Petrochemical Market Size Projected to Surpass USD 1.25 Trillion by 2035 on Rising Demand from Construction and Automotive Sectors

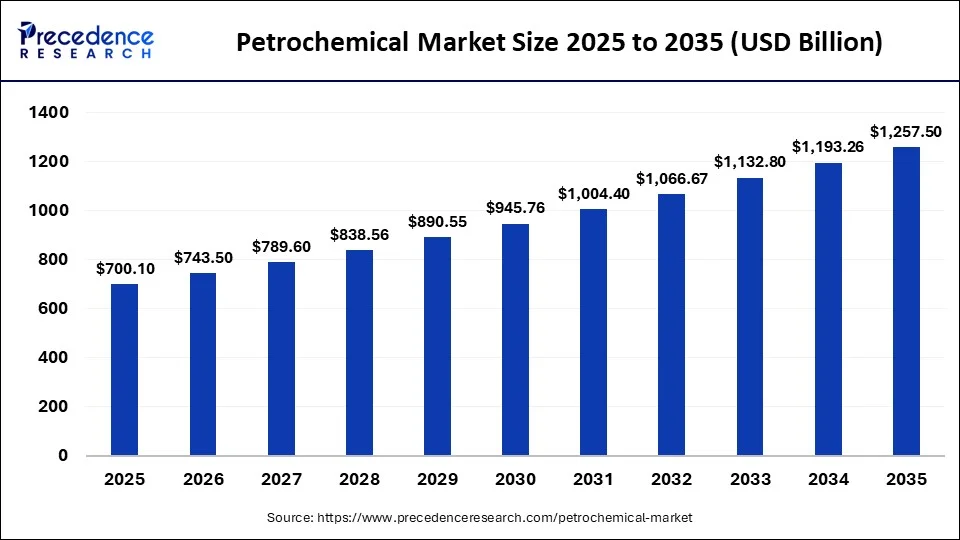

The global petrochemical market size is valued at USD 743.50 billion in 2026 and is predicted to surpass nearly USD 1.25 trillion by 2035, expanding at a CAGR of 6.03% from 2026 to 2035. The increased production of textiles and the rise in demand for construction materials drive market growth.

Ottawa, Feb. 05, 2026 (GLOBE NEWSWIRE) -- According to Precedence Research, the global petrochemical market size was estimated at USD 700.10 billion in 2025 and is expected to grow from USD 743.50 billion in 2026 to USD 1,257.50 billion by 2035.

The market is set to rise at a CAGR of 6.03% from 2026 to 2035. Market growth is being driven by rapid urbanization, expanding construction and automotive sectors, rising demand for plastics and synthetic fibers, and increased use of lightweight materials across industries. Technological advancements, strong R&D investments, and the integration of digital tools are further supporting long-term industry expansion.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1193

Petrochemical Market Key Insights

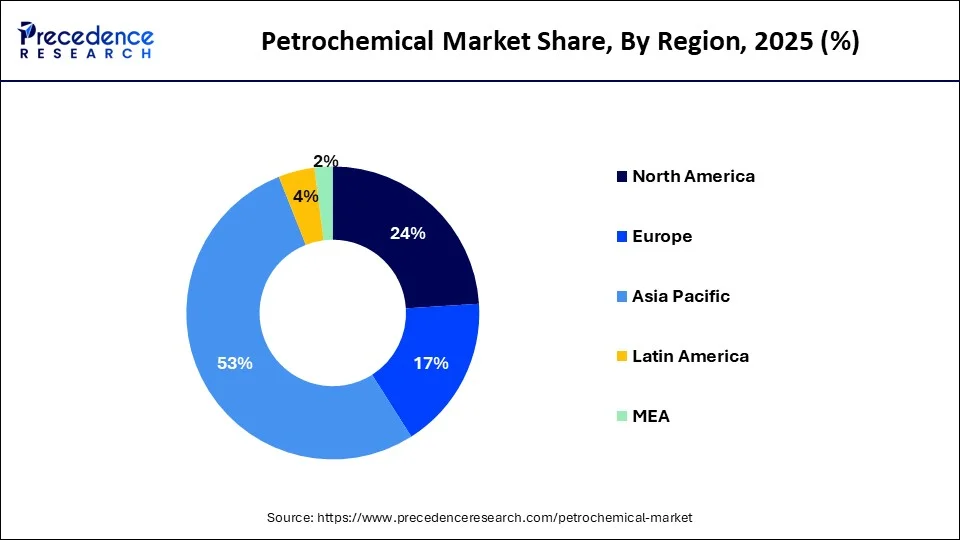

- Asia Pacific dominated the petrochemical market, accounting for 52.14% of total revenue in 2025.

