Should You Buy Bank of America Corp (NYSE:BAC)

Bank of America (NYSE:BAC) looks like a promising investment according to several analysts. The Bank is expected to benefit from President Trump’s plans of an economic reform. Bank of America has a huge exposure to non-interest segments, which gives it an edge in an environment where Federal Reserve is expected to lower interest rates.

Bank of America has come out of its legal and structural problems. Its cost cutting measures have started to work. In the second quarter, Bank of America ’s net interest income increased by 9% to reach $11.2 billion. The stock is up over 7% so far this year.

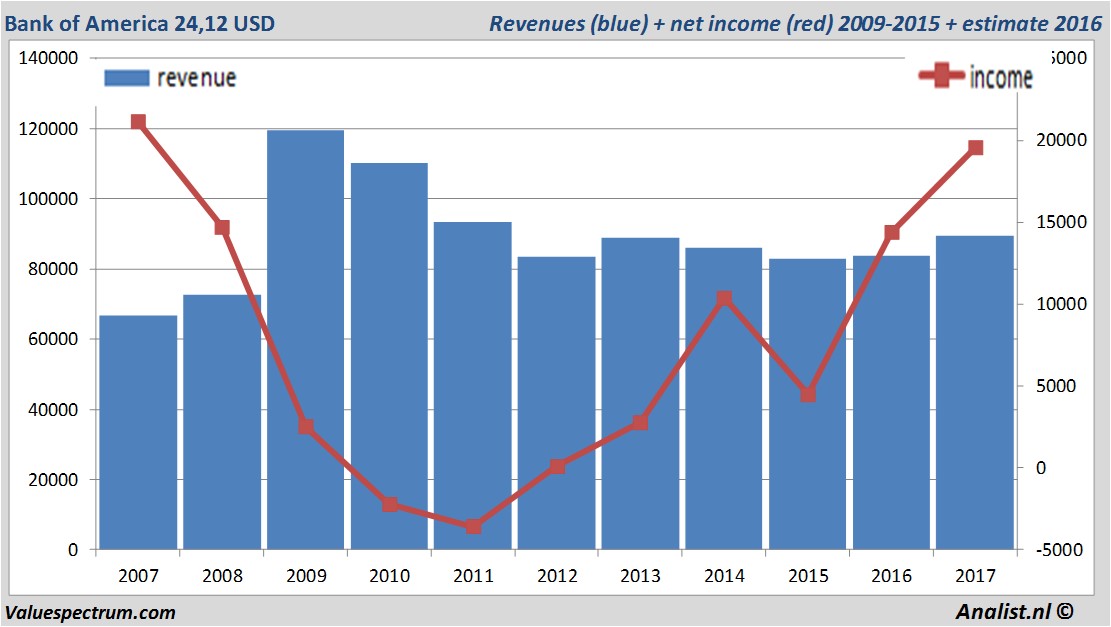

For this year Bank of America 's revenue will be around 89,49 billion USD. This is according to the average of the analysts' estimates. This is slightly more than 2016's revenue of 83,7 billion USD.

Historical revenues and results Bank of America plus estimates 2017

The analysts expect for 2017 a net profit of 19,5 billion USD. The majority of the analysts expects for this year a profit per share of 1,81 USD. So the price/earnings-ratio equals 13,47.

For this year the analysts expect a dividend of 0,39 cent per share. The dividend yield is then 1,6 percent. The average dividend yield of the banks equals a low 0,70 percent.

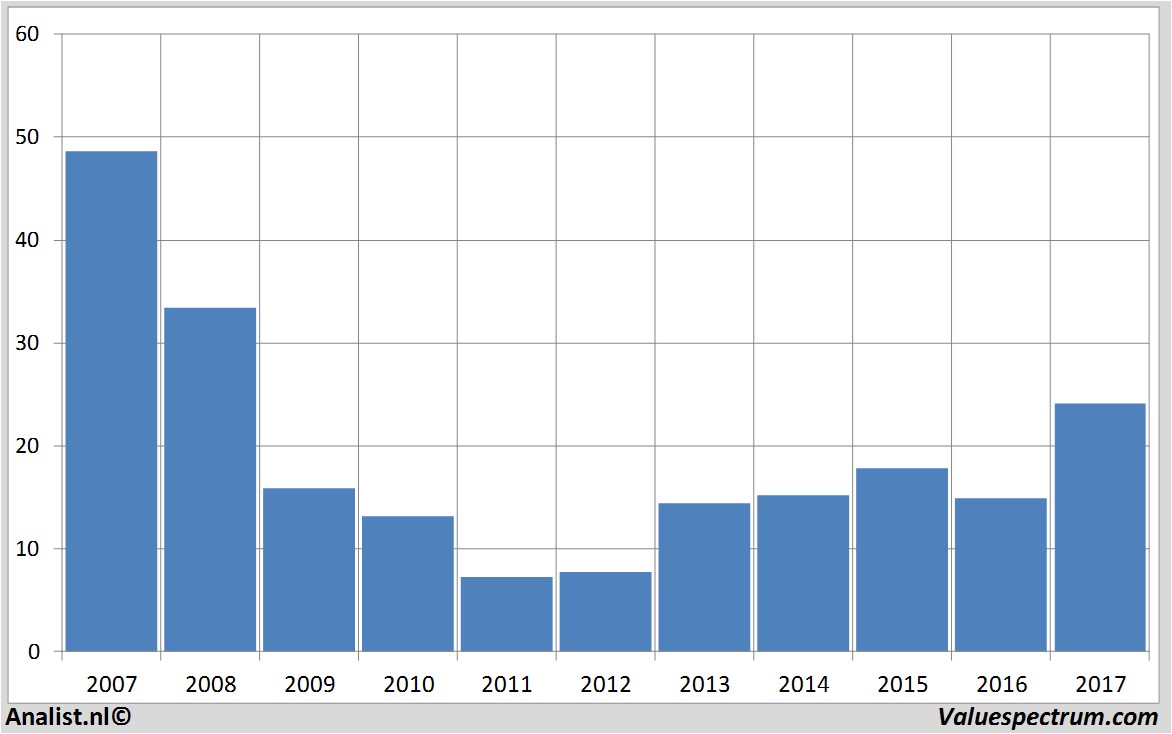

Latest estimates around 25 USD

The most recent recommendations for the bank are from Berenberg, Keefe Bruyette & Woods and Citigroup . Based on the current number of outstanding shares Bank of America 's market capitalization is 253,07 billion USD. On Friday, the stock closed at 24,38 USD.Historical stock prices Bank of America period 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.