AMG outperforms past years Dutch exchanges

The past years AMG gained a lot in value. The past year the 10 year with a huge profit of 349 percent one of the best shares of the Netherlands. Since the start of this year, the average Dutch stock rose year approximately 132 percent in value. Other winners over the past 10 years are BE Semiconductor, ASML and Acomo.

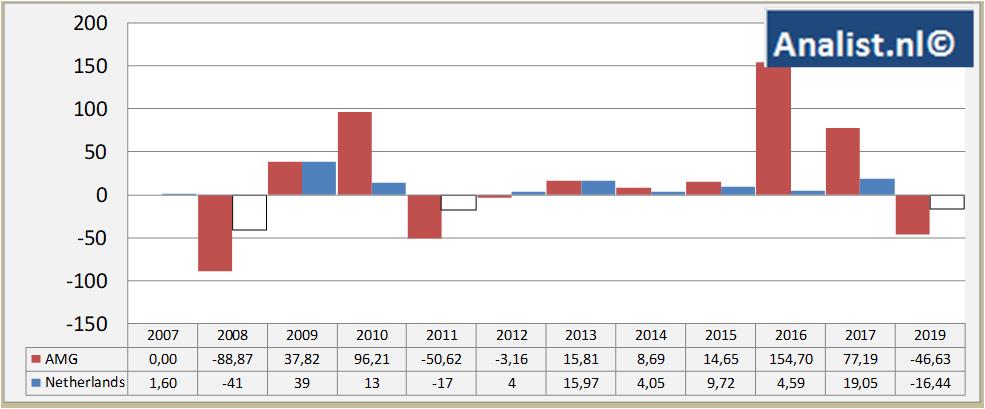

Returns AMG versus Dutch stocks

Buy & hold Returns stock AMG several periods, excluding dividend returns

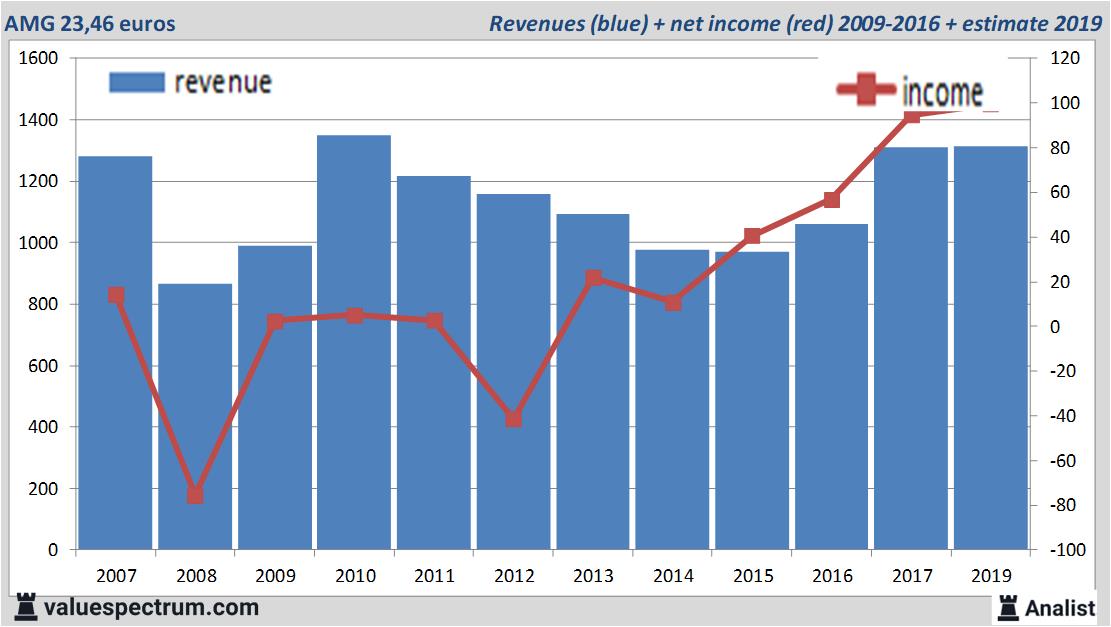

Since 2012 the stock has a price gain of 200 percent. over the past 90 days the stock made a loss of 31 percent.For this year AMG's revenue will be around 1,31 billion euros. This is according to the average of the analysts' estimates. This is slightly more than 2017's revenue of 1,31 billion euros.

