Carrefour among the worse European glamour stocks

Share Carrefour among the losing European glamour stocks

The Carrefour share now belongs to the underperforming glamour stocks in Europe. Over the past 12 months the large cap is an impressive 35 percent lower. The European glamour stocks are 4 percent lower. Investors pay now 98 times the CAPE-ratio per share. The average European glamour stocks are traded at 82.

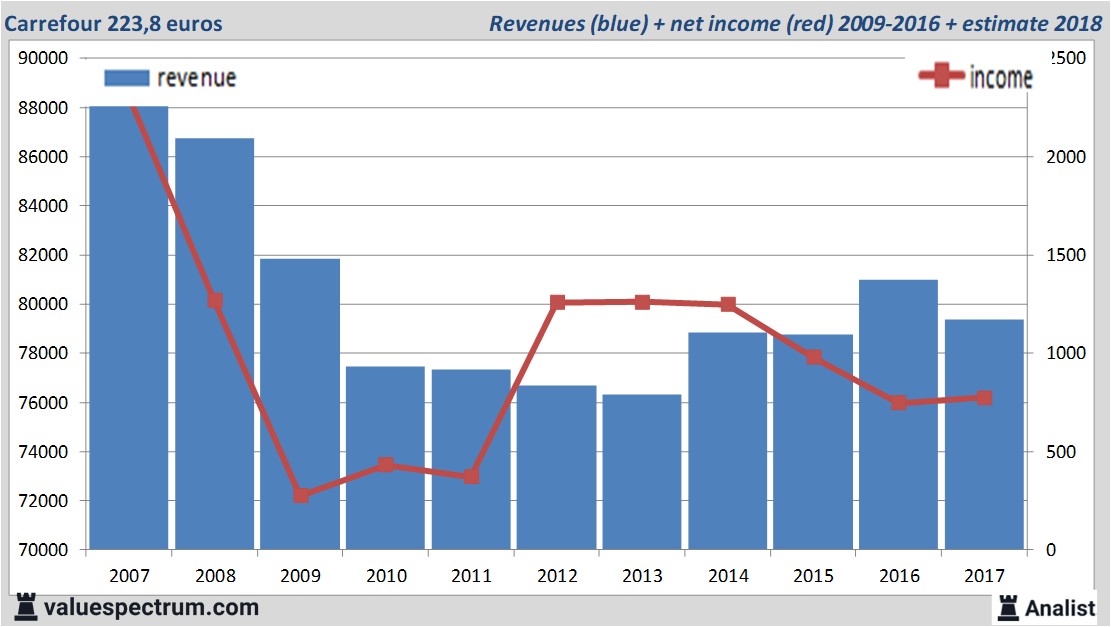

Over the current book year the total revenue will be 79,35 billion euros (consensus estimates). This is slightly lower than 2017's revenue of 80,98 billion euros.

Historical revenues and results Carrefour plus estimates 2018

The analysts expect for 2018 a net profit of 774 million euros. For this year most of the analysts expect a profit per share of 1,01 euros. The PE-ratio therefore is 15.

Huge dividend Carrefour

For this year the analysts expect a dividend of 0,49 cents per share. Thus the dividend yield equals 3,23 percent. The average dividend yield of the food & drug retailers is a poor 1 percent.Recent target prices around 20 euros

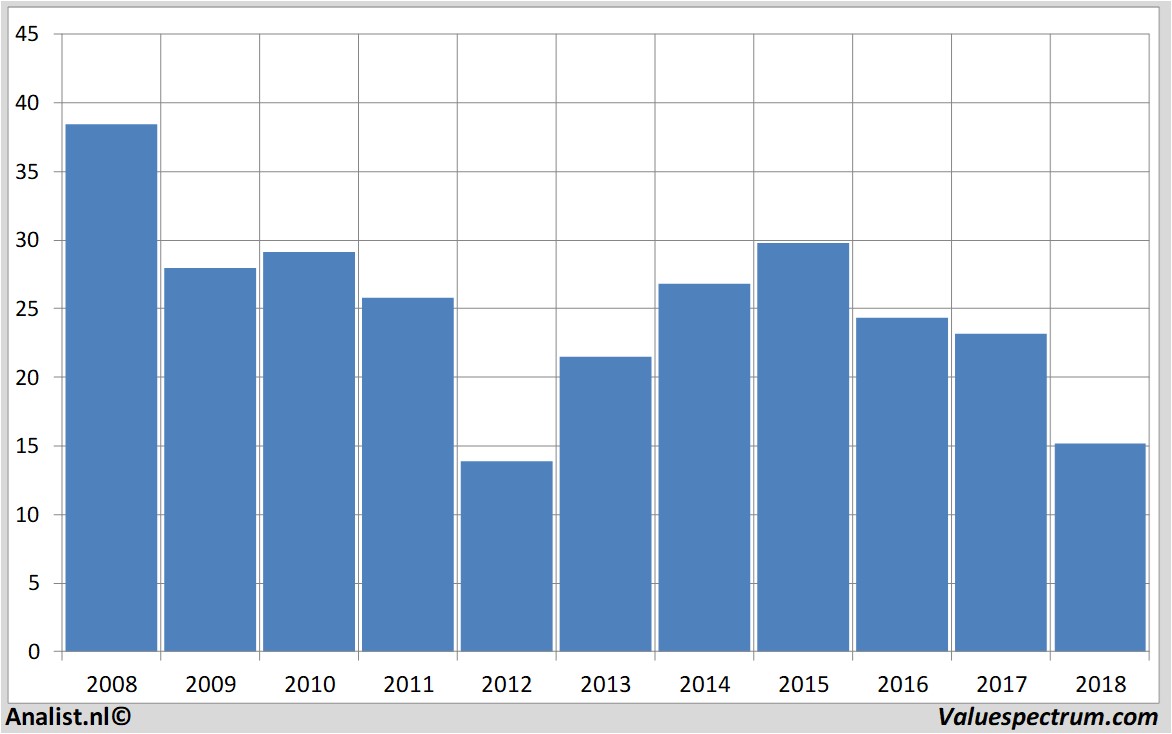

The most recent recommendations for the food & drug retailer are from Exane BNP Paribas , Kepler Capital Markets and Raymond James. Carrefour 's market value equals around 11,31 billion .Historical stock prices Carrefour

At 12.14 the stock trades 1,49 percent lower at 15,15 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.