Analysts: Buy Bank of America Corp (NYSE:BAC) Ahead of Earnings

Bank of America (NYSE:BAC) is gaining value after it announced several measures to increase shareholder value. The measures were announced after the bank passed stress tests in June. The bank recently authorized a $12 billion worth of stock buyback program. Bank of America also increased its dividend to 44 cents per share, while quarterly cash dividend was increased by 60%.

Bank of America (NYSE:BAC) will announce quarterly results on Tuesday. Analysts think that the stock is a good investment ahead and after the earnings report. Bank of America plans to cut $53 billion in costs by the end of 2018. These factors will weigh-in positively for the stock in the coming months.

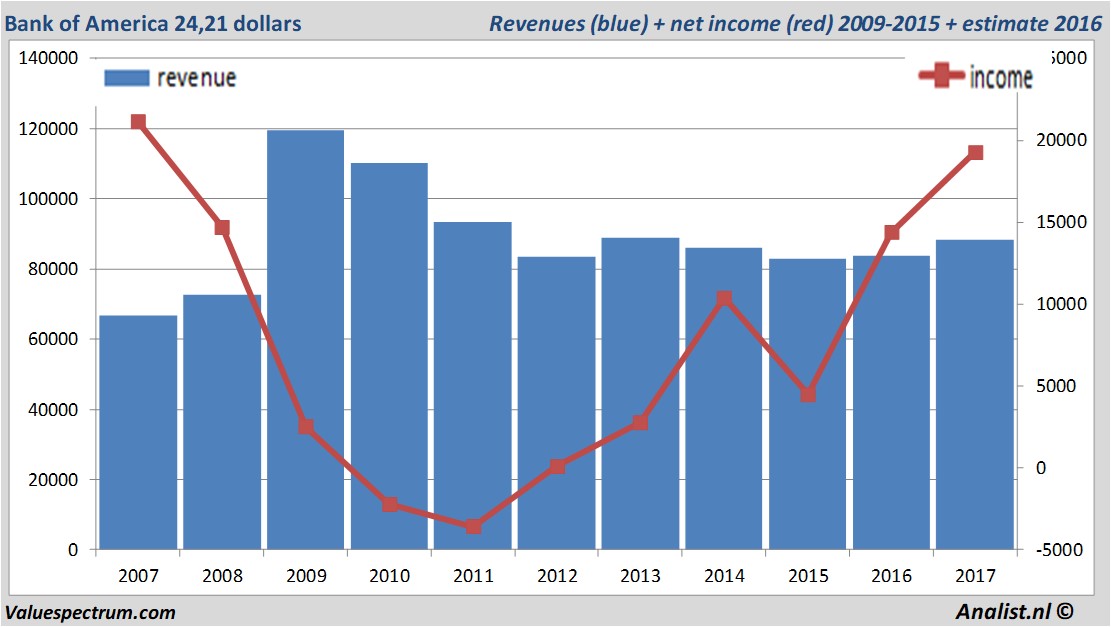

Bank of America will announce it's last quarter's results tomorrow. Over the current book year the total revenue will be 88,38 billion Dollar (consensus estimates). This is slightly more than 2016's revenue of 83,7 billion Dollar.

Historical revenues and results Bank of America plus estimates 2017

The analysts expect for 2017 a net profit of 19,26 billion Dollar. For this year most of the analysts expect a profit per share of 1,77 Dollar. Based on this the price/earnings-ratio is 13,68.

For this year the analysts expect a dividend of 0,38 cent per share. The dividend yield is then 1,57 percent. The average dividend yield of the banks equals a limited 0,64 percent.

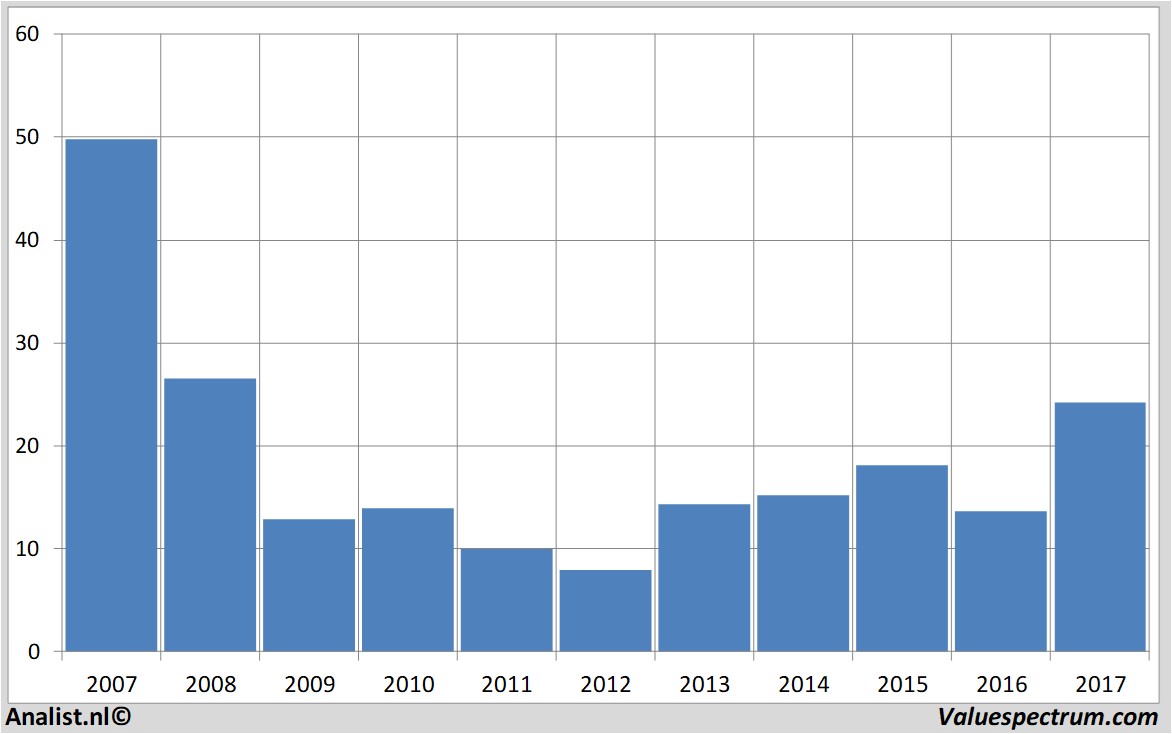

Recent target prices around 25 Dollar

The most recent recommendations for the bank are from Berenberg, Keefe Bruyette & Woods and Citigroup . Based on the current number of outstanding shares Bank of America 's market capitalization is 251,31 billion Dollar. Friday the stock closed at 24,21 Dollar.Price data Bank of America 2007-2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.