- Europe is expected to grow steadily at a CAGR of 5.7% during the forecast period from 2026 to 2035.

- By product, the ethylene segment held the largest share, capturing 40.6% of market revenue in 2025.

- The methanol segment is projected to expand at a strong CAGR of 7.9% between 2026 and 2035.

What are Petrochemicals?

The petrochemical market growth is driven by increased use of plastic products, development of modern infrastructure, increasing use of synthetic fibers, increased need for lightweight materials, growth in the automotive sector, investment in petrochemical complexes, expanding electronic industry, and the shift towards clean technology.

Petrochemical refers to a chemical compound extracted from natural gas liquids and crude oil. They are widely used as feedstocks in the production of soaps, glues, cosmetics, plastics, fertilizers, synthetic rubbers, paints, and others. Petrochemicals are cheaper for production and support the development of new products. They are widely used across industries like automotive, pharmaceuticals, plastics, construction, and packaging.

The petrochemical industry is undergoing a structural transformation driven by downstream demand, sustainability mandates, and digital integration,” said a Saurabh Bidwai a Principal Consultant at Precedence Research. Asia Pacific will remain the growth engine, while Europe and North America focus on efficiency and low-carbon innovation.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Key Government Initiatives for Petrochemicals:

- Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs): These are large-scale, cluster-based industrial regions established by the Indian government to attract over $420 billion in investments through integrated infrastructure and tax incentives.

- China’s 2025–2026 Petrochemical Growth Plan: This two-year strategic initiative aims to achieve an average annual growth rate of over 5% in industry added value while strictly controlling new refining capacity to prevent oversupply.

- Production-Linked Incentive (PLI) Schemes: Governments use these to offer financial rewards to companies that increase domestic manufacturing of critical petrochemical derivatives, such as those used in semiconductors, batteries, and pharmaceuticals.

- U.S. Section 45Z Clean Fuel Production Credit: Introduced under the Inflation Reduction Act, this technology-neutral incentive provides up to $1.75 per gallon for domestic sustainable fuels based on their carbon intensity.

- Plastic Parks Scheme: This initiative supports the establishment of specialized industrial hubs with common testing and waste management facilities to boost the efficiency and output of downstream plastic processing units.

- Centres of Excellence (CoEs) for Petrochemical Innovation: These government-funded research hubs focus on developing green chemistry, advanced polymers, and sustainable materials by fostering collaboration between academia and industry.

What are the Key Trends of the Petrochemical Market?

- Accelerated Sustainability and the Circular Economy: Producers are aggressively pivoting toward bio-based feedstocks and advanced chemical recycling to meet stringent global carbon-neutrality targets and rising consumer demand for eco-friendly materials. This shift is driving significant capital investment into "green" petrochemicals, such as biodegradable plastics and carbon capture technologies, as companies aim to decouple growth from fossil fuel reliance.

- Widespread Digitalization and AI Integration: In response to volatile feedstock prices and narrowing margins, the industry is scaling AI-driven predictive maintenance and real-time process optimization to maximize operational efficiency. These digital tools are no longer experimental but essential for 2026 survival, enabling firms to reduce energy consumption, minimize unplanned downtime, and rapidly adapt production to shifting market demands.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Market Opportunity

The Expanding Healthcare Industry Surges Demand for Petrochemicals

The growing healthcare industry and the increased utilization of medical devices increase demand for petrochemicals. The rise in production of gloves, medical gowns, test tubes, orthopedic devices, disposable syringes, masks, and hearing aids increases demand for petrochemicals. The increasing utilization of aspirin and the higher need for biocompatible devices require petrochemicals.

