Can Gilead Sciences, Inc. (NASDAQ:GILD) Reach $100

Investors are concerned about Gilead Sciences , Inc. (NASDAQ:GILD) amid the company’s rapidly declining HCV business. Gilead Sciences ’s blockbuster Hepatitis drugs are under threat from competitors and their patents are also about to expire. However, analysts think that Gilead Sciences is making a major foray into the oncology market, which remains the most lucrative domain in the healthcare sector.

Gilead Sciences acquired Kite Pharma earlier this year. Kite Pharma excels in gene therapy to cure cancer. Investment firm Argus Research said in a report that Kite’s buyout was the “game changer” for Gilead Sciences . The firm has a price target of $100 for Gilead Sciences .

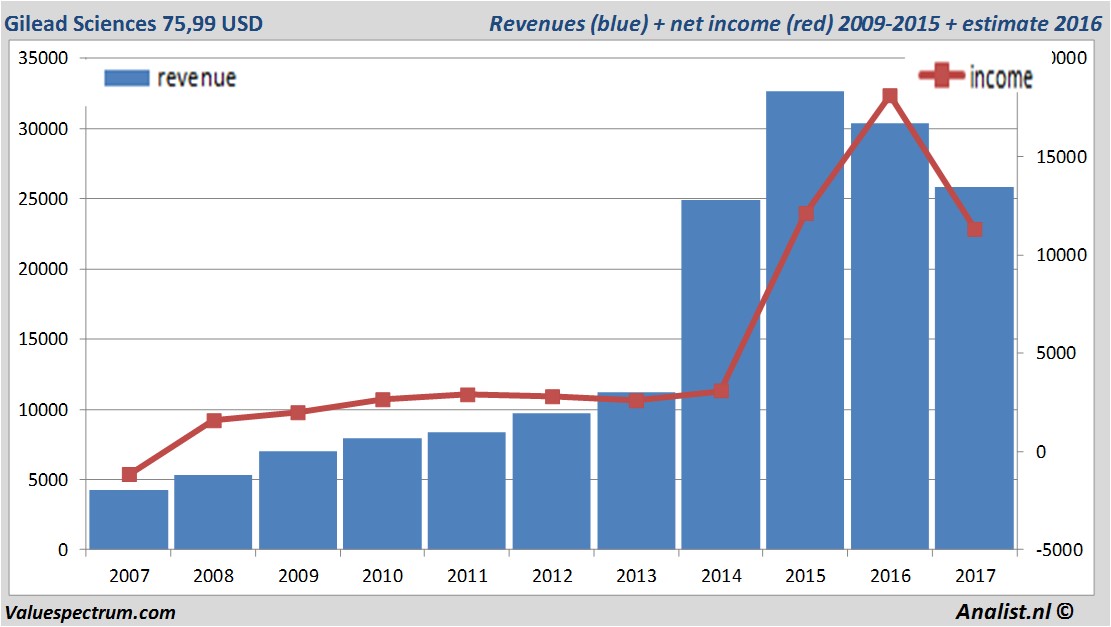

Over the current book year the total revenue will be 25,8 billion USD (consensus estimates). This is rather significant lower than 2016's revenue of 30,39 billion USD.

Historical revenues and results Gilead Sciences plus estimates 2017

The analysts expect for 2017 a net profit of 11,32 billion USD. According to most of the analysts the company will have a profit per share for this book year of 8,71 USD. Based on this the price/earnings-ratio is 8,72.

For this year the analysts expect a dividend of 2,12 USD per share. The dividend yield is then 2,79 percent. The average dividend yield of the biotech companies equals a poor 0,06 percent.

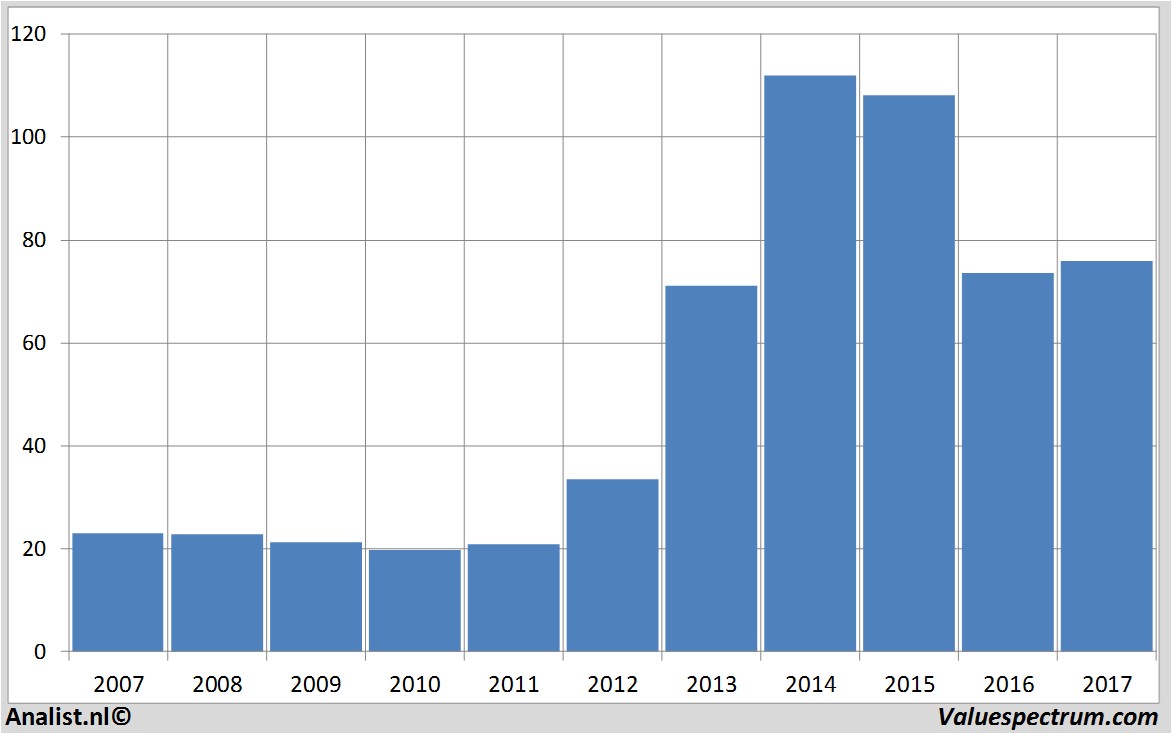

Latest estimates around 89 USD

The most recent recommendations for the biotech company are from Barclays , Morgan Stanley and Jefferies & Co.. Gilead Sciences 's market capitalization is around 108,06 billion USD. On Monday the stock closed at 75,99 USD.Historical stock prices Gilead Sciences period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.