Caixabank huge underperformer in European banking sector

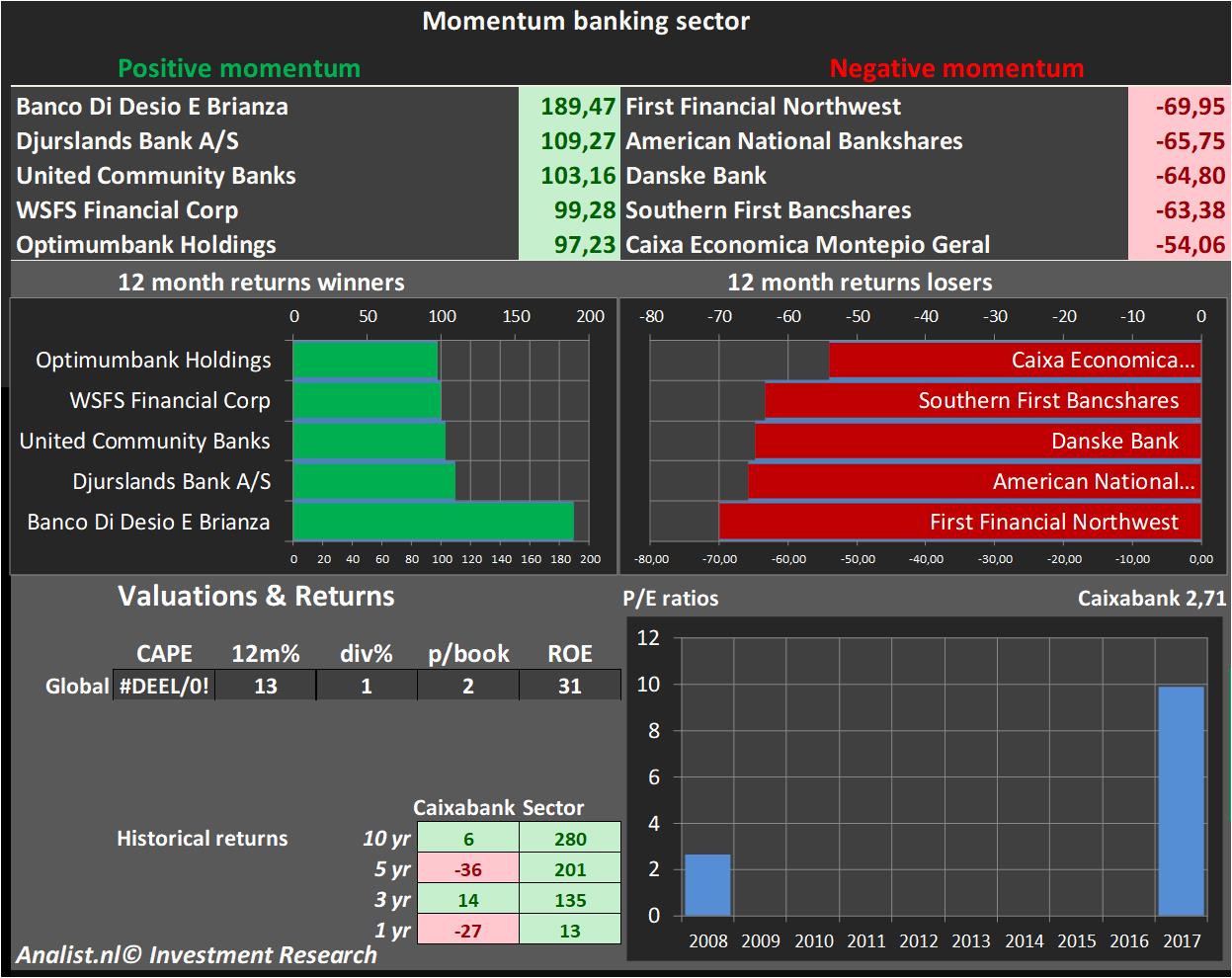

Because of the huge loss of 14 percent since early this year, the share is one of the worst shares of the banking sector. The average stock of the banking sector yielded the this year a profit of 4 percent. Other bad performing shares in the sector are First Financial Northwest, American National Bankshares and Danske Bank. First Financial Northwest, American National Bankshares and Danske Bank are among the losers in the sector.

Momentum banking sector

For the average share in the sector around 18 times the earnings per share is paid. The sector trades now at 1,88 times the book value per share. Since 2012 the sector made a plus of 201 percent and since 2007 a plus of 280 percent.

