Unibail-Rodamco-Westfield a favorite stock

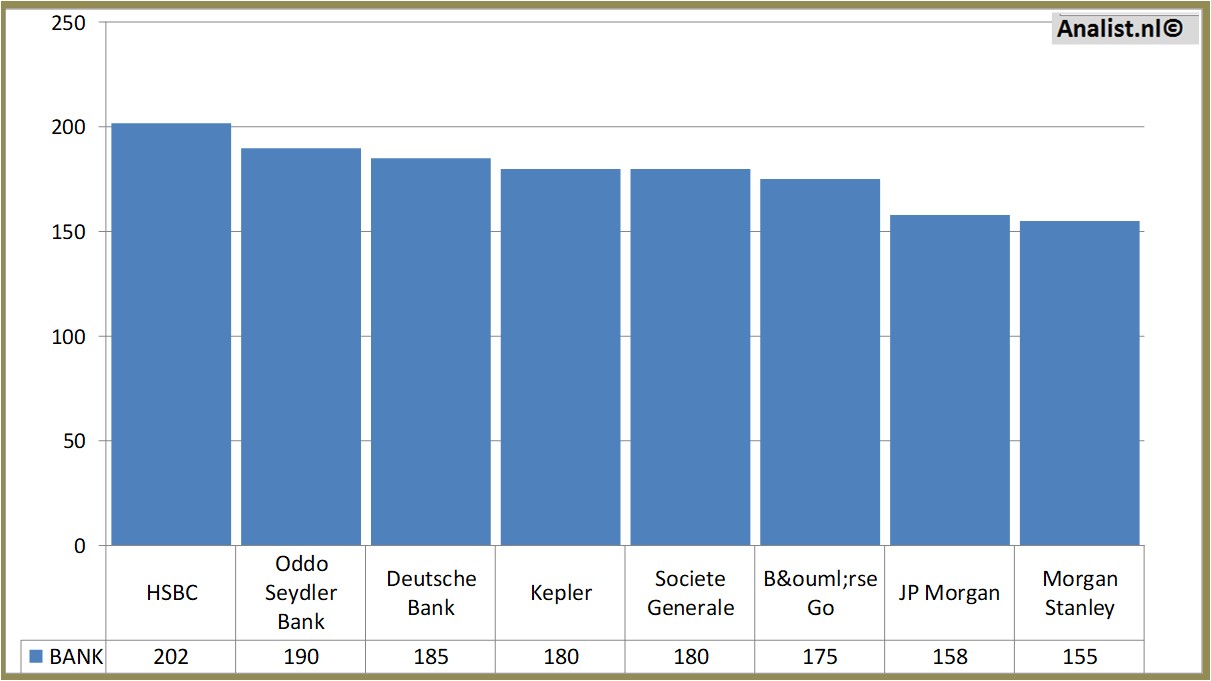

It seems Unibail-Rodamco-Westfield's stock trades with a discount.The majority of the analysts thinks Unibail-Rodamco-Westfield is currently underpriced. Currently the company is being followed by 18 analyst. The recommendations are: 1 times sell, 8 times hold and no buys. The average of the target prices for the stock equals 184,12 euros. This is around 26 percent more than the current price of 148,5 euros. Morgan Stanley, JP Morgan and ING recently provided recommendations for the stock.

Target prices for Unibail-Rodamco-Westfield vary a lot

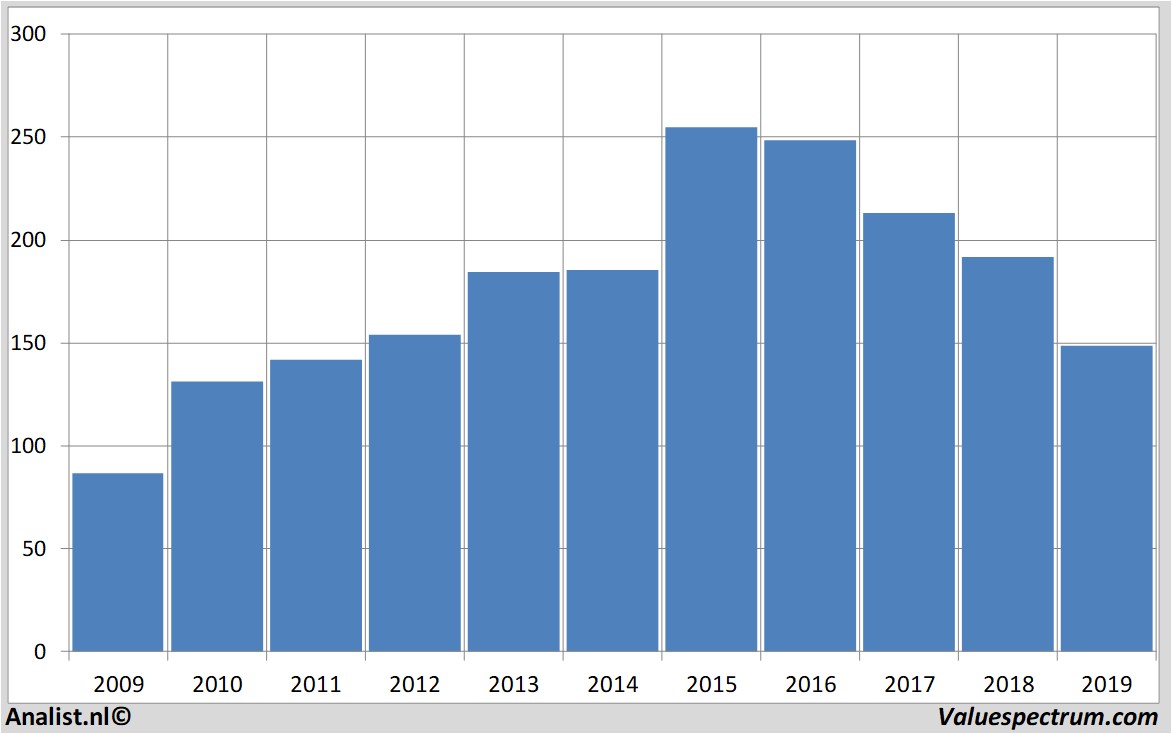

Unibail-Rodamco-Westfield's market capitalization is based on the number of outstanding shares around 14,83 billion euros. The Unibail-Rodamco-Westfield stock was the past 12 months quite volatile. Since last March the stock is 18 percent lower. This year the stock price moved between 130 and 200 euro. Since 2008 the stock price is almost 71 percent higher.

Historical stock prices Unibail-Rodamco-Westfield past 10 years

On Thursday, the stock closed at 148,5 euros.

Analist.nl Nieuwsdienst: +31 084-0032-842

nieuws@analist.nl

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. Analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.