Netflix, Inc. (NASDAQ: NFLX) To Cross $700 Over the Next Three Years?

Netflix, Inc. (NASDAQ: NFLX) is reporting a strong growth in its monthly subscribers. The company has become a content giant. In the first quarter of 2018, Netflix added 7.4 million subscribers.

In June, stock was given an “Outperform” rating with a price target of $360 by RBC Capital Markets analyst Mark Mahaney. Mahaney also increased his five-year outlook for subscribers and earnings. The analyst said that in the next three year Netflix can cross price range of $450 to $750.

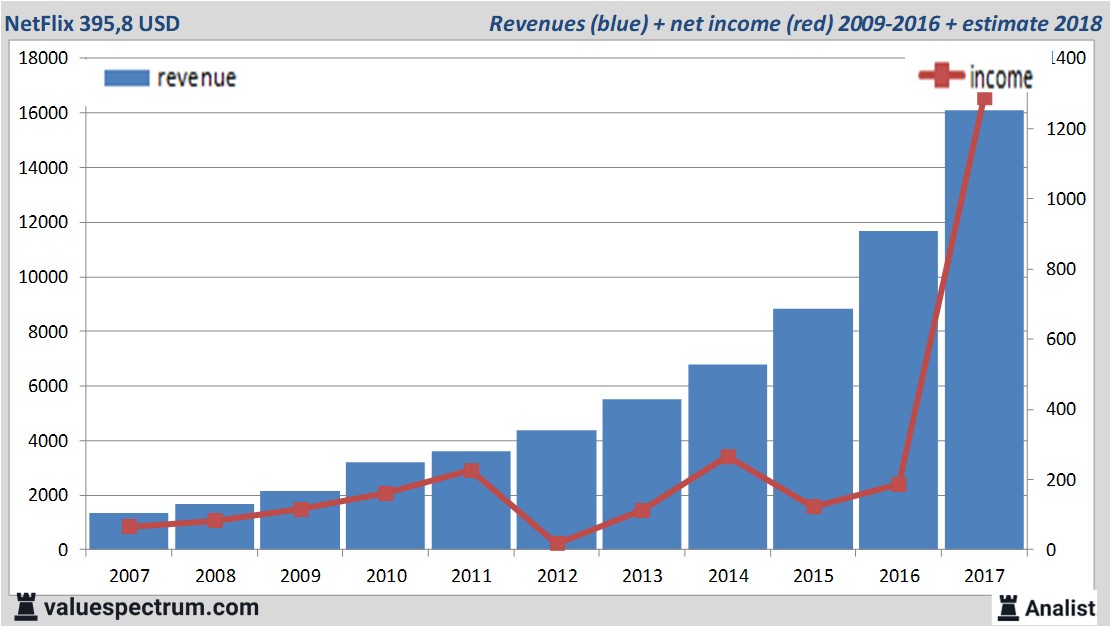

For this year NetFlix 's revenue will be around 16,1 billion USD. This is according to the average of the analysts' estimates. This is rather significant more than 2017's revenue of 11,69 billion USD.

Historical revenues and results NetFlix plus estimates 2018

The analysts expect for 2018 a net profit of 1,29 billion USD. Most of the analysts anticipate on a profit per share of 2,85 USD. Based on this the price/earnings-ratio is a very high 138,88.

Analysts don't expect the company to pay a dividend. The average dividend yield of the internet companies equals a poor 0,5 percent.

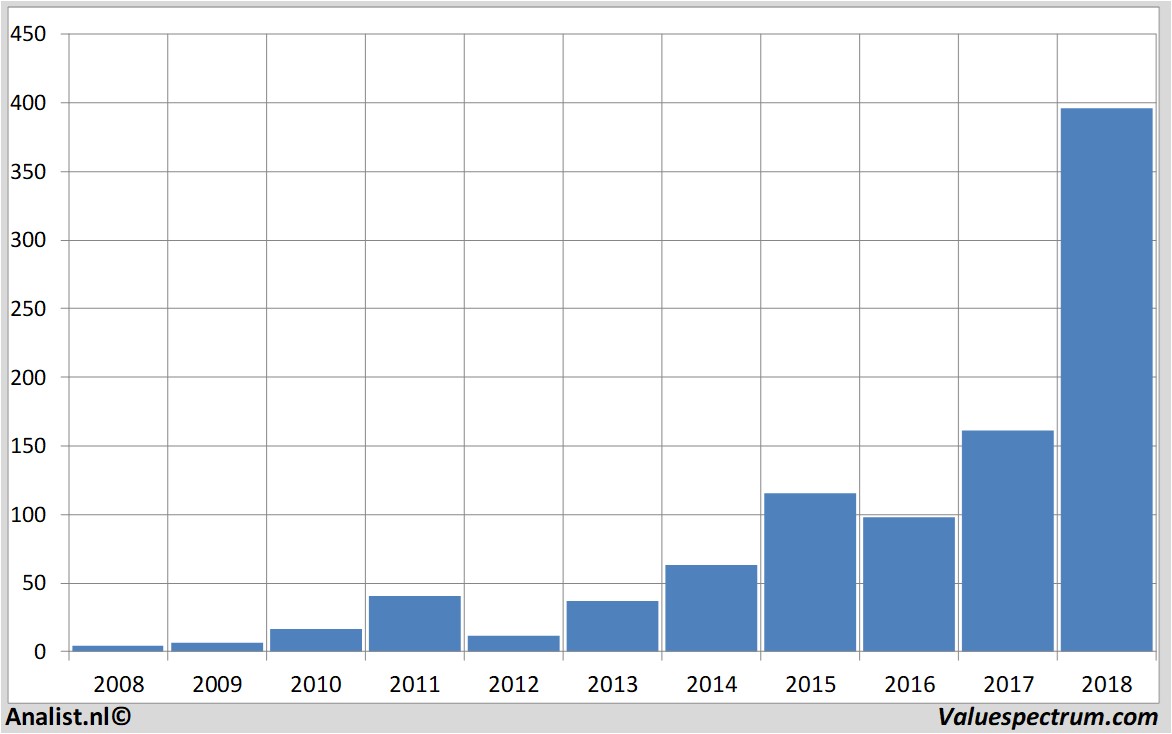

Most recent target prices around 460 USD

The latest 3 recommendations for the internet company were provided by BMO Capital Markets, Canacord Adams and Morgan Stanley . NetFlix 's market capitalization is based on the number of outstanding shares around 170,22 billion USD. At 15.50 the stock trades 0,97 percent higher at 395,8 USD.Historical stock prices NetFlix

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.