Losses for mining sector

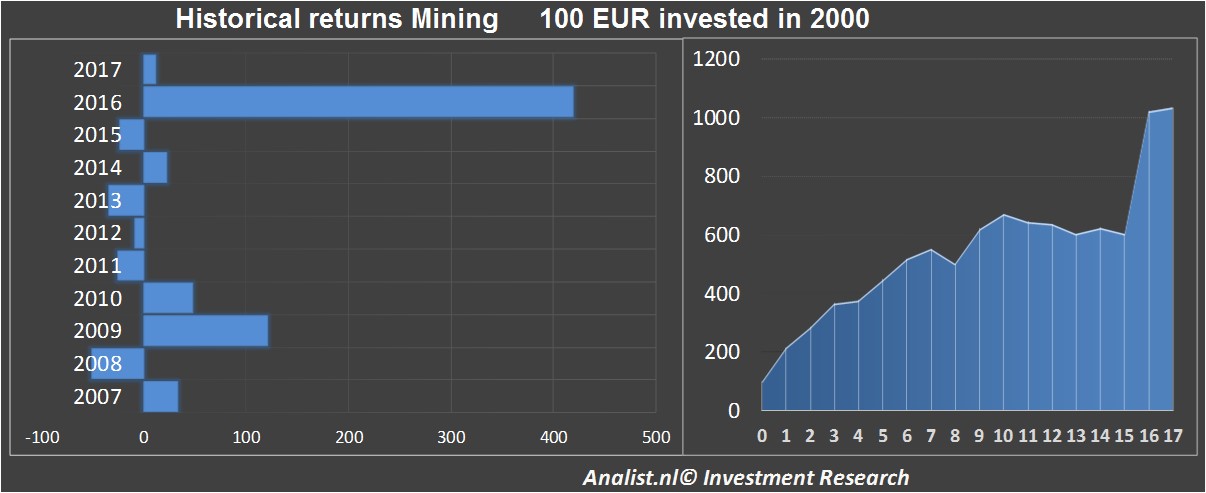

Lately most stocks of the mining sector are under selling pressure. Over the past 3 months the sector is 3 percent lower. Investors who in 2000 bought the average share of the sector now have an extreme gain of around 1034 percent. Since 2012 the sector trades 263 percent higher. On average the sector yields a moderate dividend yield of 1 percent.

Returns mining sector

The European mining companies are in terms of their price/earnings ratios cheaper than the US ones. Per European share investors pay now less the for the expected earnings per share. So it seems the markets expect less growth of them. The whole sector now trades at a quite huge CAPE-ratio of 34. Franco Nev Corp, Newmont Mining are Royal Gold are among the top CAPE-ratios. Harmony Gold Mining Co. Ltd, Alliance Resource Partners are BHP Billiton among the ones with the lower CAPE-ratios.

The European mining sector has a CAPE of -13 and the US's sector of . ,

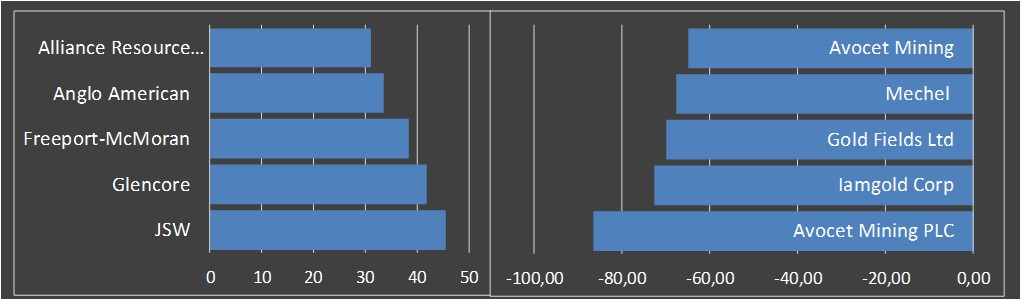

Winners and losers mining sector

The EU stocks in this sector are around -13 percent lower and the US's are percent lower.

The European mining companies now deliver more dividends then the US ones. These in Europe now yield 1,53 percent and these in US 0,12 percent. 0, 0 and 0 have now the highest dividend returns (in case the dividends per share are unchanged).

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.