Focus on the miners

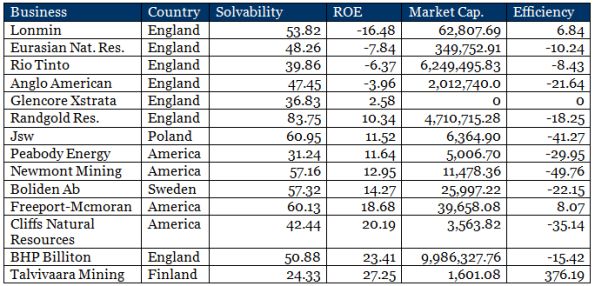

Portfolio of companies in mining sector under consideration for analysis is dominated by English and American companies. Let us get a quick picture of the performance and financial position of different mining companies at the end of 2012.

Mediocre ROE’s

We could say that Mining sector has given mediocre result in terms of return on equity to its shareholders, with Talvivaara Mining taking the lead by achieving a ROE of 27.25% in the financial year 2012. Interesting to note that Talvivaara Mining had scored a net loss of 5.21 million Euro at a net loss margin of (2.25%) in 2011, against a net profit of 83.59 million Euro at a net profit margin of 58.47% in 2012. Moving forward 4 mining companies out of 14 i.e. 29% of the companies in mining sector have only managed to secured losses during the year, with some companies scoring losses as high as (16.48%) on equity if we take example of Lonmin. One notable aspect about loss incurring companies in the financial year 2012 is that all of the 4 companies are either large or middle cap companies.

Bad results

For shareholders investing in mining sector with the intention of capital gain on equity stock of these companies, it has turned out to be a terrible choice for them. Only 3 companies have managed to accomplish an increase in their stock price in the latest year to date share prices. Lonmin and Freeport Mcmoran have achieved reasonable growth in their share prices in last one year by 6.84% and 8.07% respectively. However, Talvivaara Mining’s result in terms of growth in its share price in past one year has been an anomaly for mining sector when compared with results of other companies present in this sector. Its share price has witnessed growth by approximately 400% in last one year.

On the contrary, companies like Newmont Mining, Jsw and Cliffs Natural Resources have experienced a drastic fall down in share prices by (49.76%), (41.27%) and (35.14%) respectively in past one year.

Randgold strong balance sheet

In terms of solvability, Randgold Res. has the most stable capital structure in the sector, with equity to total asset ratio of 84% at the end of 2012. Eurasian Nat. Res. has experienced a downward trend in terms of its stability of capital structure which is reflected by the fact that its equity to total asset ratio has decreased from 70% in 2011 to 48% in 2012, a mammoth decrease by 22% in just one year. It could be inferred that there has been a major restructuring in its operations in past one year. Vedanta Res. has the weakest capital structure ratio in the sector with equity to total asset ratio less than 20% at the end of 2012.

It has been a good year for shareholders of Freeport McMoran in terms of dividend yield, which has offered the highest yield in the sector of 4.39% in 2012. It is also one of those few companies that have experienced growth in its share price in the latest year to date results. Surprising to note that Talvivaara Mining who has managed to achieve highest return on equity during the financial year 2012, and has accomplished enormous and also the highest growth in its share price by 376.19% in latest year to date result has paid no dividend in financial year 2012, and therefore its dividend yield is zero and lowest in the sector. Rather, it has no record of paying dividends in last 5 years.