Historical revenues and results AMG plus estimates 2019

The analysts expect for 2019 a net profit of 100 million euros. For this year the consensus of the result per share is a profit of 3,53 euros. Based on this the price/earnings-ratio is 6,65.

Huge dividend AMG

Per share the analysts expect a dividend of 0,72 cents per share. Thus the dividend yield equals 3,07 percent. The average dividend yield of the industrial companies is a limited 1 percent.Most recent target prices around 48 euros

The most recent recommendations for the industrial metals company are from ING, UBS and Citigroup.Based on the current number of shares AMG's market capitalization equals 698,74 million euros. The AMG stock was the past 12 months quite unstable. Since last May the stock is 46 percent lower. This year the stock price moved between 23 and 53 euro.

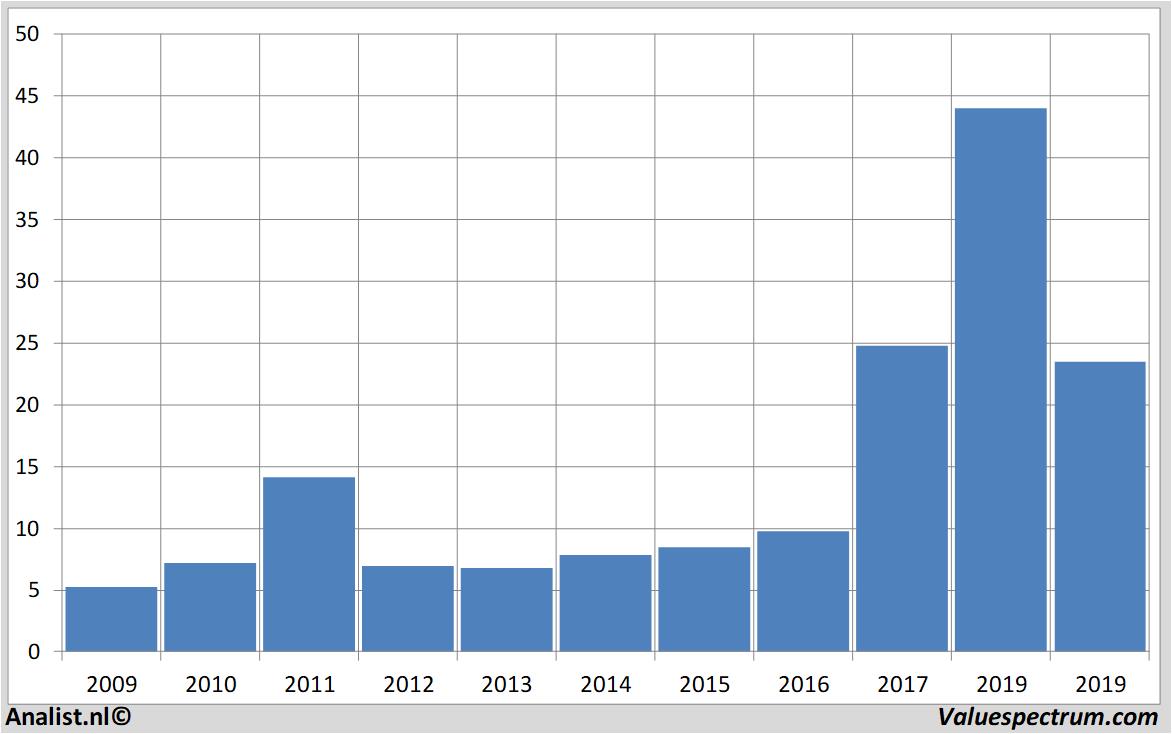

Historical stock prices AMG2007-2019

At 11.28 the stock trades 0,98 percent lower at 23,46 euros.

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.