Nestle reports lower-than-expected earnings, citing a challenge in North America market

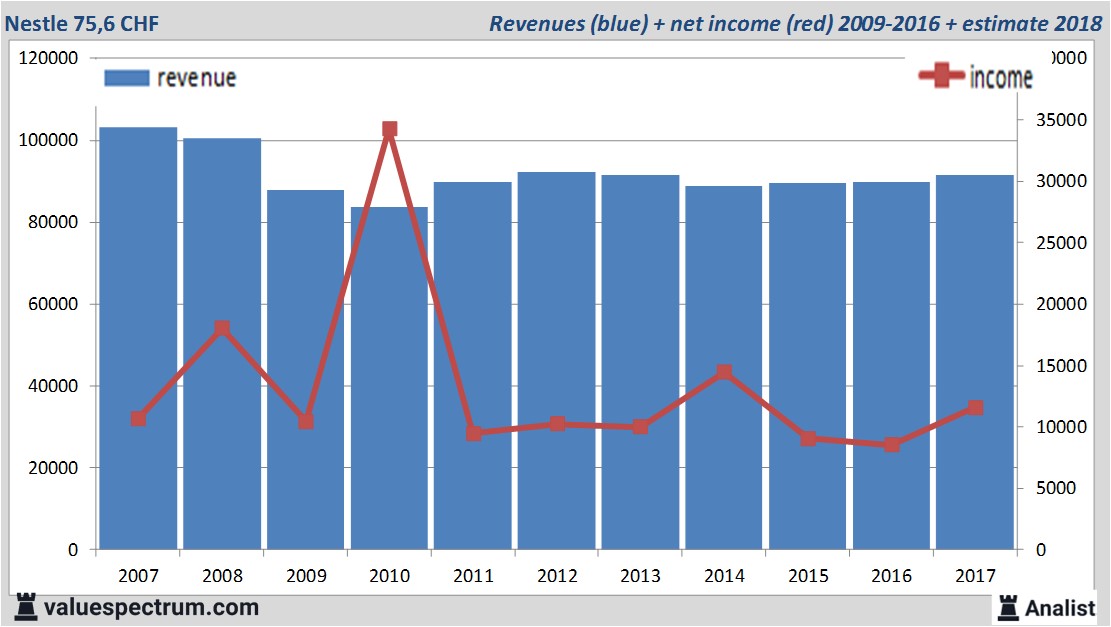

Nestle posted its net income for 2017 of 7.2 billion Swiss francs. The figure was lower than analysts’ estimation of 9.652 billion francs. Last year’s sales reached 89.8 billion Swiss francs, 0.4 percent up compared to the sales in 2016. But still below analysts’ expectation from a Reuters poll.

The Swiss food titan shares dropped 2.7 percent in Thursday’s European market opening, as CNBC reported.

According to Nestle CEO Mark Schneider, the decline in sales and net income targets last year was due to a weaker sales at the end of 2017.

"We were somewhat surprised with the fourth quarter, that came in a little softer than anticipated, mainly due to North America and the market in Brazil, geographically speaking," the CEO described as quoted by CNBC.

Schneider explained that sales in North America and Brazil were weaker than anticipated in the fourth quarter of 2017.

Nestle ’s revenues jumped 2.4 percent last year on an organic basis, still below an initial forecast (2.7 percent increase).

Nestle has some reasons to be optimistic in 2018

Schneider added that sales in Asia and Europe were”encouraging”. Sales in China grew modestly in 2017, and all categories saw a satisfactory sales growth such as Nestle Health Science, pet care, and coffee.

Despite not feeling satisfied with last year’s result, Schneider is optimistic Nestle will recover in 2018. The company estimates sales growth will be between 2 and 4 percent this year.

He furthermore cited that Europe has been recovering over the last two years. North America has been showing a positive sign, and most emerging markets are going stronger than ever.

Nestle stated that it would not renew a shareholder agreement with L’Oreal, in which it has a 23 percent stake. But Schneider did not give any details explanation about the future of the stake.

For this year Nestle 's revenue will be around 91,61 billion CHF. This is according to the average of the analysts' estimates. This is slightly more than 2016's revenue of 89,79 billion CHF.

Historical revenues and results Nestle plus estimates 2018

The analysts expect for 2018 a net profit of 11,59 billion CHF. According to most of the analysts the company will have a profit per share for this book year of 3,8 CHF. The PE-ratio therefore is 19,89.

Huge dividend Nestle

Per share the analysts expect a dividend of 2,49 CHF per share. Nestle 's dividend yield thus equals 3,29 percent. The average dividend yield of the food producers equals a moderate 1 percent.Latest estimates around 79 CHF

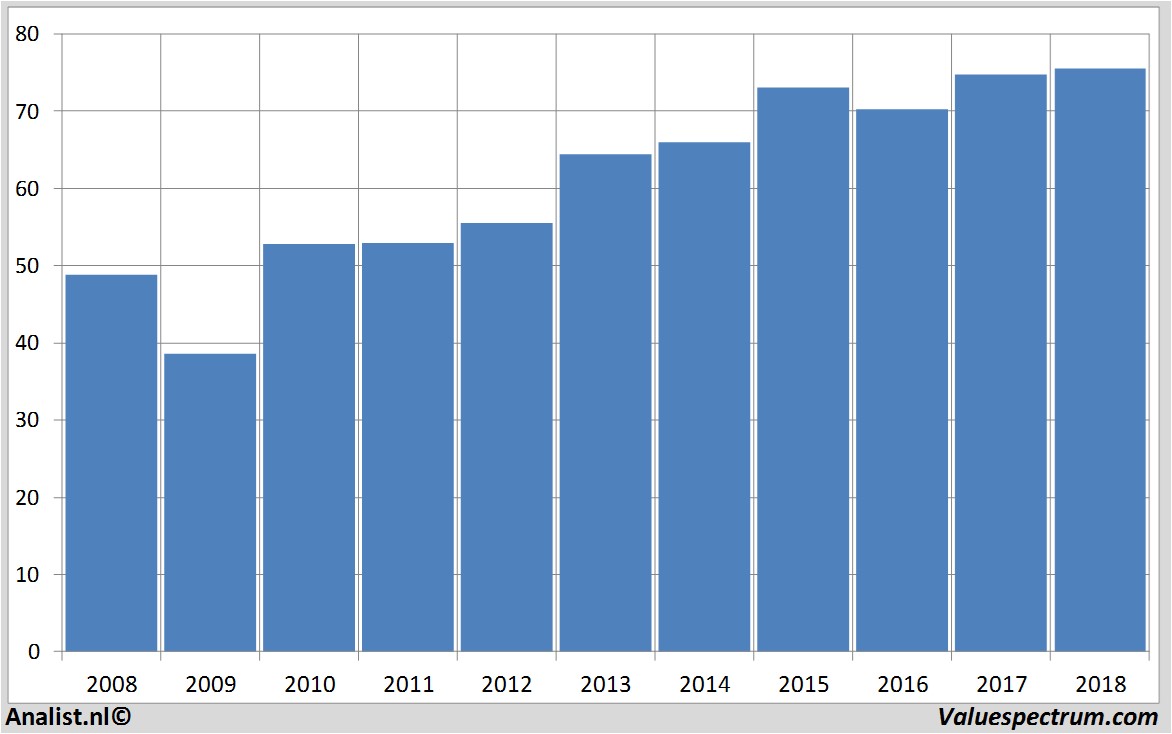

The most recent recommendations for the food producer are from Helvea Baader, UBS and Credit Suisse . Nestle 's market value equals around 234,21 billion .Historical stock prices Nestle

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.