TESARO Inc (NASDAQ:TSRO)’s Worth Without M&A Chatter

TESARO Inc (NASDAQ:TSRO) has been making moves since the start of 2017 after several reports suggesting that major pharmaceutical companies like Gilead Sciences and Sanofi are interested in acquiring the company. But the stock is on a rollercoaster ride, which begs the question that whether the stock has any intrinsic value? Tesaro is famous for its Ovarian cancer treatment. But the company is under threat from competitors like AstraZeneca’s PARP inhibitor and Clovis Oncology.

Tesaro is also planning to expand its ovarian cancer treatment into metastatic breast cancer and lung cancer industry. There are several strong growth catalysts for TESARO Inc (NASDAQ:TSRO), including immuno-oncology drugs and inhibitors like PD-1, TIM-3, and LAG-3.

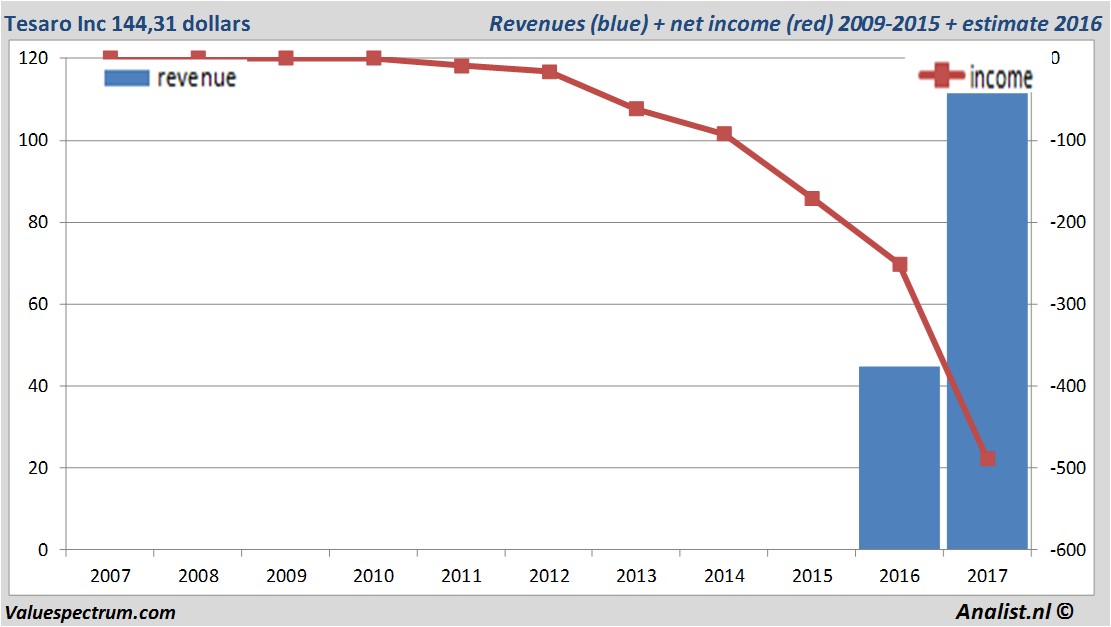

Over the current book year the total revenue will be 111,48 million dollars (consensus estimates). This is hugely more than 2016's revenue of 44,82 million dollars.

Historical revenues and results Tesaro Inc plus estimates 2017

The analysts expect for 2017 a net loss of 488 million dollars. According to most of the analysts the company will have a loss per share for this book year of 8,74 dollars. The price-earnings-ratio equals -16,51.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the pharmaceutical companies equals a moderate 1,27 percent.

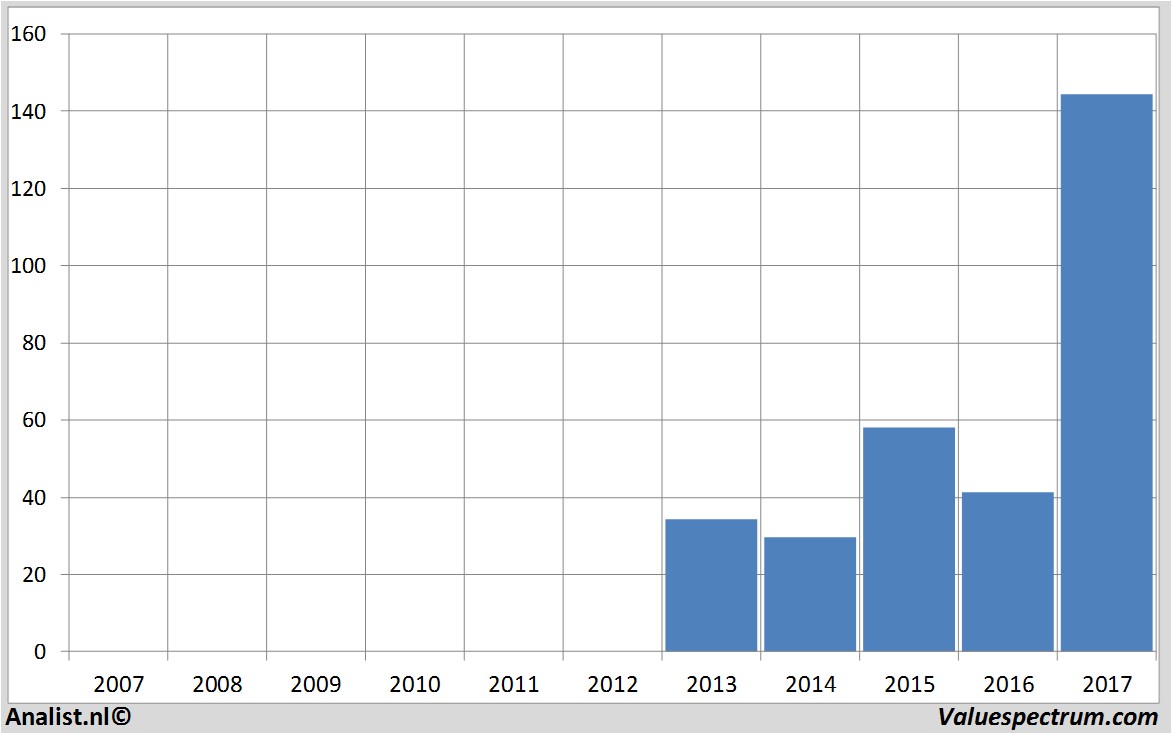

Tesaro Inc's market capitalization is based on the number of outstanding shares around 5,21 billion dollars. At 22.54 the stock trades 0,88 percent lower at 144,31 dollars.Historical stock prices Tesaro Inc

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.