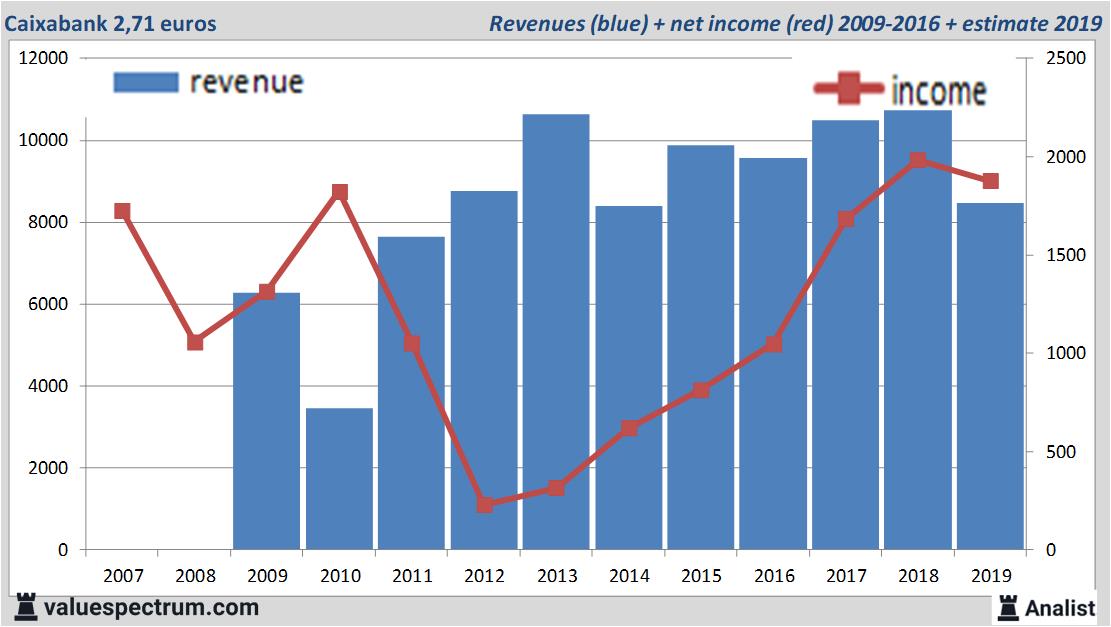

For the average share in the sector around 18 times the earnings per share is paid. The sector trades now at 1,88 times the book value per share. Since 2012 the sector made a plus of 201 percent and since 2007 a plus of 280 percent. Over the current book year the total revenue will be 8,47 billion euros (consensus estimates). This is hugely lower than 2018's revenue of 10,75 billion euros.

Historical revenues and results Caixabank plus estimates 2019

The analysts expect for 2019 a net profit of 1,88 billion euros. For this year the consensus of Caixabank's result per share is a profit of 32 cent. Based on this the price/earnings-ratio is 8,47.

Huge dividend Caixabank

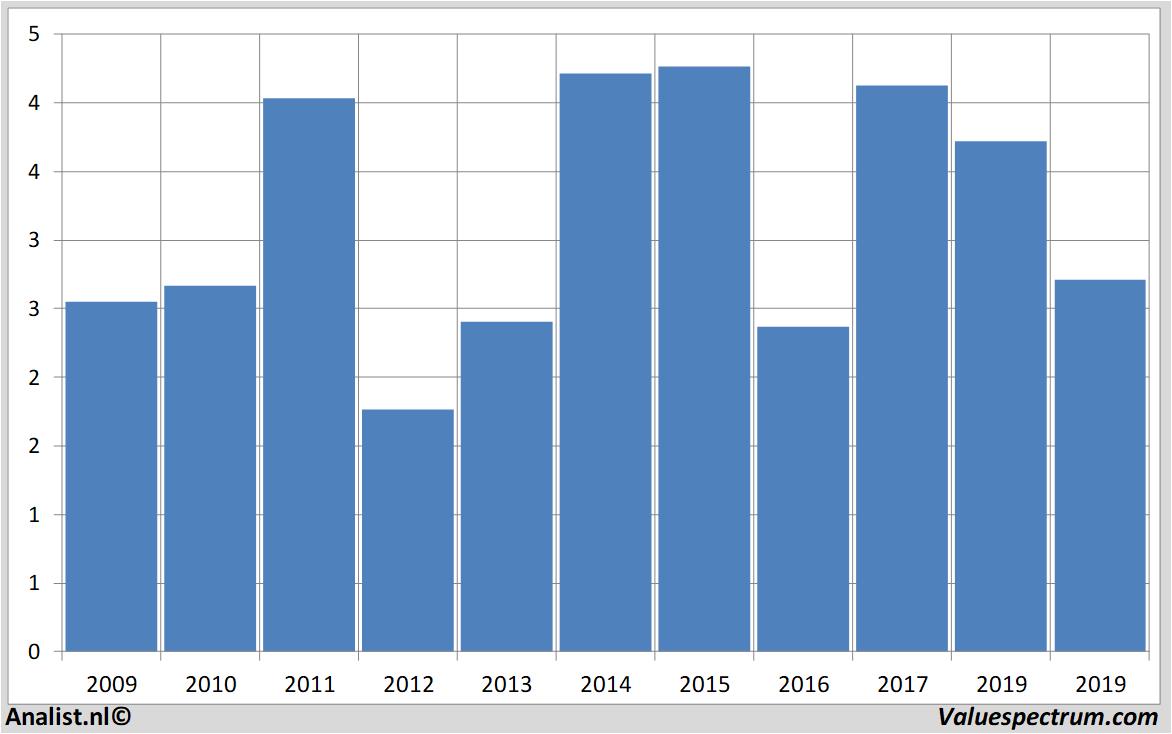

For this year the analysts expect a dividend of 0,17 cents per share. Caixabank's dividend yield thus equals 6,27 percent. The average dividend yield of the banks is a limited 1 percent.Caixabank's market capitalization is around 16,19 billion euros. The Caixabank stock was the past 12 months quite volatile. Since last June the stock is 23 percent lower. This year the stock price moved between 3 and 4 euro.

Historical stock prices Caixabank period 2007-2019

At 12.06 the stock trades 2,55 percent higher at 2,71 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.