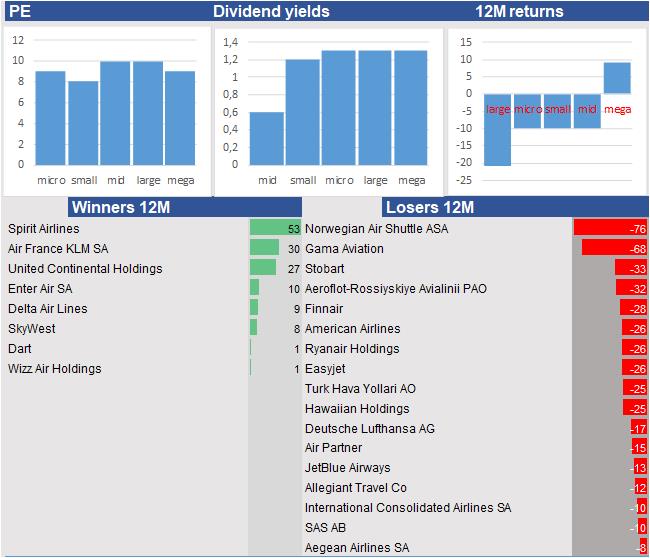

Large caps are the most expensive in the airline sector

There is a low diversification of 12 months returns within the airline sector. The sector is around 8 percent lower since April. Among the winners we find Spirit Airlines, Air France-KLM Air France-KLM SA and United Continental Holdings. Relatively big losses are for Norwegian Air Shuttle ASA, Gama Aviation and Stobart Group.

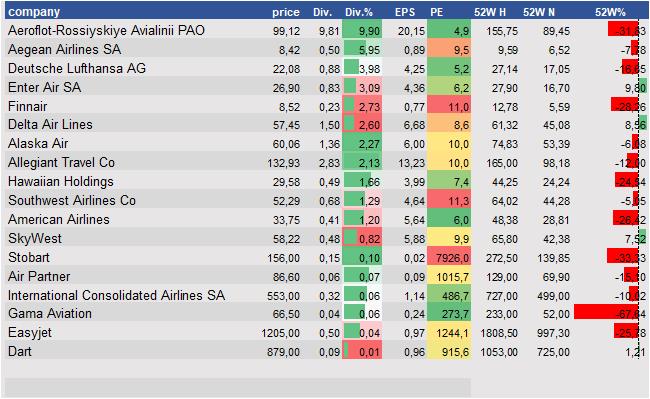

Core figures airline sector

The megacaps in this sector are the winners. Among the less performing are mostly the large caps.

Lowest PE-ratios airline sector

Regarding the price/earnings-ratios we see a uniform palette. The large caps are with the price/earnings-ratio of 10 the most expensive. The smallcaps are the cheapest and trade at 8 times the earnings per share. Stobart Group, Wizz Air Holdings and Easyjet are the stocks with the highest ratios. Stocks with the lowest ratios are Mesa Air, Turk Hava Yollari AO and Aeroflot-Rossiyskiye Avialinii PAO.

Highest dividend yields airline sector

The sector's average dividend yield is with 1,1 percent relatively limited. Stocks now high dividend yields now are Aeroflot-Rossiyskiye Avialinii PAO, Aegean Airlines SA and Deutsche Lufthansa AG.

This is a free publication from Valuespectrum Pro. Valuespectrum Pro is a professional platform with analyses from all US and European companies. Click here to sign up for free.