Will Boeing Co (BA) Cross $270

Boeing Co (NYSE:BA) surprised investors recently by posting an upbeat second quarter report. The company reported a net cash from operations of $5 billion, double the consensus estimate. Revenue in the period fell by 8% by the damage was undone by a 17% decline in expenses. Analysts think that Boeing ’s revenue in 2018 and 2019 will rise amid the ongoing cost-cutting plan. Boeing ’s air cargo traffic 10% for the in the first five months of 2017. The company is facing growth amid a rising travel trend worldwide. In the commercial sector Boeing will continue to gain traction.

However, the company is facing a tough competition in the defense sector, amid a loss of several big government contracts. But experts think that Boeing is focusing on the space industry, which will become a new revenue stream in the coming years. Financial services firm Argus upped its price target on Boeing to $270 earlier this month.

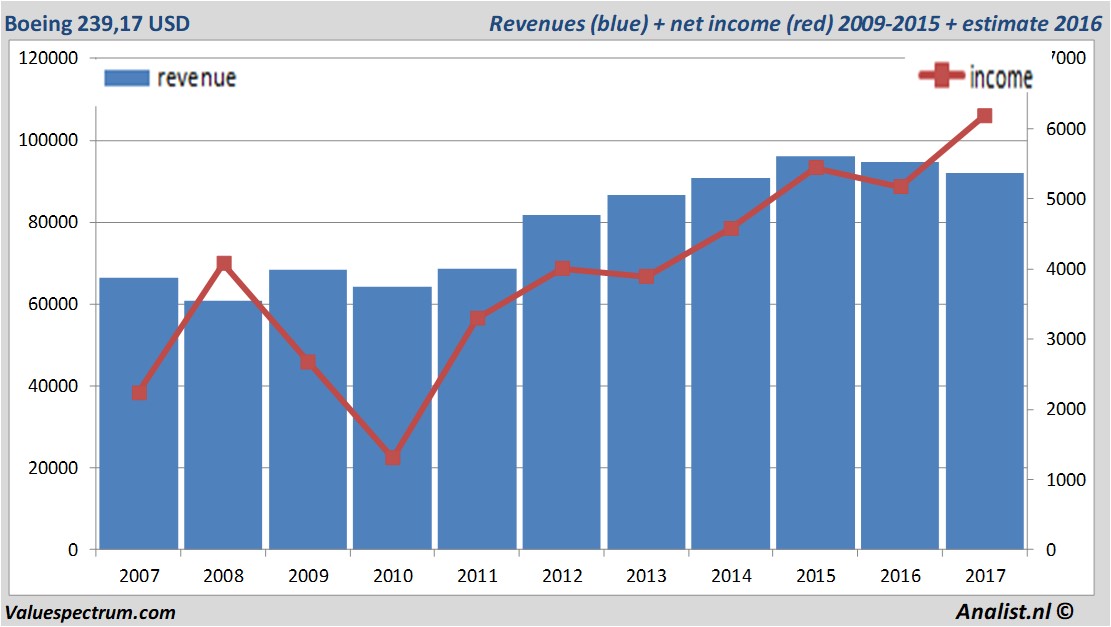

For this year Boeing 's revenue will be around 91,87 billion USD. This is according to the average of the analysts' estimates. This is slightly lower than 2016's revenue of 94,57 billion USD.

Historical revenues and results Boeing plus estimates 2017

The analysts anticipate for 2017 a record net profit a 6,18 billion USD. According to most of the analysts the company will have a profit per share for this book year of 9,95 USD. The price/earnings-ratio is then 24,04.

For this year the analysts expect a dividend of 5,61 USD per share. The dividend yield is then 2,35 percent. The average dividend yield of the aerospace & defense companies equals a limited 0,42 percent.

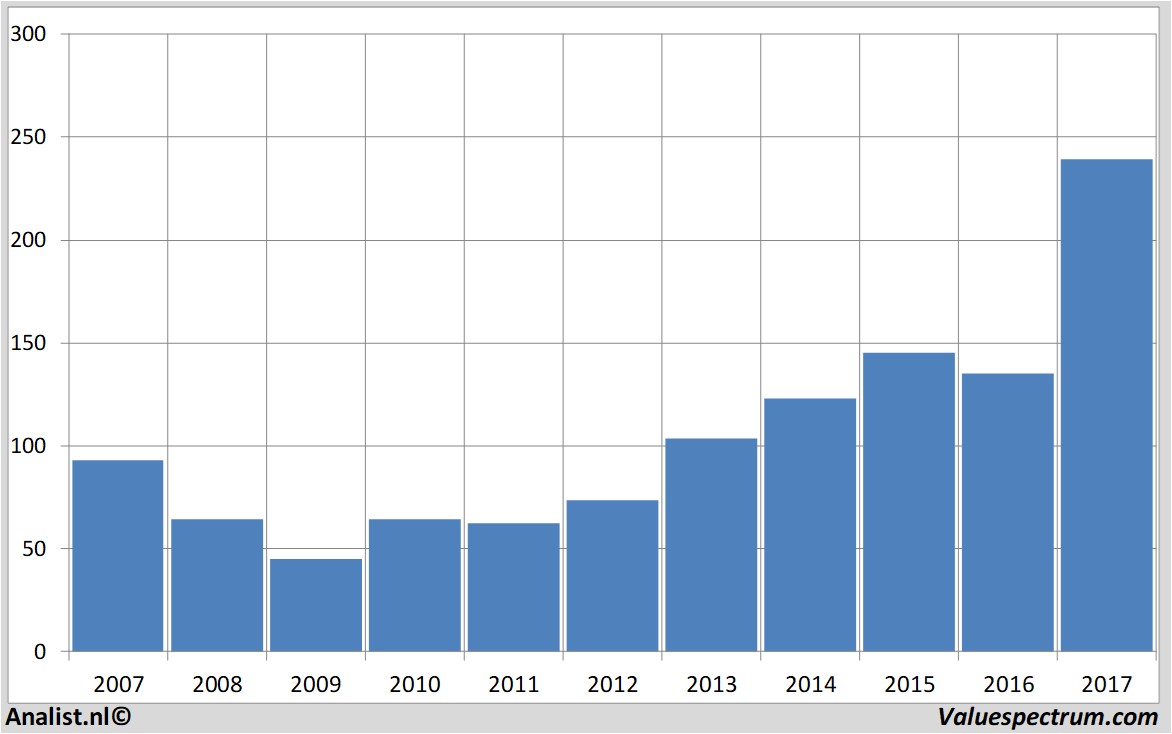

Newest target prices around 241 USD

The most recent recommendations for the aerospace & defense company are from RBC Capital Markets, Canacord Adams and Sanford C. Bernstein & Co. Boeing 's market capitalization is based on the number of outstanding shares around 159,44 billion USD. On Tuesday the stock closed at 239,17 USD.Historical stock prices Boeing from 2007 till 2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.