2011 best year, 2010 worst year for DSM

DSM-investors have very negative for long times. Even without dividend payments the stock is one of the outperformers from as well chemical sector as the Dutch exchange. The received dividends are a cherry on the cake for investors.

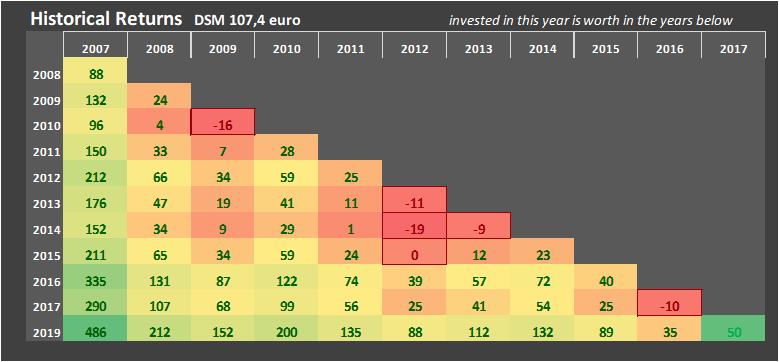

The matrix above shows DSM's historical returns expressed in the different entry years in the left axis.

The stock plummeted to about 16 percent in 2010 which was the worst performance since 2008. The best year for the stock was 2008. The stock gained no less than 88 percent in the period. The total return since 2008 till current is even around plus 212 percent.For this year DSM's revenue will be around 9,31 billion euros. This is according to the average of the analysts' estimates. This is slightly more than 2018's revenue of 9,27 billion euros.

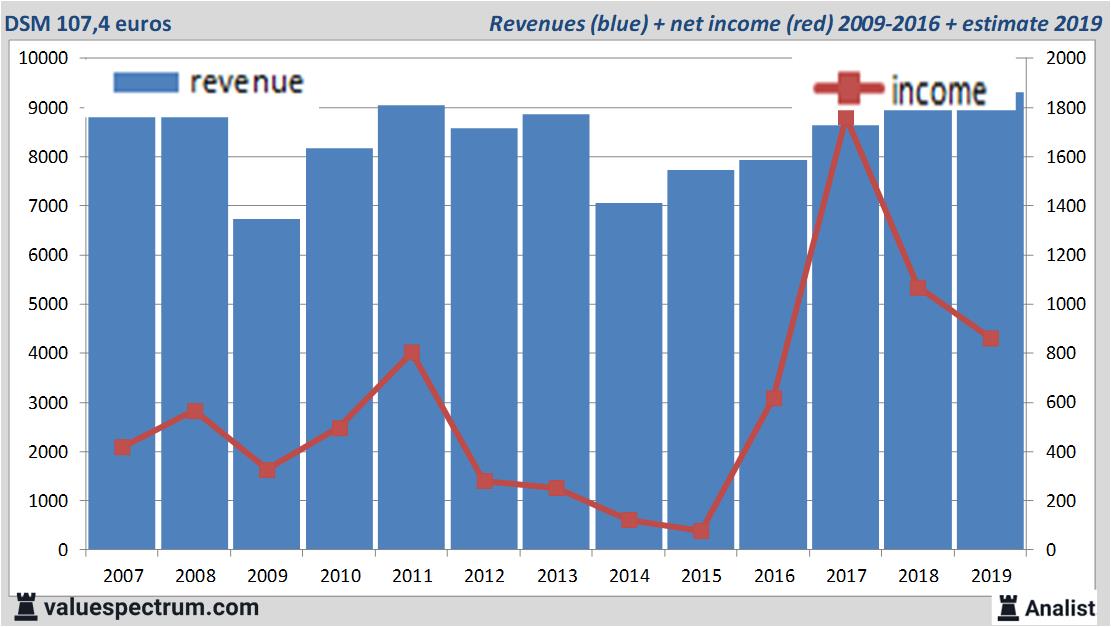

Historical revenues and results DSM plus estimates 2019

The analysts expect for 2019 a net profit of 862 million euros. For this year most of the analysts expect a profit per share of 5,05 euros. The price-earnings-ratio equals 21,27.

Analysts expect a dividend of 2,4 euros per share. Thus the dividend yield equals 2,23 percent. The average dividend yield of the chemical companies is an attractive 3 percent.

Most recent target prices around 109 euros

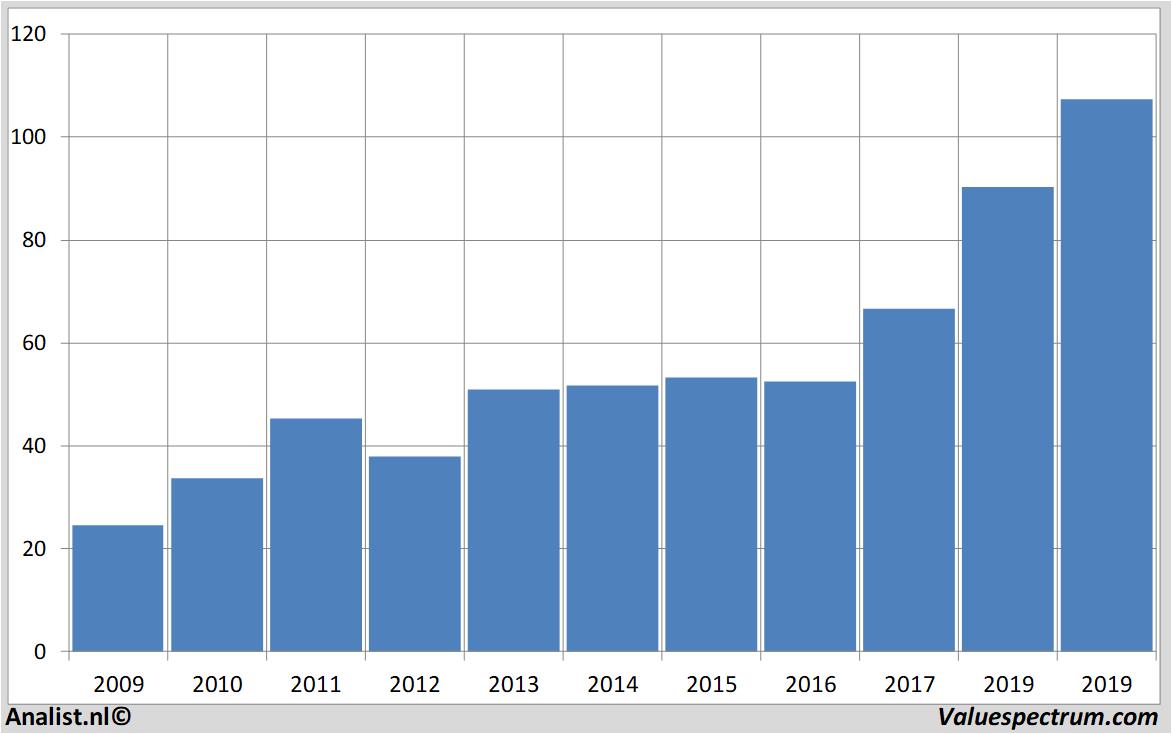

The most recent recommendations for the chemical company are from HSBC, Goldman Sachs and Deutsche Bank.Based on the current number of shares DSM's market capitalization equals 18,8 billion euros. The DSM stock was the past 12 months quite unstable. Since last June the stock is even 22 percent higher. This year the stock price moved between 68 and 108 euro.

Historical stock prices DSM

At 10.52 the stock trades 0,33 percent lower at 107,4 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.