Is Bank of America Corp (BAC) Stable

Bank of America (NYSE:BAC) recently reported better-than-expected second quarter results but the stock didn’t budge amid concerns and uncertainty about the future. However, analysts believe that Bank of America has a secure credit base. The bank has the lowest interest rates in the industry. Therefore, concerns regarding increasing net charge-off rates should wear off in the coming weeks. Bank of America ’s Net interest income in the quarter increased by 9% to reach $11 billion in the second quarter.

The Bank’s Global Wealth and Investment Management (GWIM) also reported a record growth, which shows that BAC’s international growth strategy is working.

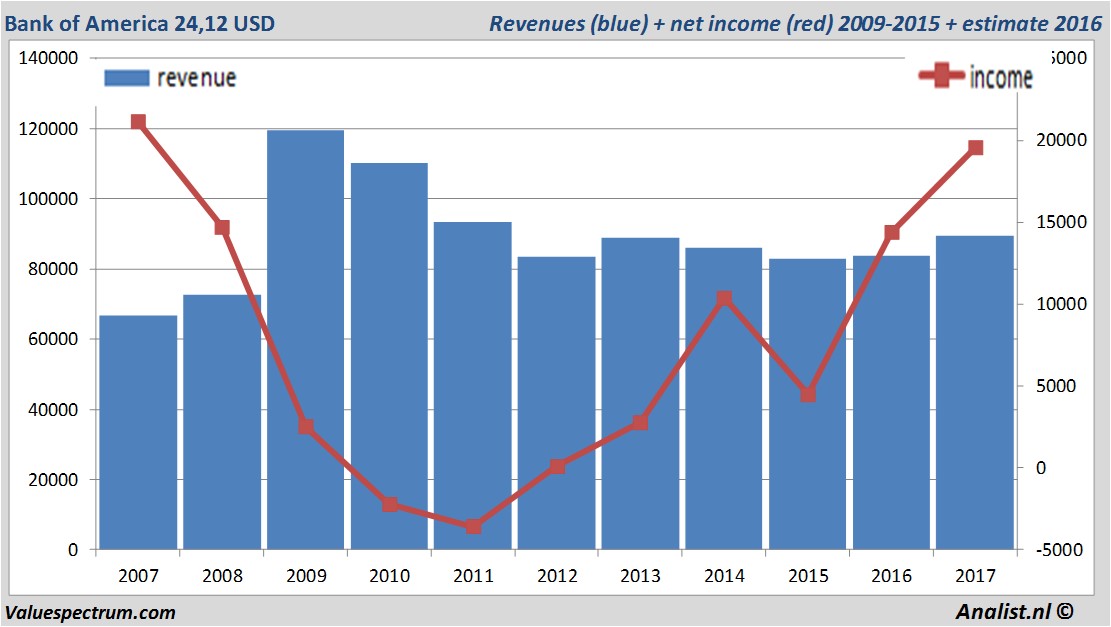

Over the current book year the total revenue will be 89,5 billion USD (consensus estimates). This is slightly more than 2016's revenue of 83,7 billion USD.

Historical revenues and results Bank of America plus estimates 2017

The analysts expect for 2017 a net profit of 19,55 billion USD. For this year the consensus of the result per share is a profit of 1,82 USD. The price-earnings-ratio equals 13,25.

For this year the analysts expect a dividend of 0,39 cent per share. Bank of America 's dividend yield thus equals 1,62 percent. The average dividend yield of the banks equals a low 0,70 percent.

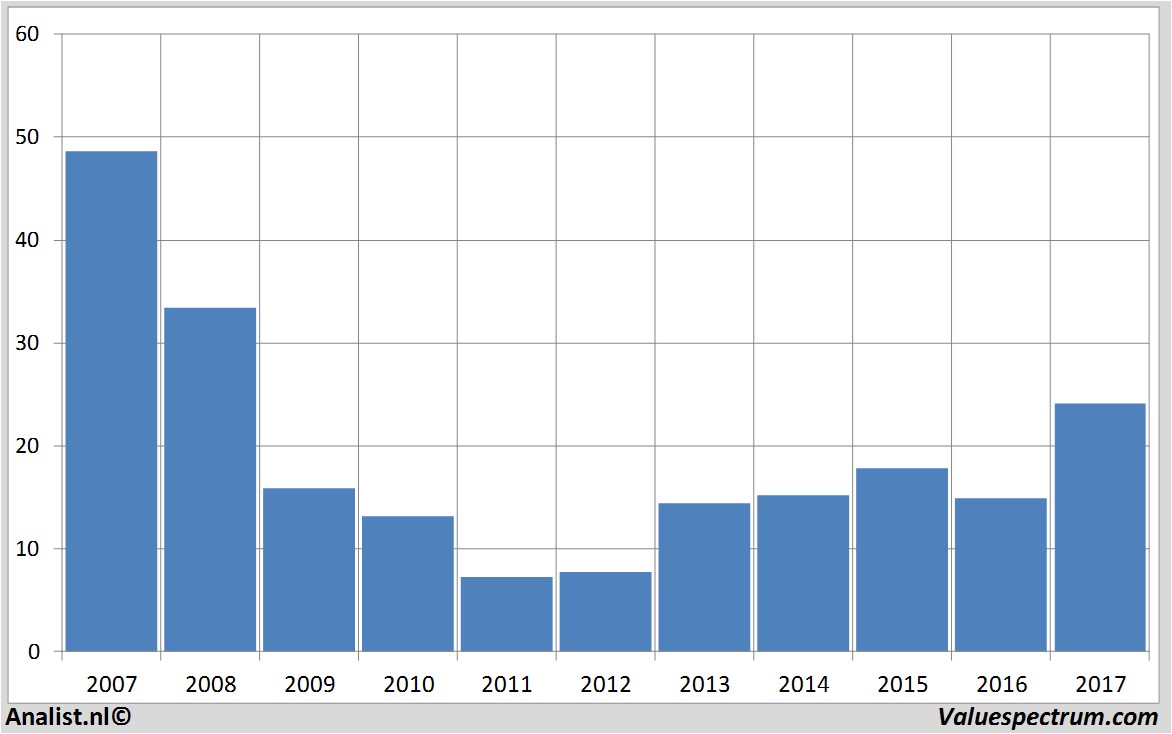

Recent target prices around 25 USD

The most recent recommendations for the bank are from Berenberg, Keefe Bruyette & Woods and Citigroup . Based on the current number of shares Bank of America 's market capitalization equals 250,37 billion USD. On Thursday, the stock closed at 24,12 USD.Historical stock prices Bank of America

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.