Is GoPro Inc (NASDAQ:GPRO) Worth the Wait

GoPro Inc (NASDAQ:GPRO) has been a big money loser for investors over the last 12 months amid execution issues and sliding demand. But the company is hopeful that its new products like Fusion camera, Karma drones and Hero product line will bring in hefty sales in the coming months. Several latest surveys suggest that the action camera industry is about to get a new life. Global Market Insights recently said in a report that action camera industry will grow at a rate of 22% between 2016 and 2023.

GoPro Inc (NASDAQ:GPRO) cut 200 jobs last year. Recently, it announced another series of layoffs and cost cutting measures. Analysts think that GoPro is a solid investment for investors who are ready to wait.

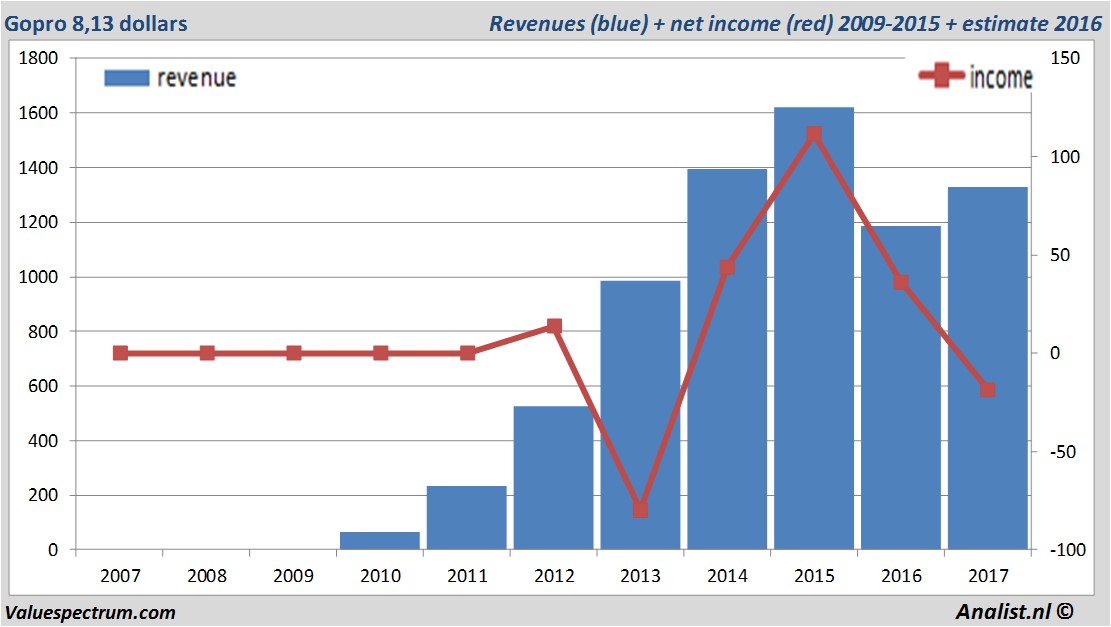

Over the current book year the total revenue will be 1,33 billion Dollar (consensus estimates). This is rather significant more than 2016's revenue of 1,19 billion Dollar.

Historical revenues and results Gopro plus estimates 2017

The analysts expect for 2017 a net loss of 18 million Dollar. According to most of the analysts the company will have a loss per share for this book year of 16 cent. The price/earnings-ratio therefor is -51,75.

For this year analysts don't expect the company to pay a dividend.The average dividend yield of the electronics companies equals a low 0,78 percent.

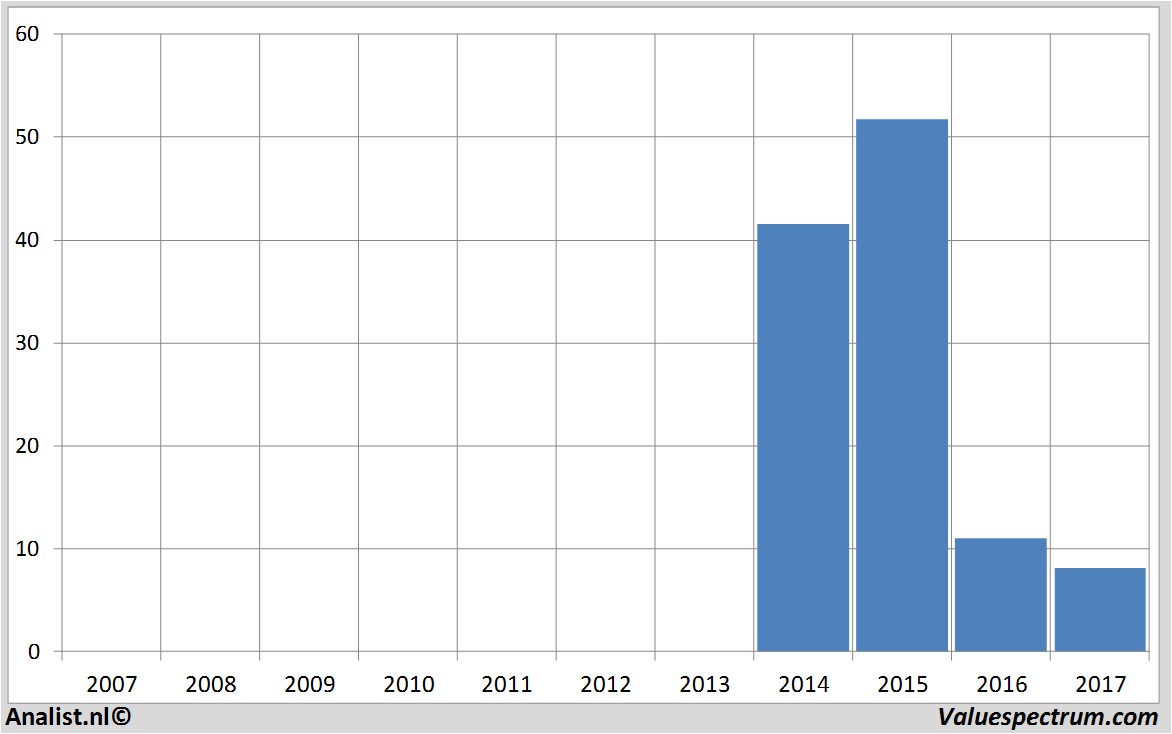

Based on the current number of outstanding shares Gopro's market capitalization is 832,93 million Dollar. At 20.55 the stock trades 1,21 percent lower at 8,28 Dollar.Historical stock prices Gopro of 2007 till 2017

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.