JD.Com Inc (JD): Best Tech Stock to Buy Right Now

JD.Com Inc (ADR) (NASDAQ: JD) is proving its potential amid staggering growth and traction. The company’s revenue in the first quarter jumped 33% annually. A report published by BrandZ Retail in collaboration with Kantar and WPP suggest that JD.com is the fastest growing retail brand, with a 94% rate. JD.com recently signed deals with Walmart, Chinese retailer Yonghui and Alphabet to expand its business in Asia and beyond.

JD.com announced that Alphabet will invest a whopping $550 million in JD in exchange for 27 million newly issued JD.com Class A ordinary shares. JD has a partnership with Tencent which operates WeChat app. The app has over 1 billion users. Analysts think that JD can use this data in the future for advertising purposes and revenue generation.

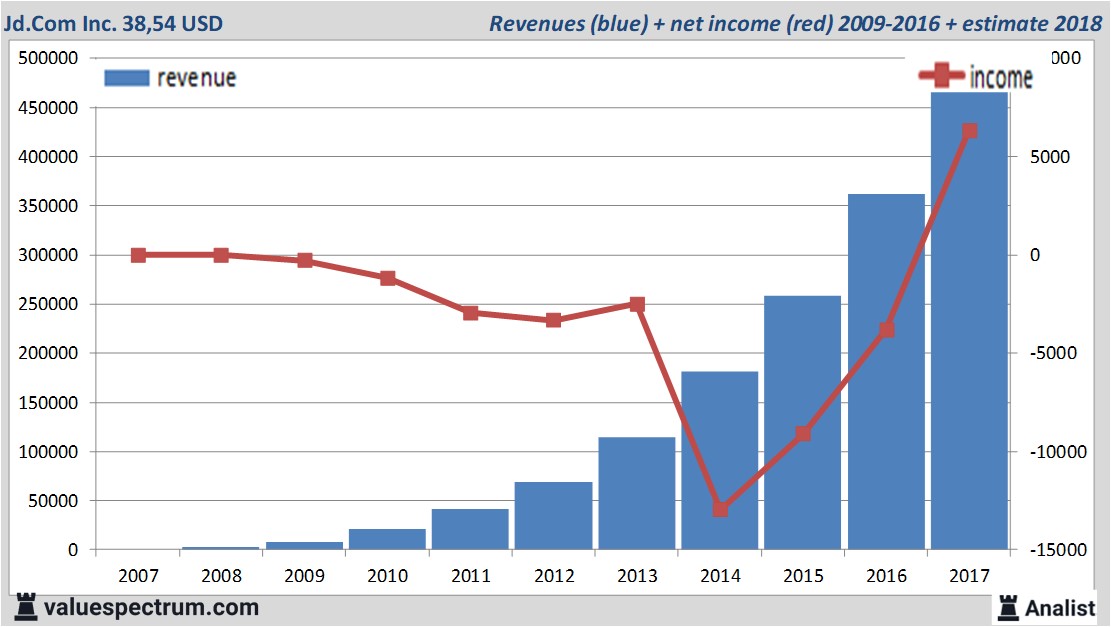

For this year Jd.Com Inc.'s revenue will be around 473,24 billion USD. This is according to the average of the analysts' estimates. This is quite more than 2017's revenue of 362,33 billion USD.

Historical revenues and results Jd.Com Inc. plus estimates 2018

The analysts expect for 2018 a net profit of 6,34 billion USD. For this year the consensus of Jd.Com Inc.'s result per share is a profit of 4,42 USD. With this the price/earnings-ratio is 8,72.

Analysts don't expect the company to pay a dividend. The average dividend yield of the offshore companies equals a low 0,5 percent.

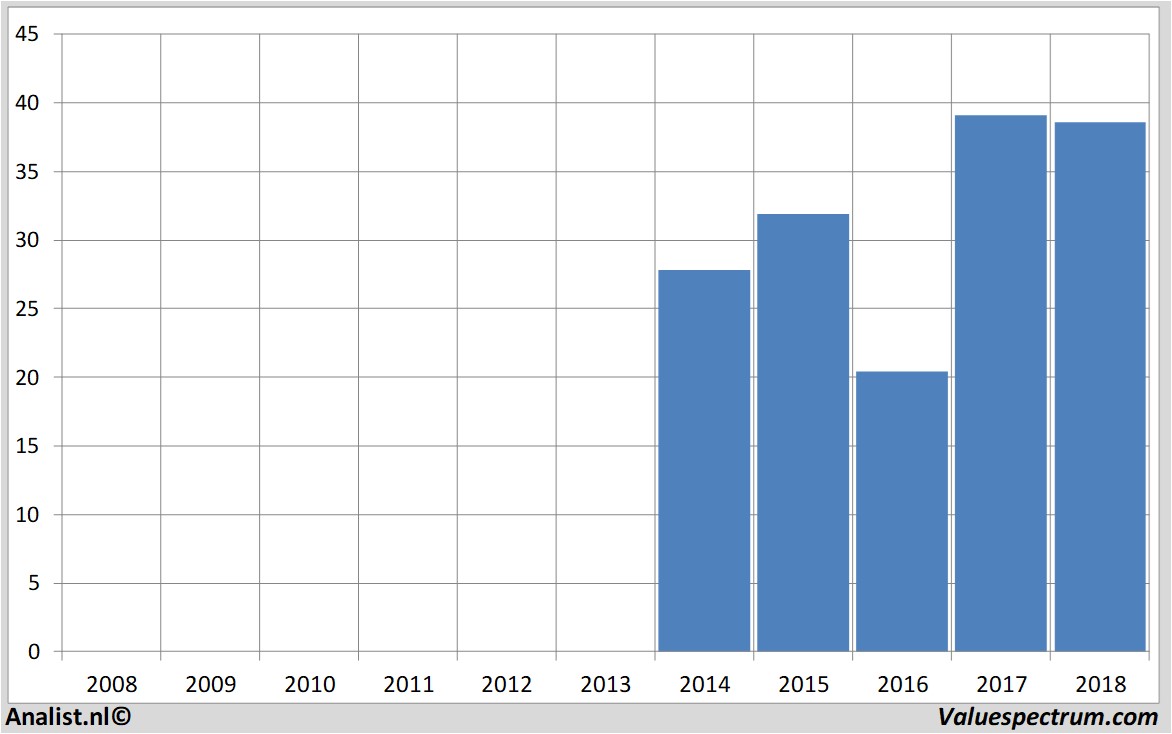

Jd.Com Inc.'s market value equals around 91,92 billion . At 16.40 the stock trades 1,5 percent higher at 38,54 USD.Historical stock prices Jd.Com Inc.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.