Analysts expect over 2020 decreasing revenue DSM

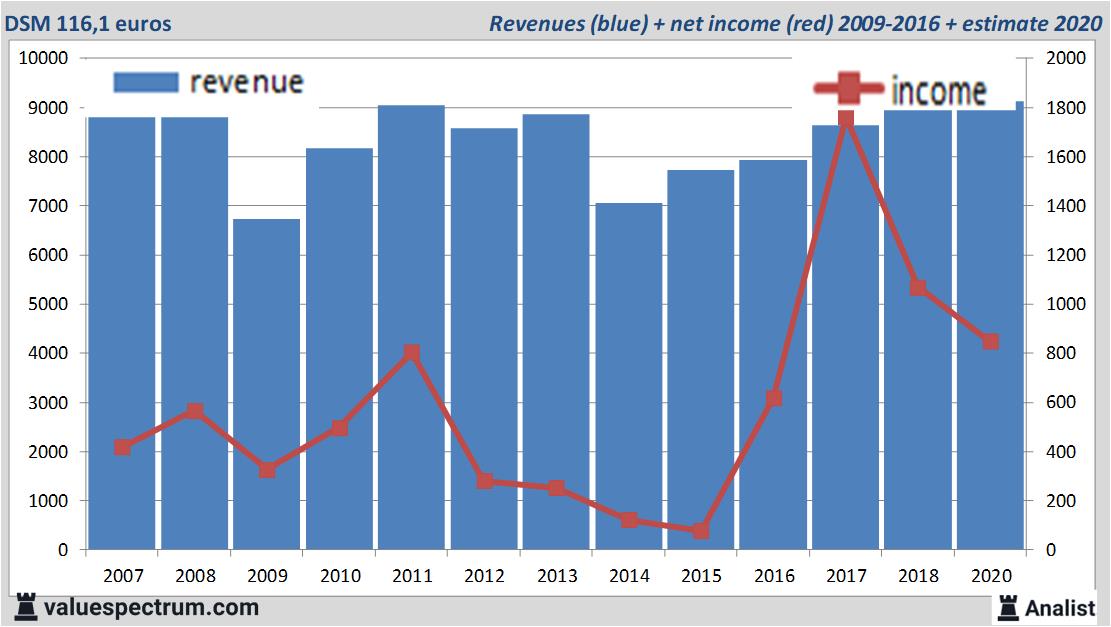

Over the current book year the total revenue will be 9,13 billion euros (consensus estimates). This is slightly lower than 2018's revenue of 9,27 billion euros.

Historical revenues and results DSM plus estimates 2020

The analysts expect for 2020 a net profit of 849 million euros. For this year the majority of the analysts, consulted by press agency Thomson Reuters, expects a profit per share of 4,9 euros. So the price/earnings-ratio equals 23,69.

Per share the analysts expect a dividend of 2,43 euros per share. The dividend yield is then 2,09 percent. The average dividend yield of the chemical companies is a good 2,52914715614742 percent.

Based on the current number of shares DSM's market capitalization equals 20,32 billion euros. The DSM stock was the past 12 months quite unstable. Since last January the stock is even 66 percent higher. This year the stock price moved between 72 and 118 euro. Since 2008 the stock price is almost 10 percent higher.

Historical stock prices DSM

Click here for dividend . At 17.35 the stock trades 1,07 percent lower at 116,1 euros.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.