The increased manufacturing of disposable healthcare items and the growing need for antibiotics increase demand for petrochemicals. The strong focus on drug purification and the development of advanced surgical items requires petrochemicals. The expanding healthcare sector creates an opportunity for the growth of the petrochemical industry.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Petrochemical Market Report Highlights

| Report Coverage | Details |

| Market Size in 2025 | USD 700.10 Billion |

| Market Size in 2026 | USD 743.50 Billion |

| Market Size by 2035 | USD 1,257.50 Billion |

| Growth Rate (2026 – 2035) | 6.03% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Manufacturing Processes |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

➤ Access the Full Petrochemical Market Study @ https://www.precedenceresearch.com/petrochemical-market

Petrochemical Market-Value Chain Analysis

- Feedstock Procurement: The stage focuses on acquiring raw materials like propane, ethane, naphtha, crude oil, butane, and olefins.

- Key Players:- Exxon Mobil Corporation, TotalEnergies, Dow, Saudi Arabian Oil Co., Sinopec, INEOS Group

- Key Players:- Exxon Mobil Corporation, TotalEnergies, Dow, Saudi Arabian Oil Co., Sinopec, INEOS Group

- Chemical Synthesis and Processing: The stage performs chemical reactions like catalytic reforming, oxidation, steam cracking, polymerization, and alkylation.

- Key Players:- Sinopec, SABIC, Exxon Mobil Corporation, Reliance Industries Limited, BASF SE, Dow

- Key Players:- Sinopec, SABIC, Exxon Mobil Corporation, Reliance Industries Limited, BASF SE, Dow

- Quality Testing and Certifications: Quality testing involves testing of attributes like distillation range, color, contamination, water content, density, octane numbers, and flash points. The certifications, like API, ASTM, ISO 9001, and BIS, are required.

- Key Players:- Intertek Group, TUV NORD Group, Cotecna, SGS Limited SA, Bureau Veritas

Petrochemical Market Regional Insights

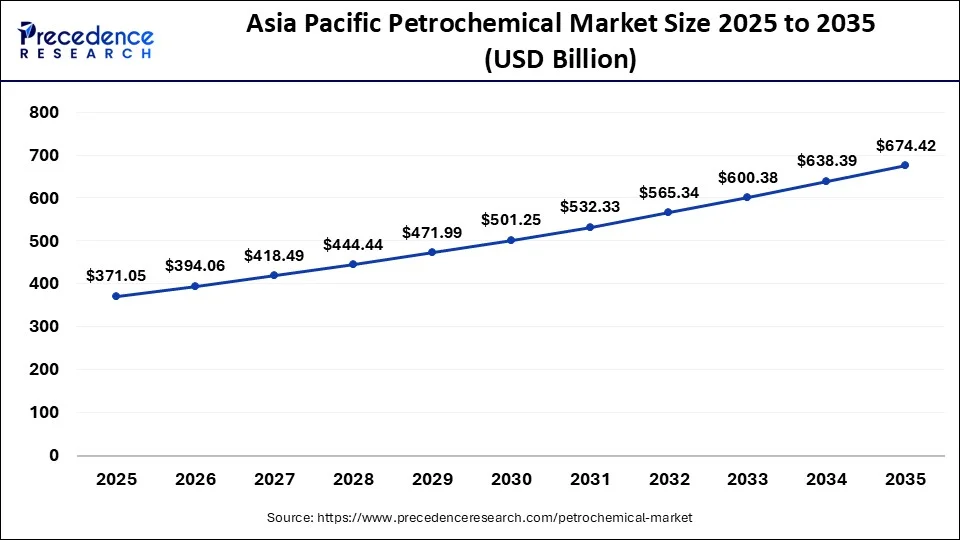

What is the Asia Pacific Petrochemical Market Size in 2026?

The Asia Pacific petrochemical market size is accounted at USD 394.06 billion in 2026 and is projected to be worth around USD 674.42 billion by 2035, growing at a CAGR of 6.16% from 2026 to 2035.

Why Asia Pacific Dominates the Petrochemical Market?

Asia Pacific dominated the market in 2025. The strong presence of large manufacturing sectors and growing general industrial activities increases demand for petrochemicals. The increased utilization of consumer goods and the rise in manufacturing of automotive parts increase petrochemical demand. The expansion of the packaging sector and the growing production of electronics require petrochemicals, driving the overall market growth.

