Should AbbVie Inc (NYSE:ABBV) Shareholders be Worried

AbbVie Inc (NYSE:ABBV) shareholders are concerned as the company is set to lose patent for blockbuster arthritis drug Humira. But the company has done a lot of undo the damage. AbbVie has a strong pipeline, with immunology and neurology drugs. The company is planning to extend IMBRUVICA, ABT-414 and Risankizumab. AbbVie Inc (NYSE:ABBV) is also working on leukemia drug Venclexta and endometriosis treatment Elagolix.

The company recently announced positive results Phase III study for a rheumatoid arthritis candidate, ABT-494. The company is also expected to be a huge benefactor of President Trump’s tax reforms.

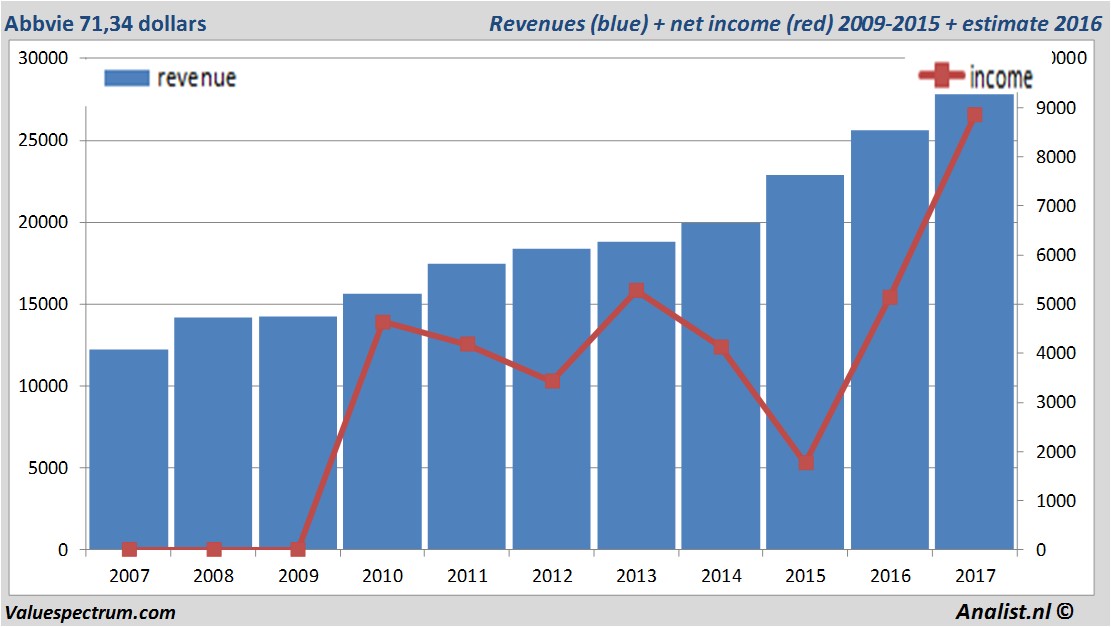

Over the current book year the total revenue will be 27,77 billion dollars (consensus estimates). The expected revenue would be a record for the company. This is slightly more than 2016's revenue of 25,64 billion dollars.

Historical revenues and results Abbvie plus estimates 2017

The analysts expect for 2017 a net profit of 8,85 billion dollars. The majority of the analysts expect for this year a profit per share of 5,53 dollars. The price/earnings-ratio therefor is 12,85.

huge dividend Abbvie

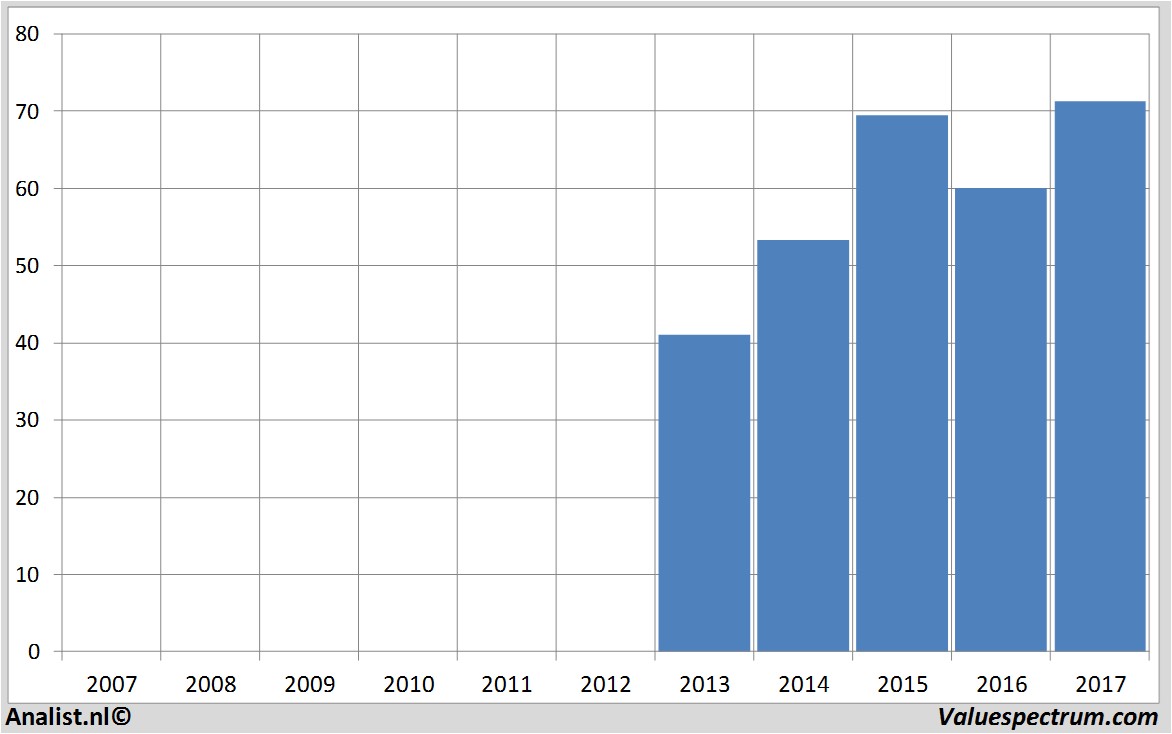

For this year the analysts expect a dividend of 2,58 dollars per share. The dividend yield is then 3,63 percent. The average dividend yield of the biotech companies equals a low 0,04 percent. Abbvie's market capitalisation is based on the number of outstanding shares around 114,38 billion dollars. At 21.01 the stock trades 0,37 percent higher at 71,05 dollars.Historical stock prices Abbvie

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.