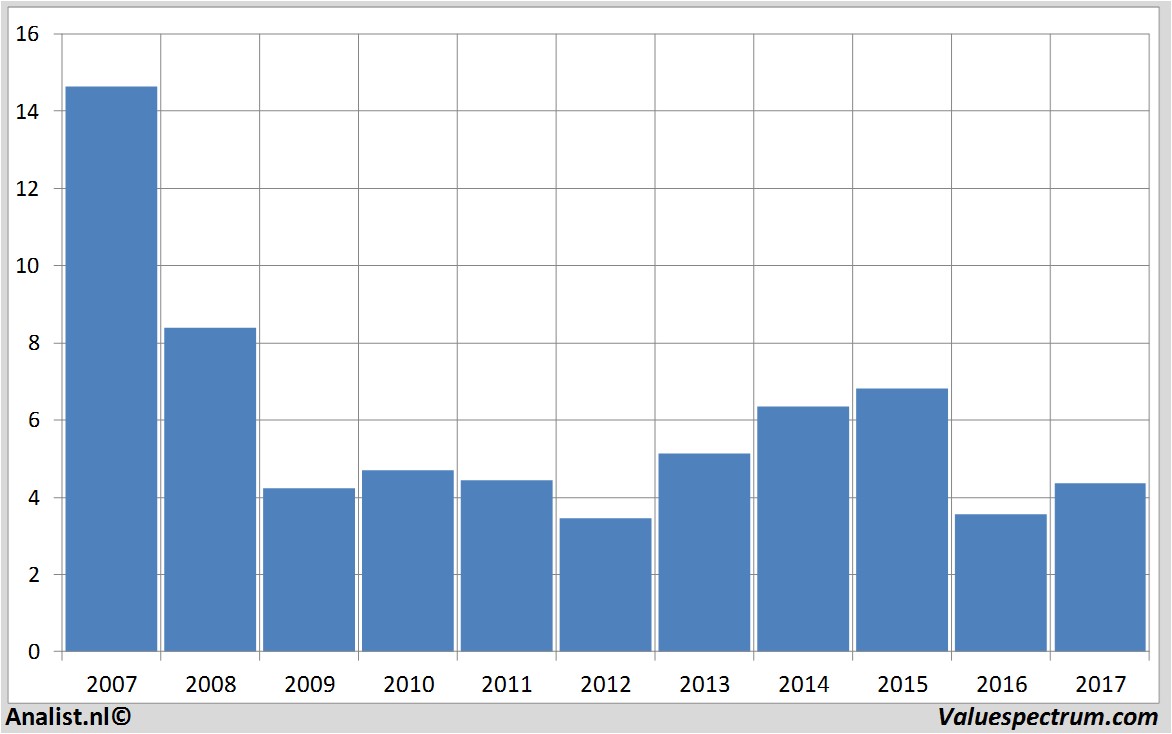

Huge dividend Aegon

Per share the analysts expect a dividend of 0,26 cent per share. The dividend yield is then 5,98 percent. The average dividend yield of the insurers equals a limited 1,00 percent.Latest estimates around 5 Euro

Standard & Poors, A.G. Edwards and ER Capital recently provided recommendations for the stock. Aegon 's market capitalization is based on the number of outstanding shares around 9,15 billion Euro.Historical stock prices Aegon

At 11.12 the stock trades 0 percent lower at 4,35 Euro.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.