This Analyst Thinks You Should Sell Netflix, Inc. (NASDAQ:NFLX)

Netflix, Inc. (NASDAQ:NFLX) is trading in the green after handily beating the subscriber growth estimates made by industry watchers. The company added 5.2 million new subscribers in the last quarter, versus the consensus estimate of 3.2 million subscribers. But there are some analysts who think that Netflix, Inc. (NASDAQ:NFLX) is not a suitable investment despite of the subscriber growth. Richard “Trip” Miller, the boss at the famous hedge fund Gullane Capital, thinks that Netflix shares will crash in the near future. Miller thinks that Netflix is operating in an industry where barriers to entry are almost negligible. Miller also cites Netflix, Inc. (NASDAQ:NFLX) massive cash burn rate of $1.5 billion for his bearish outlook.

Analysts think that Netflix, Inc. (NASDAQ:NFLX) is under threat from Facebook and Snapchat which plan to launch exclusive TV shows and streaming content. This initiative will dent the Netflix, Inc. (NASDAQ:NFLX) market share, at least in the US.

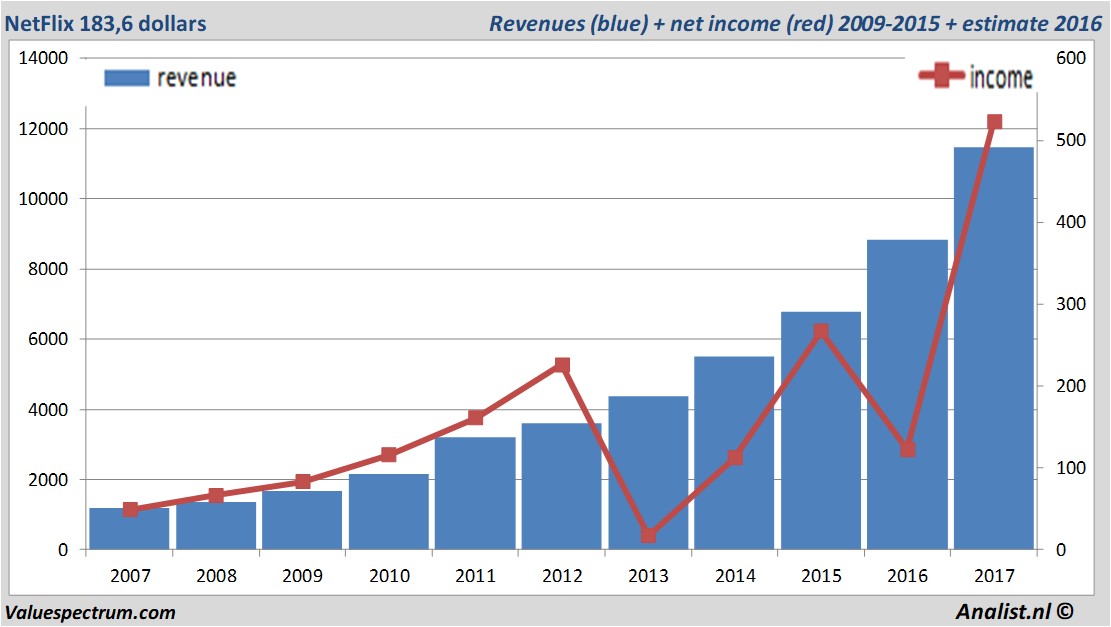

Based on the analysts' consensus: both the revenue and the net result would be on record levels. For this year NetFlix 's revenue will be around 11,48 billion Dollar. This is according to the average of the analysts' estimates. The expected revenue would be a record for the company. This is rather significant more than 2016's revenue of 8,83 billion Dollar.

Historical revenues and results NetFlix plus estimates 2017

The analysts anticipate for 2017 a record net profit a 523 million Dollar. For this year the consensus of the result per share is a profit of 1,16 Dollar. So the price/earnings-ratio equals an extreme 158,28.

Analysts don't expect the company to pay a dividend.The average dividend yield of the internet companies equals a limited 0,09 percent.

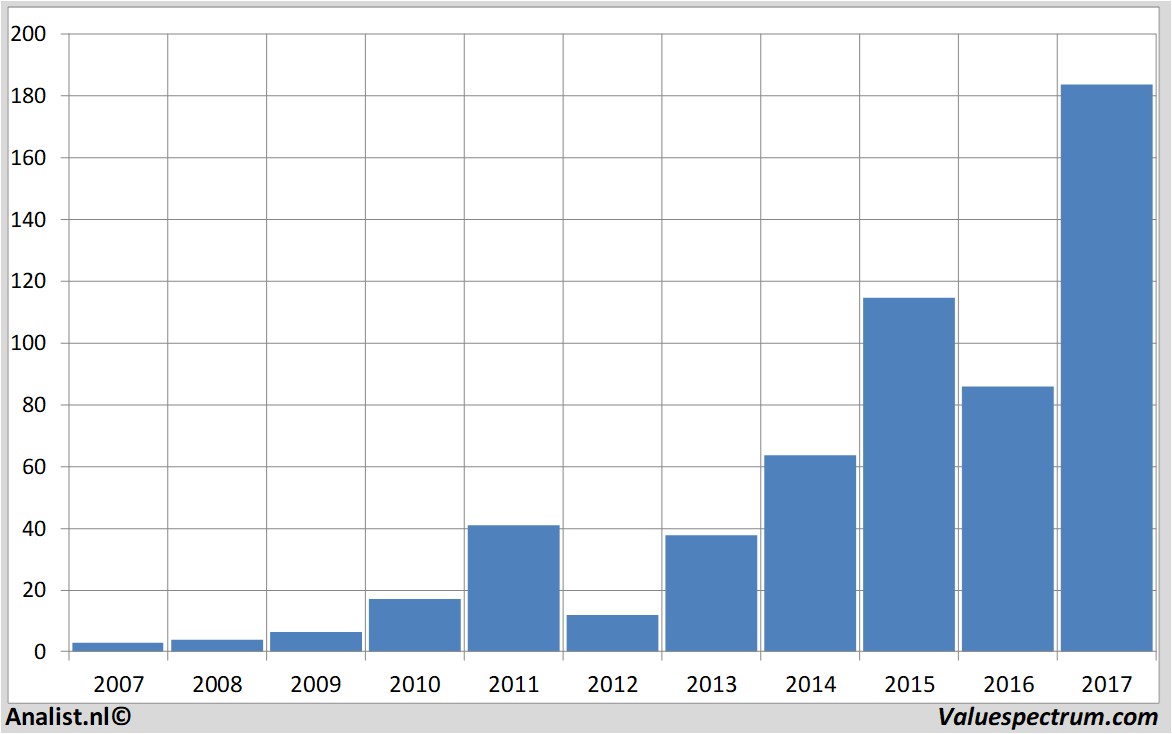

Most recent target prices around 185 Dollar

The most recent recommendations for the internet company are from Jefferies & Co., Canacord Adams and UBS . NetFlix 's market capitalization is based on the number of outstanding shares around 78,57 billion Dollar. At 16.21 the stock trades 0,38 percent higher at 183,6 Dollar.Price data NetFlix 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.