Extreme dividend yield Banco Santander

Huge dividend Banco Santander

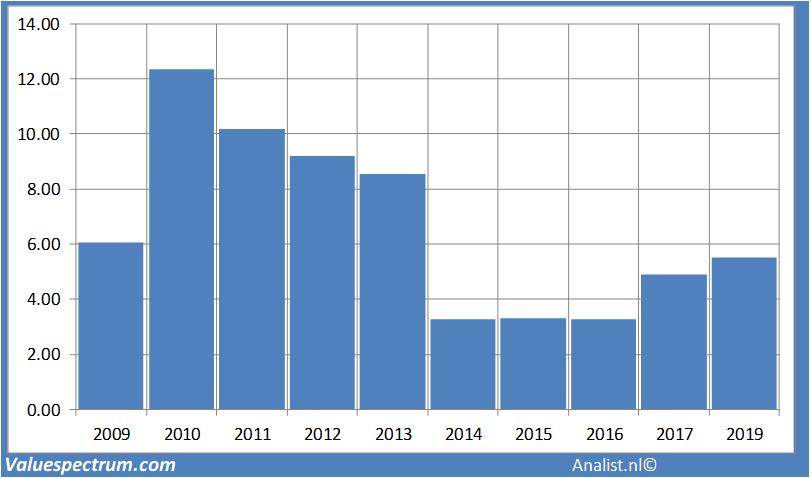

Investors inBanco Santandercan expect a huge dividend payment. Based on the recent analysts' consensus the stock now has one of the highest dividend returns of the Spanish market. For this year most of the analysts expect a dividend of 0,22 cents per share. Thus the dividend yield equals 5,51 percent. The average dividend yield of the banks is a good 25 percent.

Dividend returns Banco Santander

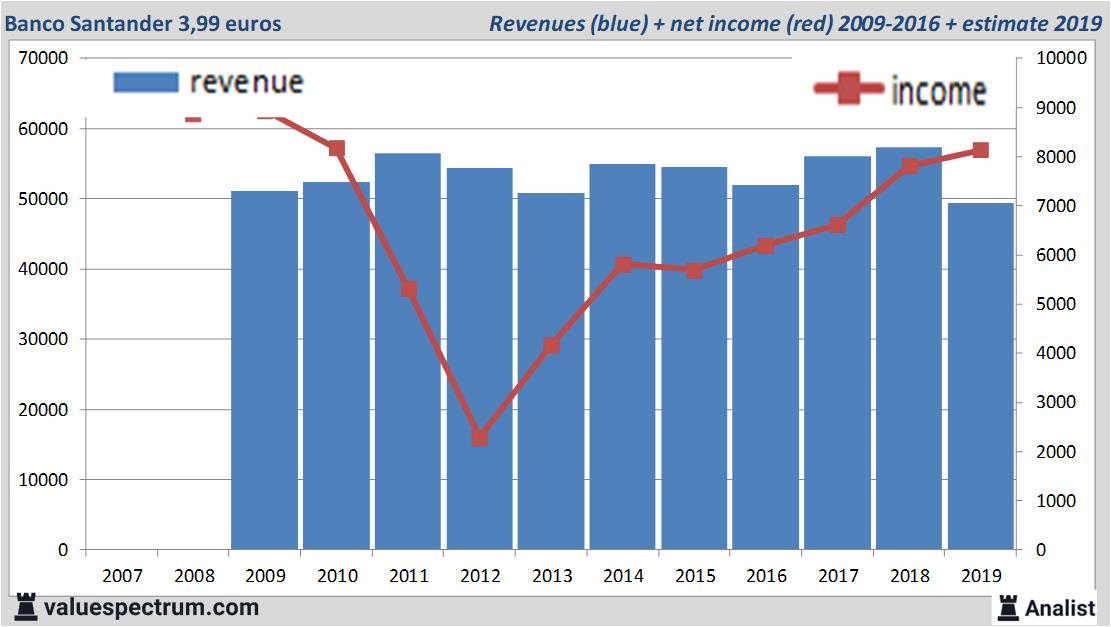

Tomorrow the SpanishBanco Santanderwill publish its past quarters figures. Over the current book year the total revenue will be 49,42 billion euros (consensus estimates). This is hugely lower than 2018's revenue of 57,3 billion euros.

Historical revenues and resultsBanco Santanderplus estimates 2019

The analysts expect for 2019 a net profit of 8,14 billion euros. For this year most of the analysts expect a profit per share of 49 cent. The price-earnings-ratio equals 8,14.

Based on the current number of outstanding shares Banco Santander's market capitalization is 64,74 billion euros. TheBanco Santanderstock was the past 12 months quite unstable. Since last July the stock is 9 percent lower. This year the stock price moved between 4 and 5 euro.

At 10.54 the stock trades 2,62 percent higher at 3,99 euros.Historical stock pricesBanco Santanderperiod 2007-2019

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.