Analysis of the insurance sector

Insurance sector mainly consists of companies belonging to America, England, Germany, Denmark, Netherlands and France. This sector has managed to get an average return on equity of 9.20% in 2012, with 2 companies namely, Delta Lloyd and Aviva only managing to get net loss in 2012 and a negative ROE of (63.55%) and (26.85%), respectively.

If we look at the top 10 companies offering the highest return on equity to shareholders, we will observe that it is clearly dominated by English companies with 5 English companies making it to the top 10. However, these 10 companies are a mix of small, middle and large cap companies having a reasonable capital structure ratio, and relatively high P/E and dividend yield when compared with relevant averages of this sector.

Admiral has offered highest return on equity of 56.53% in year 2012 in the insurance sector, and there is no other company anywhere near to compete with it. Furthermore, it has rewarded its shareholders in the form of healthy dividend yield as well. It offers the second highest dividend yield of 8.59% in the sector and has also experienced second highest growth (by 4.45%) in terms of dividend yield from 4.14% in 2011 to 8.59% in 2012.

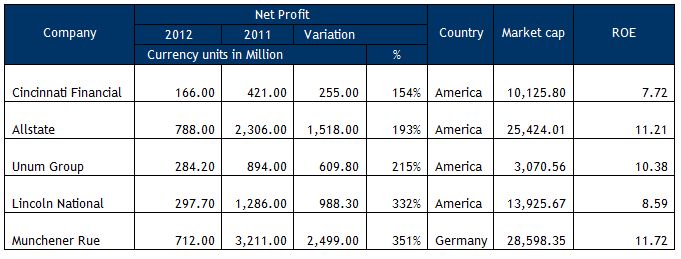

US companies dominant

When looking at performance of companies in terms of growth in profitability i.e. Net profit, we realize that it is completely dominated by American companies, with 4 American companies making it to the top 5 under such category. Even though these companies have achieved extra ordinary growth in terms of profitability when compared to prior year, all of them have only managed to give average return on equity. All the top 5 companies are small or middle cap companies.

Large difference capital structures

If we have to talk about a company who has the healthiest capital structure ratio in this sector, then Alliance Trust is that company with equity to total asset ratio of almost 77%. However, its equity ratio has deteriorated in 2012 compared to its equity ratio of 90% in 2011, resulting in a huge decrease by 13%, the highest decline of equity ratio of any company in the sector in past one year. Alliance Trust also enjoys the highest net profit margin in the sector of 76.64%. XL Capital, a small cap company with ROE of 6.16% in 2012, has shown good growth in its capital structure ratio with equity to total asset ratio moving from 21% in 2011 to 26% in 2012, an increase by 5%, the highest increase in the sector.

Sampo offers highest dividend yield of 16.57% in the year 2012 in the sector, which is way high when compared to industry average. The second highest dividend yield of 8.59% offered by Admiral in anyway cannot be compared to dividend yield offered by Sampo, and it clearly leads the chart as far as dividend yield is concerned. Moreover, its growth in dividend yield from 5.63% in 2011 to 16.57% in 2012 in insurance sector, an increase by 10.94% is the highest in the sector.