Buy Alibaba Group Holding Ltd (NYSE: BABA) amid Trade War Weakness

Alibaba Group Holding Ltd (NYSE: BABA) stock has been tanking amid trade war fears between the US and China, but some analysts believe this is a buying opportunity. Alibaba stock has strong fundamentals. The company’s Cloud revenue more than doubled in the first three months of 2018 alone. Alibaba recently announced a partnership with Siemens to bring Internet of Things projects in China. Alibaba sales are expected to expand by a whopping 60% in 2018.

Trade war fears will soon abate, analysts think, as US and China both cannot sustain the losses of going into a trade war.

Alibaba is also reported to be the main contender to acquire American ecommerce marketplace Groupon.

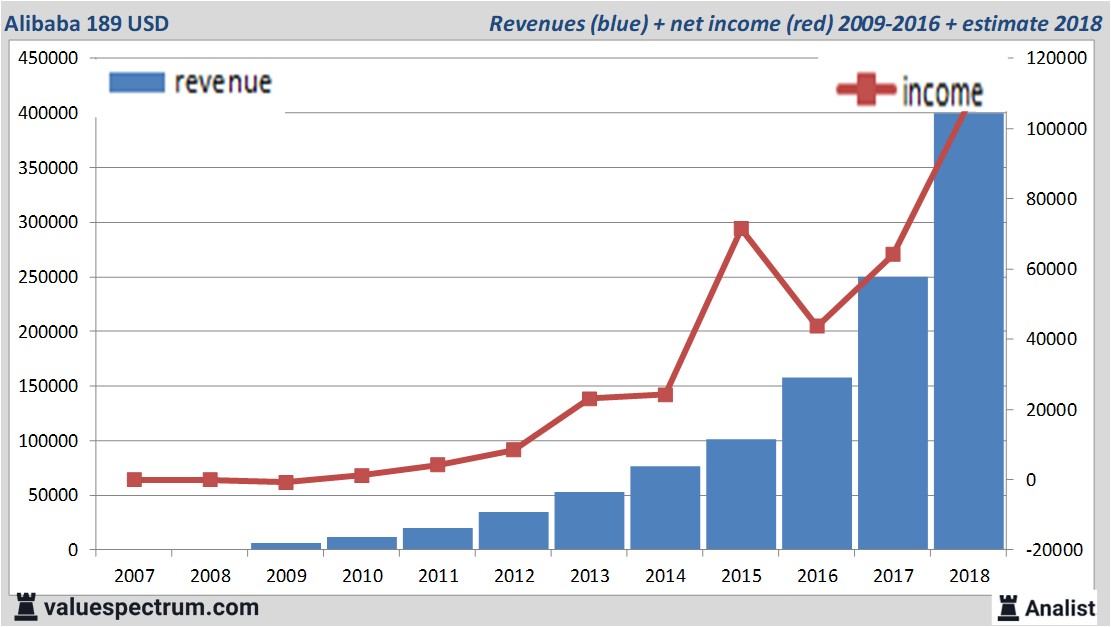

Over the current book year the total revenue will be 399,66 billion USD (consensus estimates). This is hugely more than 2017's revenue of 250,27 billion USD.

Historical revenues and results Alibaba plus estimates 2018

The analysts expect for 2018 a net profit of 107,15 billion USD. The majority of the analysts expects for this year a profit per share of 41,01 USD. With this the price/earnings-ratio is 4,61.

Analysts don't expect the company to pay a dividend. The average dividend yield of the internet companies equals a limited 0,5 percent.

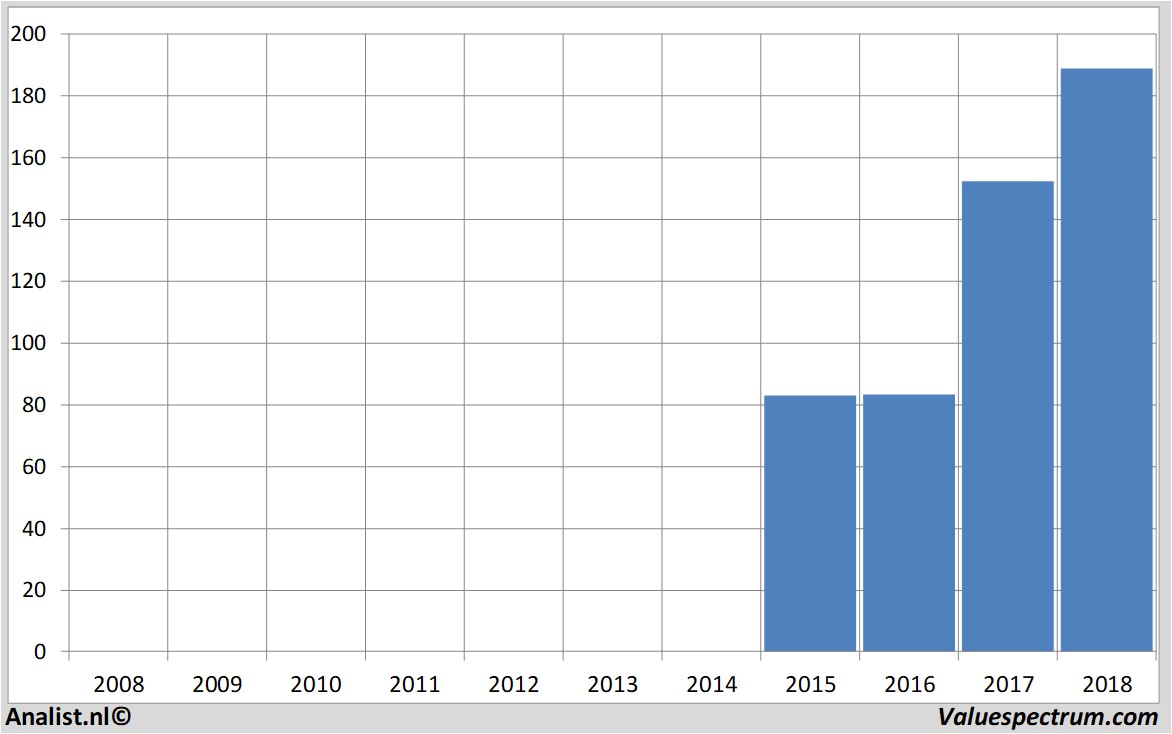

Latest estimates around 209 USD

ABN AMRO, KBC Securities and Deutsche Bank recently provided recommendations for the stock. Based on the current number of outstanding shares Alibaba's market capitalization is 477,06 billion USD. At 17.29 the stock trades 1,98 percent higher at 189 USD.Price data Alibaba 2007-2018

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.