China Petrochemical Market Trends

China's market continues to expand as producers increase capacity for key feedstocks like ethylene and propylene to meet rising demand, especially for plastics and chemicals used in manufacturing and consumer goods. Domestic output growth is outpacing demand in some segments, creating oversupply risks that put pressure on margins and challenge smaller producers.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1193

How is Europe experiencing the Fastest Growth in the Petrochemical Market?

Europe is experiencing the fastest growth in the market during the forecast period. The increased manufacturing of fuel-efficient vehicles and the growth in the development of infrastructure projects require petrochemicals. The increasing use of consumer electronics and the expansion of electronic gadgets increases demand for petrochemicals. The strong government focus on sustainable petrochemicals supports the overall market growth.

Germany Petrochemical Market Trends

Germany's market is expected to grow at a moderate pace through 2030, supported by demand for core products such as ethylene, methanol, and downstream chemical applications. The sector is currently under pressure from weak domestic and export demand, high energy and feedstock costs, and low-capacity utilization, which are impacting profitability. Companies are responding by focusing on efficiency improvements, digitalization, and selective restructuring to remain competitive.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Petrochemical Market Segmentation

Product Type Insights

Why the Ethylene Segment Dominated the Petrochemical Market?

The ethylene segment dominated the market in 2025. The expansion of food packaging applications and the huge production of lightweight automotive components increase demand for ethylene. The growing utilization of household items and the growth in construction activities create a higher demand for ethylene. The increased production of vinyl chloride, polyethylene, and ethylene glycol requires ethylene drives the overall market growth.

The methanol segment is experiencing the fastest growth in the market during the forecast period. The growing demand for marine fuel and the focus on lowering automotive emissions increase the demand for methanol. The transition towards clean fuel and the expansion of the energy sector require methanol. The increased production of chemicals like acetic acid, formaldehyde, and olefins increases demand for methanol, supporting the overall market growth.

Manufacturing Processes Insights

How did the Fluid Catalytic Cracking Segment hold the Largest Share in the Petrochemical Market?

The fluid catalytic cracking ( FCC ) segment held the largest revenue of the market in 2025. The increased utilization of high-octane gasoline and the growing production of light olefins increase demand for FCC . The higher production of petrochemical products and the growth in the petrochemical sector increase demand for FCC . The cost-effectiveness, operational flexibility, and efficiency of FCC drive the market growth.

The catalytic reforming segment is the fastest-growing in the market during the forecast period. The increasing need for synthetic fibers and the growing demand for hydrogen increase the adoption of catalytic reforming. The increased production of petrochemical intermediates and the focus on maximizing crude value increase demand for catalytic reforming, supporting the overall market growth.

Application Insights

Which Application Segment Dominated the Petrochemical Market?

The building and construction segment dominated the market in 2025. The rapid urbanization and the growing development of commercial spaces increase demand for petrochemicals. The growing modernization of infrastructure projects and the growth in residential construction require petrochemicals. The increasing use of petrochemicals in applications like insulation foams, flooring, piping systems, paints, roofing materials, and window frames drives the market growth.

The automotive segment is experiencing the fastest growth in the market during the forecast period. The increased production of lightweight vehicle parts and the production of aerodynamic vehicle designs increase demand for petrochemicals. The rise in the electrification of vehicles and the focus on lowering the weight of vehicles require petrochemicals. The increasing use of petrochemicals in automotive parts like interior components, bumpers, battery components, dashboards, bumpers, and fuel system supports the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Global Specialty Chemicals Market: Explore how high-performance formulations and end-use diversification are driving value-added chemical demand

➡️ Artificial Intelligence in the Chemical Market: Understand how AI-driven process optimization, predictive maintenance, and R&D acceleration are reshaping chemical manufacturing

➡️ Petroleum Refining Hydrogen Market: Analyze hydrogen’s growing role in cleaner refining processes and fuel quality compliance

➡️ Xylene Market: Discover demand trends linked to polyester, packaging, and downstream petrochemical applications

➡️ Fossil Fuels Market: Track global energy demand dynamics amid the transition toward low-carbon and alternative energy sources

➡️ Propylene Market: Examine growth driven by polypropylene demand across automotive, packaging, and consumer goods sectors

➡️ Isobutene Market: Gain insight into rising use in fuel additives, synthetic rubber, and specialty chemical intermediates

