2017 best year, 2008 worst year Amazon

The performance of the Amazon stock is absolutely a mega success for the long term investors.

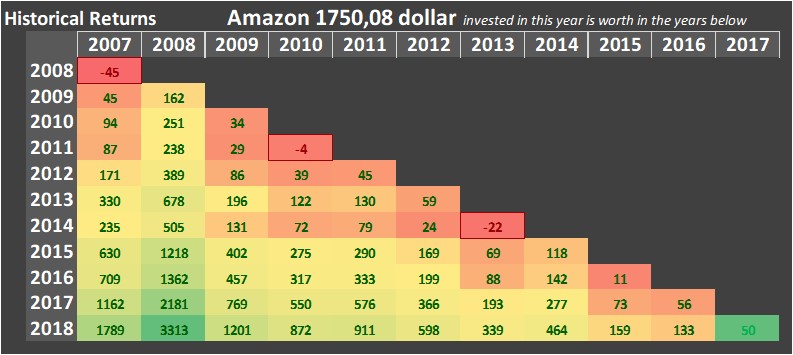

The matrix above shows Amazon 's historical returns expressed in the different entry years in the left axis.

The stock was clobbered in 2008, losing 45 percent in value. The stock skyrocketed by 162 percent in 2009, making the year the best one for the company. Who bought the stock in 2008 (price at that time 92,64 USD) now even has a price gain of 630 percent.Over the current book year the total revenue will be 237,52 billion USD (consensus estimates). This is rather significant more than 2017's revenue of 177,87 billion USD.

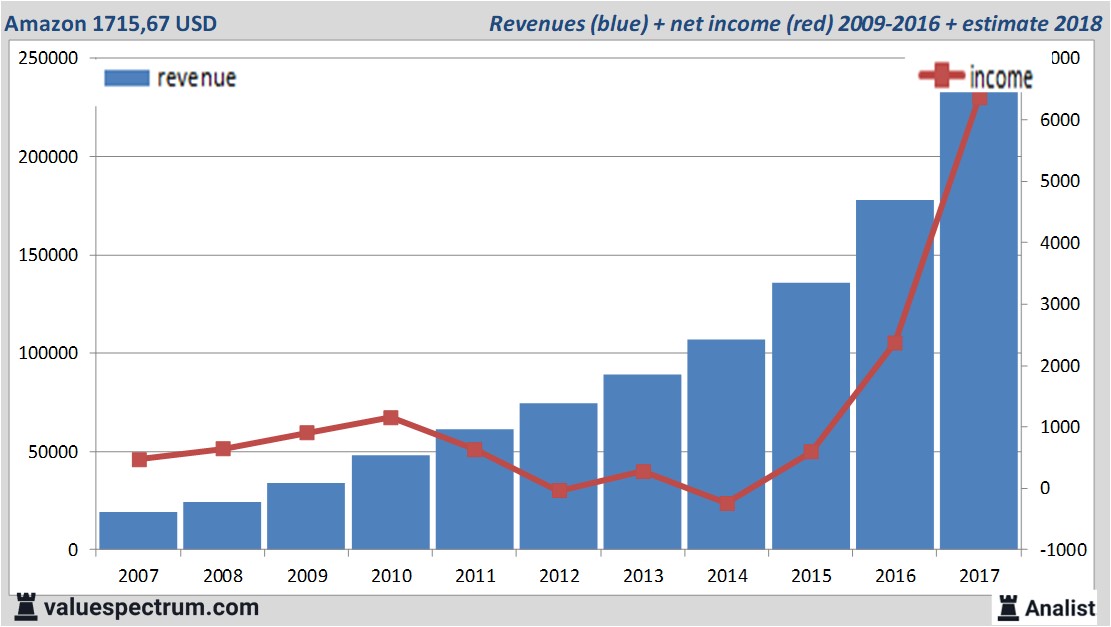

Historical revenues and results Amazon plus estimates 2018

The analysts expect for 2018 a net profit of 6,35 billion USD. The majority of the analysts expects for this year a profit per share of 12,54 USD. Based on this the price/earnings-ratio is a very high 139,56.

Analysts don't expect the company to pay a dividend. The average dividend yield of the general retailers is a low 1 percent.

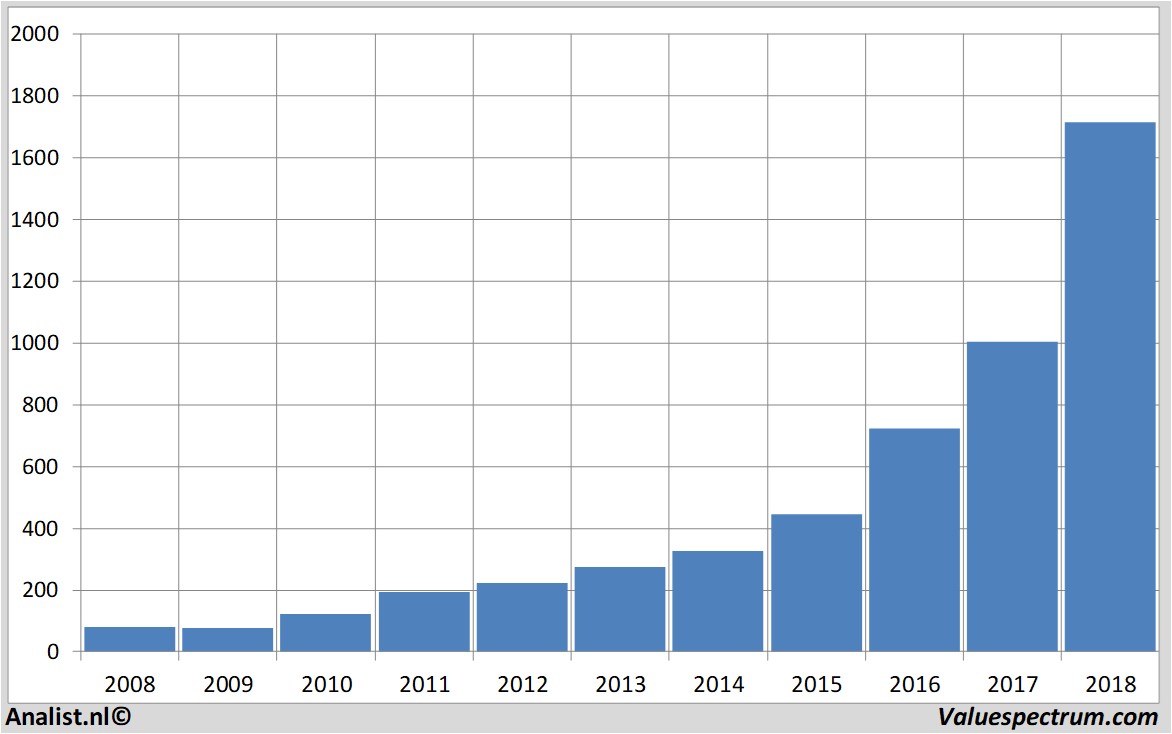

Recent target prices around 1867 USD

The latest 3 recommendations for the general retailer were provided by Morningstar, Benchmark Capital and JP Morgan. Based on the current number of outstanding shares Amazon 's market capitalization 834,79 billion USD.Historical stock prices Amazon from 2007 till 2018

On Wednesday the stock closed at 1750,08 USD.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.