Here’s Why Amgen, Inc. (NASDAQ:AMGN) Will Gain Value in the Future

Amgen , Inc. (NASDAQ:AMGN) stock is under pressure amid growth and pipeline concerns, but a detailed analysis shows that the company has some growth opportunities and the stock should be bought on its weakness. Amgen has 13 drugs in the late Phase 3 stages. The company is focusing on the lucrative oncology market. Amgen recently proved that its blockbuster drug Repatha can be used to treat lipoprotein cholesterol (LDL-C), which leads to several heart diseases.

FDA is expected to approve Repatha for heart safety treatments, which would result in massive sales growth. Amgen ’s cash flow in the second quarter came in at $2 billion. The company has a $1 billion stock buyback program. Amgen will keep investing heavily in R&D, which would result in a healthy pipeline in the future.

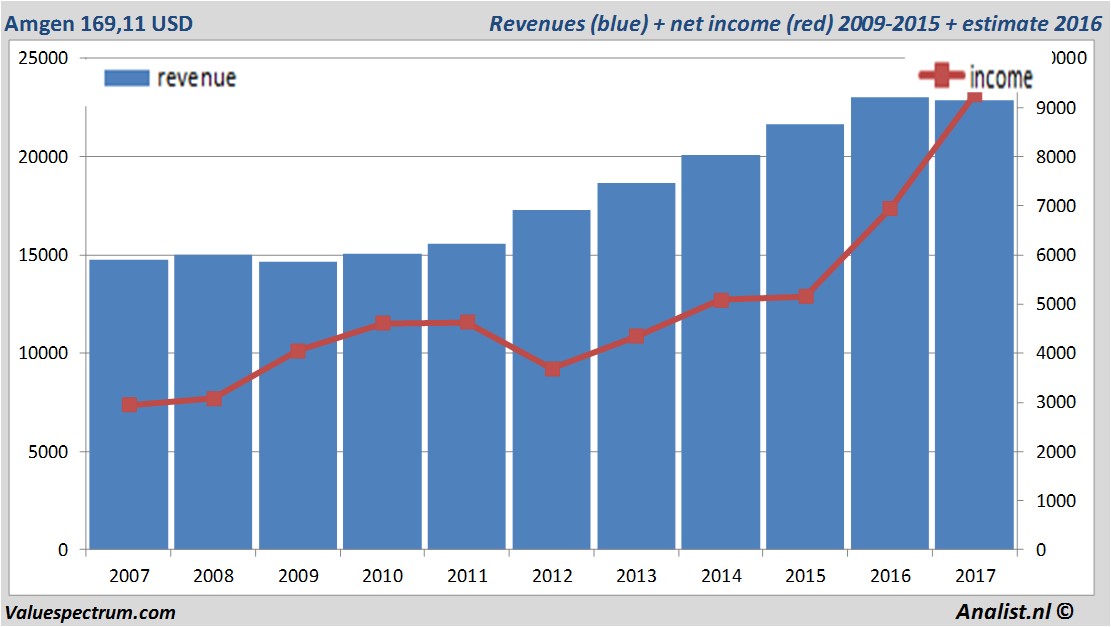

For this year Amgen 's revenue will be around 22,85 billion USD. This is according to the average of the analysts' estimates. This is slightly lower than 2016's revenue of 22,99 billion USD.

Historical revenues and results Amgen plus estimates 2017

The analysts anticipate for 2017 a record net profit a 9,26 billion USD. According to most of the analysts the company will have a profit per share for this book year of 12,57 USD. With this the price/earnings-ratio is 13,45.

Per share the analysts expect a dividend of 4,54 USD per share. The dividend yield is then 2,68 percent. The average dividend yield of the biotech companies equals a low 0,06 percent.

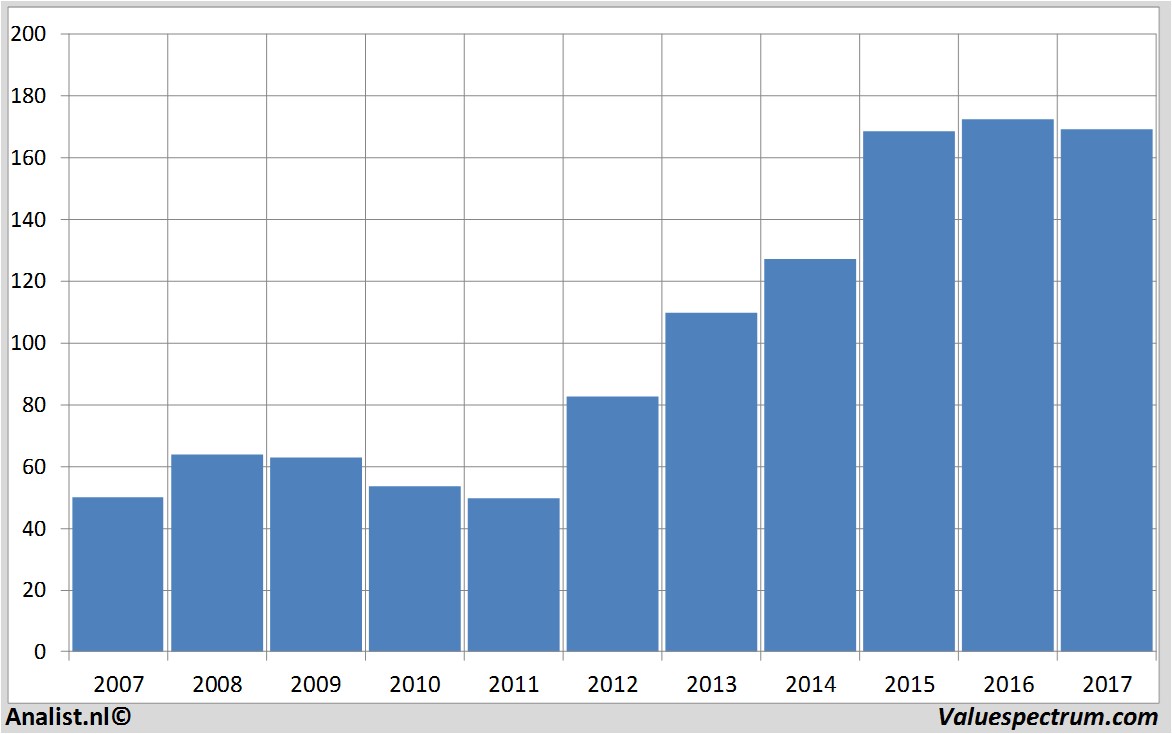

Most recent target prices around 181 USD

The most recent recommendations for the biotech company are from Morgan Stanley , Barclays and Jefferies & Co.. Amgen 's market capitalization is based on the number of outstanding shares around 127,05 billion USD. On Thursday, the stock closed at 169,11 USD.Historical stock prices Amgen

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.