➡️ Oil Refining Market: Assess capacity expansions, margin pressures, and modernization strategies shaping the global refining landscape

➡️ Basic Chemicals Market: Understand volume-driven growth supported by construction, agriculture, and industrial manufacturing demand

➡️ Solvents Market: Explore shifts toward eco-friendly and bio-based solvents across paints, coatings, and pharmaceuticals

➡️ Oilfield Chemicals Market: Analyze how drilling activity, enhanced oil recovery, and offshore projects are influencing chemical consumption

Top Companies in the Petrochemical Market & Their Offerings

- BP Plc: Primarily produces olefins and aromatics, including ethylene and propylene, used in essential products like packaging, textiles, and automotive parts.

- TotalEnergies (formerly Total S.A.): Focuses on large-scale integrated production of polymers, specialty chemicals, and biofuels through global facilities like the Amiral complex.

- Exxon Mobil .: Operates as one of the world's largest integrated producers of olefins, performance polymers, and advanced plastics for automotive and electronics applications.

- BASF SE: Offers an extensive portfolio ranging from basic petrochemicals like ethylene and propylene to sophisticated performance products and functional materials.

- Sumitomo Chemical Co., Ltd.: Provides a diverse range of essential chemicals including polyethylene, polypropylene, and various specialty engineering plastics for ICT and automotive sectors.

- Dow: Specializes in high-performance materials such as polyethylene resins, elastomers, and silicones, with a strong emphasis on circular and recycled plastics.

- Chevron Phillips Chemical Company: Leading supplier of polyethylene, normal alpha olefins, and specialty organosulfur chemicals used in pressure pipes and consumer packaging.

- Saudi Arabian Oil Co. (Saudi Aramco): Rapidly expanding its "liquids-to-chemicals" capacity, producing massive volumes of ethylene and paraxylene through massive global joint ventures and its majority stake in SABIC.

- DuPont de Nemours, Inc.: Focuses on high-value specialty materials and performance polymers derived from petrochemical feedstocks for the electronics, construction, and healthcare industries.

- China Petroleum & Chemical Corporation (Sinopec): Operates as a global giant in the production of basic petrochemicals, synthetic resins, and fibers to meet massive domestic and international industrial demand.

Recent Developments in the Petrochemical Industry:

- In December 2025, Larsen & Turbo wins a major BPCL contract to launch India’s largest polyethylene plant in Bina. The per annum capacity of the production facility is 575 kilo tonnes, and serves industries like infrastructure, agriculture, packaging, consumer goods, & automotive. (Source: https://www.chemanalyst.com)

- In June 2025, Honeywell and Borouge launched AI-powered autonomous petrochemical operations in the UAE. The operation lowers energy use and increases operational efficiency. (Source: https://www.achrnews.com)

- In September 2025, Sinopec collaborated with Aramco to launch $10 billion petrochemical venture in Fujian. The facilities' production capacity of aromatics and ethylene is 2MTA and 1.5MTA, respectively. (Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Product Type

- Ethylene

- Polyethylene

- Ethylene oxide

- EDC

- Ethyl benzene

- Other (including alpha olefins, vinyl acetate, etc.)

- Propylene

- Polypropylene

- Propylene oxide

- Acrylonitrile

- Cumene

- Acrylic acid

- Isopropanol

- Other

- Butadiene

- SB Rubber

- Butadiene rubber

- ABS

- SB latex

- Other (nitrile rubber, mechanical belts, etc.)

- Benzene

- Ethyl benzene

- Phenol/cumene

- Cyclohexane

- Nitrobenzene

- Alkyl benzene

- Other (including alkyl benzene, maleic anhydride)

- Xylene

- Toluene

- Benzene

- Xylenes

- Solvents

- TDI

- Others (including pesticides, drugs, nitro toluene, etc.)

- Methanol

- Formaldehyde

- Gasoline

- Acetic acid

- MTBE

- Dimethyl ether

- MTO/MTP

- Other

By Manufacturing Processes

- Fluid Catalytic Cracking ( FCC )

- Steam cracking

- Catalytic reforming

By Application

- Aerospace

- Agriculture

- Automotive

- Building & Construction

- Consumer & Industrial Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1193

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Meta | Twitter