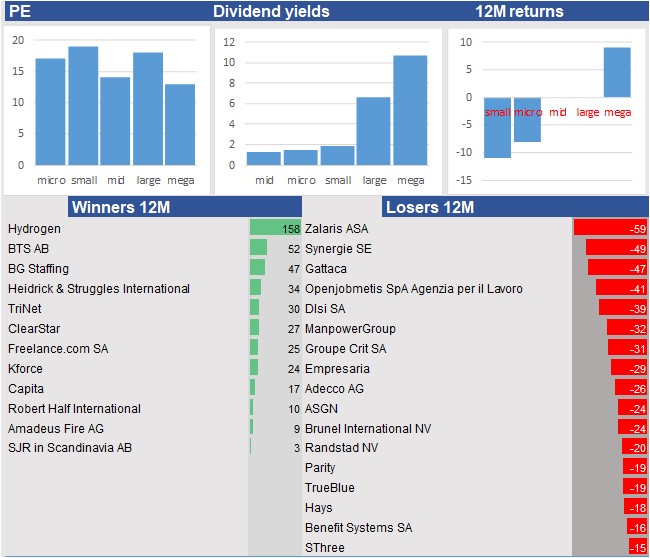

In employment sector Megacaps are the best

There is a low diversification of 12 months returns within the employment sector. Since March last year the sector is around 2 percent lower. Among the winners we find 0, 0 and 0. Relatively big losses are for 0, 0 and 0.

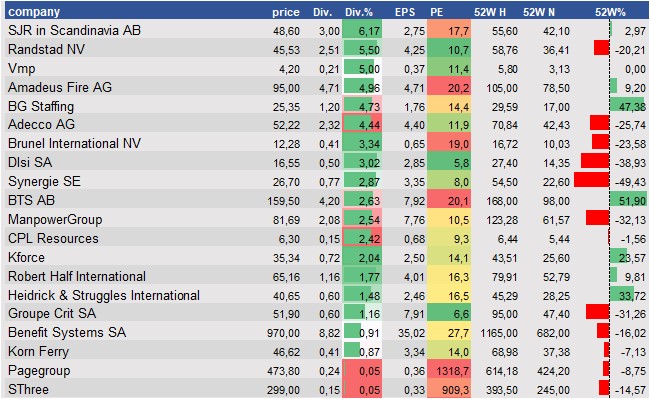

Core figures employment sector

The megacaps in this sector are the winners. Among the less performing are mostly the smallcaps.

Lowest PE-ratios employment sector

Regarding the price/earnings-ratios we see a uniform palette. The smallcaps are with the price/earnings-ratio of 19 the most expensive. The megacaps are the cheapest and trade at 13 times the earnings per share. 0, 0 and 0 are the stocks with the highest ratios. Stocks with the lowest ratios are 0, 0 and 0.

Highest dividend yields employment sector

The sector's average dividend yield is with 4,4 percent relatively high. Stocks now high dividend yields now are 0, 0 and 0.

This is a free publication from Valuespectrum Pro. Valuespectrum Pro is a professional platform with analyses from all US and European companies. Click here to sign up for free.