Analysts expect over 2018 rising revenue BP, quite high dividend

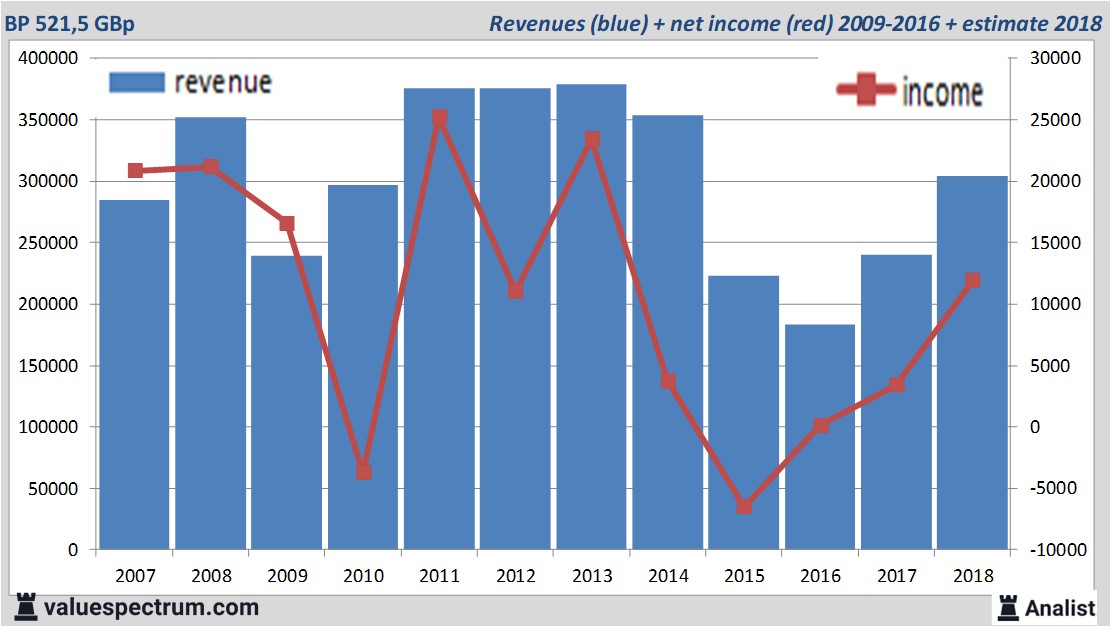

Tomorrow the English BP will publish its past quarters figures. Over the current book year the total revenue will be 304,53 billion GBp (consensus estimates). This is hugely more than 2017's revenue of 240,21 billion GBp.

Historical revenues and results BP plus estimates 2018

The analysts expect for 2018 a net profit of 11,92 billion GBp. According to most of the analysts the company will have a profit per share for this book year of 59 GBp. The price-earnings-ratio equals 8,84.

Huge dividend BP

For this year the analysts expect a dividend of 40 GBp per share. The dividend yield is then 7,67 percent. The average dividend yield of the oil & gas producers is a poor 1 percent.Recent target prices around 663 GBp

The most recent recommendations for the oil & gas producer are from Credit Suisse, Deutsche Bank and Goldman Sachs.Based on the current number of shares BP's market capitalization equals 10135,39 billion GBp. The BP stock was the past 12 months quite unstable. Since last February the stock is 13 percent higher. This year the stock price moved between 453 and 604 GBp. Since 2008 the stock price is almost 4 percent higher.

On Friday the stock closed at 521,5 GBp.Historical stock prices BP

ValueSpectrum.com News Wire & Equity Research: +31 084-0032-842

news@valuespectrum.com

Copyright analist.nl B.V.

All rights reserved. Any redistribution, duplication or archiving prohibited. analist.nl doesn't warrant the accuracy of any News Content provided and shall not be liable for any errors, inaccuracies or for any actions taken in reliance thereon.